Despite the YTD technology rally, in the event of an economic downturn, high quality technology stocks could prove to be relatively resilient compared to other sectors, given their strong balance sheets and defensive nature.

In brief

- The recent rally in U.S. equities has been dominated by a few mega-cap technology names, driven by falling yields, resilient earnings and excitement over AI.

- While there are risks to margin compressions and a further hawkish re-pricing of rates, large-cap technology companies have a relatively defensive nature and offer more resilience in an economic downturn.

At the end of 2022, if there was a crystal ball to tell us the start of 2023 would bring about three regional bank failures in the U.S., continued rate hikes from the Federal Reserve (Fed) and weaker macro data, it might surprise investors to learn that the S&P 500 would still rise nearly 10% in the first five months. However, the narrow leadership in this rally calls into question whether it’s sustainable, and specifically, how much more can technology stocks rally?

How narrow is the rally?

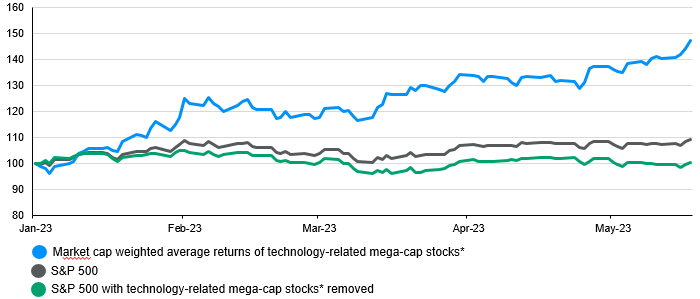

At the time of writing, the S&P 500 index was largely driven by growth stocks (returning 13.4%) and more specifically, the technology sector (returning 27.2%). In Exhibit 1, if we remove 7 of the technology-related mega-cap stocks, year-to-date (YTD) S&P 500 has practically been flat. In fact, the market capitalization of these seven stocks now make up 27.0% of the index, compared to only 20.7% at the start of the year.

Exhibit 1: Outperformance of technology-related mega-cap stocks* relative to S&P 500

January 2023 = 100

Source: FactSet, S&P, JP Morgan Asset Management. *Refers to AAPL, AMZN, META, GOOGL, NVDA, TSLA, MFST. Data as of latest available on 05/19/23.

Why did U.S. equities rally?

With 40 basis points of rate cuts by the Fed priced in for 4Q23, this dovish outlook on Fed policy led to a fall in yields, helping to support U.S. equity multiples after a major de-rating in 2022. As a result, the YTD rally has been overwhelmingly driven by an expansion of valuations, with multiples contributing to more than 7.3% of the 9% year-to-date S&P 500 returns -- 81% of overall gains. Over the past 15 years, the S&P 500 index has returned 12.8% annually on average, but returns have been primarily driven by earnings growth, with multiple expansion only accounting for 21% of the gains.

Secondly, 1Q23 earnings have held up better than expected, with 78% of S&P 500 companies delivering higher than expected earnings, according to FactSet data. A major contribution to this upside surprise has been the resiliency of profit margins. Even with the rise of input costs, companies have been able to pass on the rise in costs to consumers. Within technology, 86% of companies beat earnings estimates, the second highest among S&P 500 sectors. Operating margins for most sectors except for industrials, healthcare, and utilities are still sitting above their long-term averages. A combination of pricing power, and cost reduction such as through layoffs, has helped to preserve company bottom lines while top line growth remains flat.

Specifically for technology sectors, the hype around artificial intelligence (AI), especially ChatGPT, fueled much of the rally as well. Over the 1Q23 earnings season, a flurry of companies rushed to announce the integration of AI into their firm strategies, be it through new products, marketing campaigns, efficiency saves, customer service etc., boosting market confidence in this new growth driver. In particular, large-cap technology companies are better positioned to reap the benefits through higher investment capital and more data access.

What is the outlook from here?

There are some potential headwinds facing the technology sector in the near term. For one, the overly dovish market outlook on the Fed may lead to near-term de-rating of equity multiples as the market re-adjusts its expectations going forward or if such expectations are not met by reality. However, the weak outlook on growth and the fact that the current rate hiking cycle is at its tail-end, it is unlikely that yields will rise materially from hereon. With narrow upside risks to yields, the headwind on technology multiples likely will be limited as well.

As with most other sectors, margin compression will be a key risk to watch in the coming quarters, as disinflation momentum lowers firms’ pricing power, while high labor costs might remain sticky. This cautious earnings outlook is reflected in the muted positive reaction of prices of stocks that beat earnings expectations in 1Q23. However, the magnitude of margin compression will depend on the effectiveness of the cost reduction measures undertaken by companies. In particular, many technology companies have moved to adjust the size of their workforce since December 2022, benefiting margins in the latest quarterly results. Going forward, less labor-intensive companies with steady recurring revenues within the technology sector, such as software, may have more durable margins, not to mention the potential for AI to further enhance efficiency and optimize costs over the long run.

Investment implications

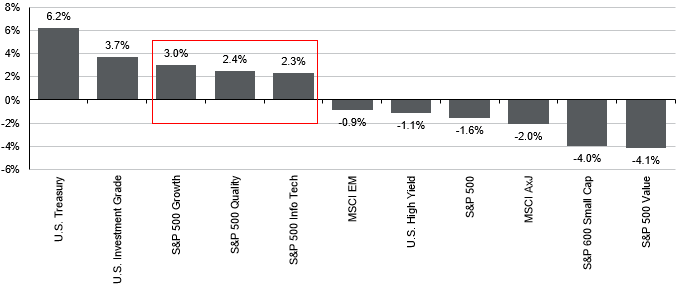

While we still maintain a preference of high quality fixed income over equities, within equities, technology stocks could surprise in a downturn protecting on the downside. For example, despite the YTD technology rally, in the event of an economic downturn, high quality technology stocks could prove to be relatively resilient compared to other sectors, given their strong balance sheets and defensive nature, as seen in Exhibit 2. In fact, fundamentals of large cap technology stocks have improved since the dot com bubble, with less leverage, more cash, higher profitability and productivity.

Exhibit 2: Asset class returns in weakening economic climate

Annualised month returns when global PMI manufacturing falls*, 1998-2023

Source: FactSet, JP Morgan Asset Management. *Refers to periods where PMI is falling, regardless of whether it is lower than or higher than 50. Data as of latest available on 05/19/23.

Even at elevated valuations, technology stocks can display defensive qualities, not to mention that the risk of de-rating has lowered with limited upside to yields, and that multiples for sectors like software-as-a-service has also come down significantly from its 2020-2023 highs.

When getting exposure to this sector, investors should also bear in mind that disruptions could drive shifts in market leadership overtime, thus, being selective and picking businesses with high quality growth is key.