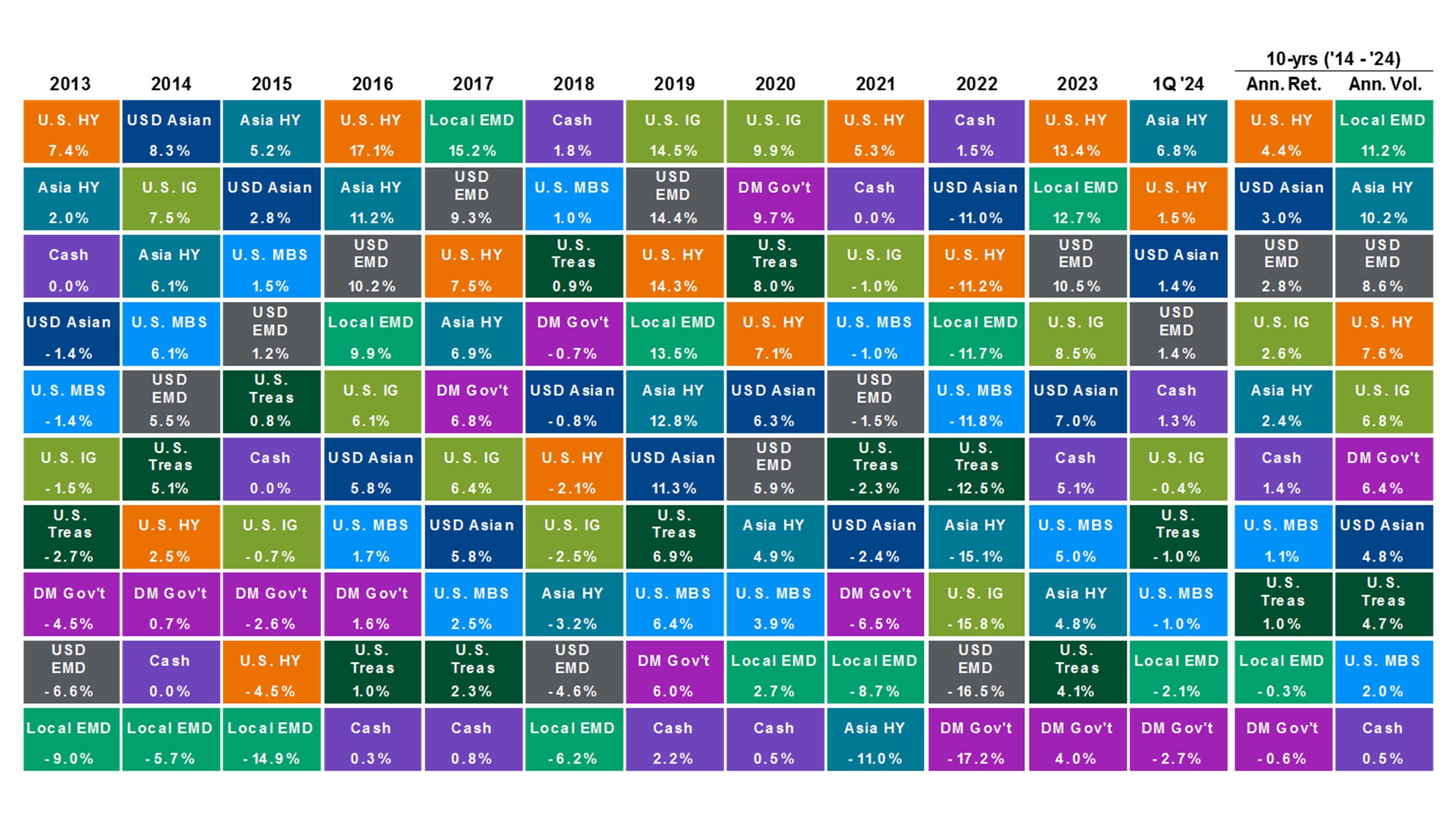

Slide Image

Chart Image

Global fixed income: Valuations

This page compares the spread of various fixed income instruments against treasuries with their long-term averages and historical ranges for a valuation comparison. Wide spreads indicate that the fixed income instrument is cheap, perhaps reflecting market concerns over credit risks. Narrow spreads show the instrument is expensive, as investors expect lower risks of default.