Slide Image

U.S. real estate dynamics

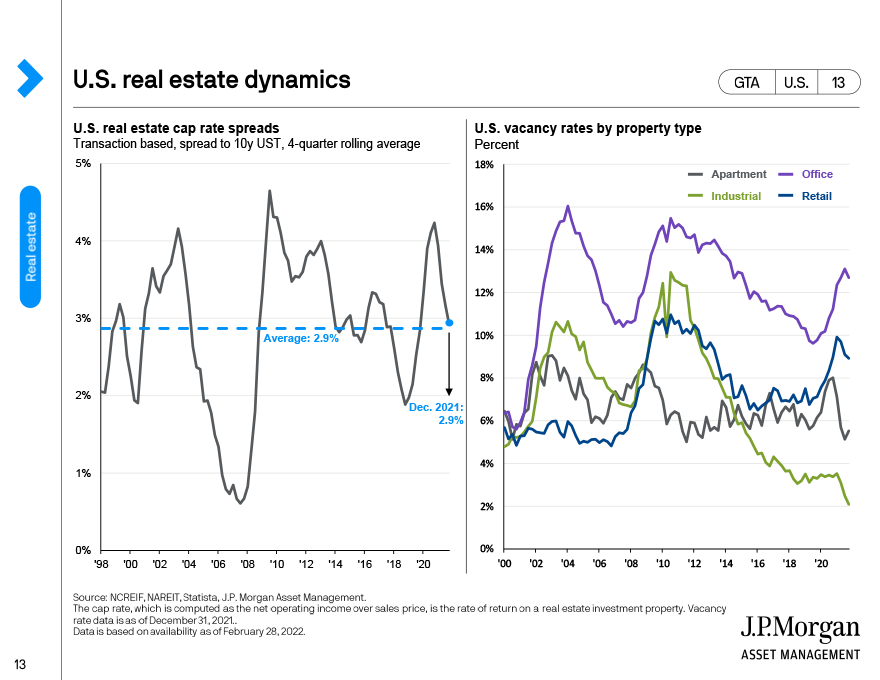

Although there continues to be a lot of concern around commercial real estate, our work suggests that this stress is relatively contained.

The chart on the left shows U.S. real estate cap rate spreads, essentially the rate of return on a real estate investment property over the U.S. 10-year Treasury, on average over four quarters. Spreads have been climbing since 2019.

However, the chart on the right, which shows vacancy rates by property type, shows only a mild uptick thus far in office, retail, and apartment vacancies through 3Q. Industrial vacancies remain low.