ECB slows hikes, but has “more ground to cover”

05/05/2023

Ian Crossman

In Brief

- At its monetary policy meeting on 4th May, the European Central Bank (ECB) tighten monetary policy further, increasing key interest rates by 25 basis points (bps).

- The accompanying statement was hawkish, with the ECB stated that “the inflation outlook has been too high for too long”, while President Christine Lagarde confirmed “we are not pausing” and “we have more ground to cover”.

- The ECB also announced its intention to stop reinvesting maturities proceeds from the asset purchase programme (APP) from 1 July 2023.

Decelerating rate hikes

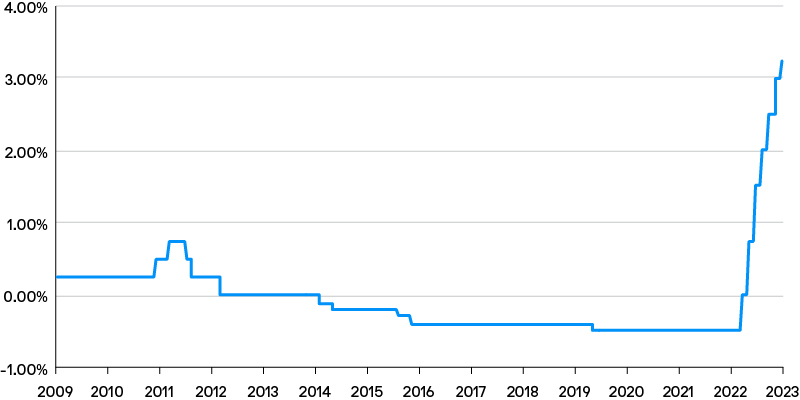

At its 4th of May monetary policy meeting, the ECB increased all three key interest rates by 25bps, bringing the refinancing rate to 3.75%, the marginal lending facility to 4.00% and the deposit facility rate to 3.25%. The increases were in-line with market expectations and represent the seventh hike in the current cycle, taking cumulative rate hikes to 375bps since July 2022.

The 25bps hike also signifies a slower pace of hikes, with the absence of a further acceleration in April’s inflation reading, alongside signs that credit conditions have tightened and loan demand declined in the recent ECB Bank Lending Survey, enough to persuade the central bank that a smaller move was appropriate.

Figure 1: ECB deposit rate has reached a 15-year high of 3.25%.

Source: Bloomberg, as at 5 May 2023.

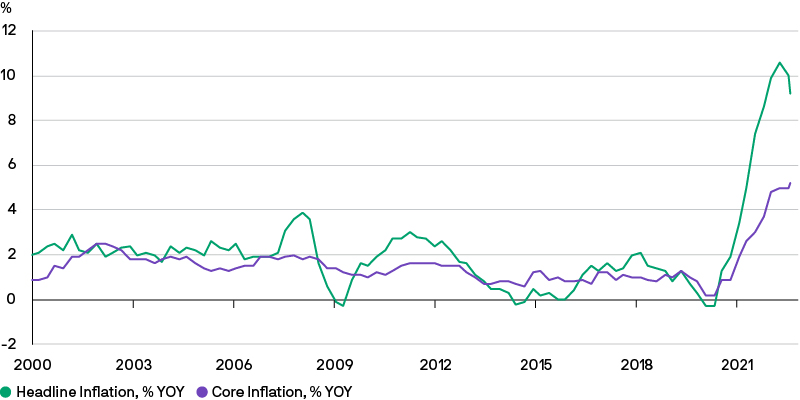

Nevertheless, the ECB still believes the inflation fight has not yet been won. At the subsequent press conference President Lagarde noted that the inflation outlook continued to be “too high, for too long”, and, although headline inflation has started to recede, “underlying price pressures remain strong”.

President Lagarde kept open the option of further hikes by stating that “future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target”.

Accelerating quantitative tightening

The GC also announced an earlier than expected decision to stop reinvesting the maturities of its APP portfolio from 1 July 2023. The portfolio is currently declining at a pace of EUR15 billion per month, which will increase to approximately EUR 25 billion from July. This increase represents an additional tightening of market liquidity. Notably, the pandemic emergency purchase programme (PEPP) holdings, will continue to be reinvested until at least the end of 2024.

Confirming confidence in the banking system

Cognizant of current global banking concerns, the ECB confirmed the European banking system was “strong” and “resilient”. At this juncture it seems unconcerned about next month’s expiry of EUR 477 billion worth of TLTROS (targeted longer-term refinancing operations) and does not appear to be planning replacement bridging loans. President Lagarde observed that commercial banks could request funding via the ECB’s refinancing operations, should the need for replacement financing arise.

Data dependent

President Lagarde confirmed that ECB decisions remain data dependent, and notably, called for governments to roll back fiscal stimulus now that the energy crisis has faded, to avoid upward pressure on inflation and the resultant additional tightening of monetary policy.

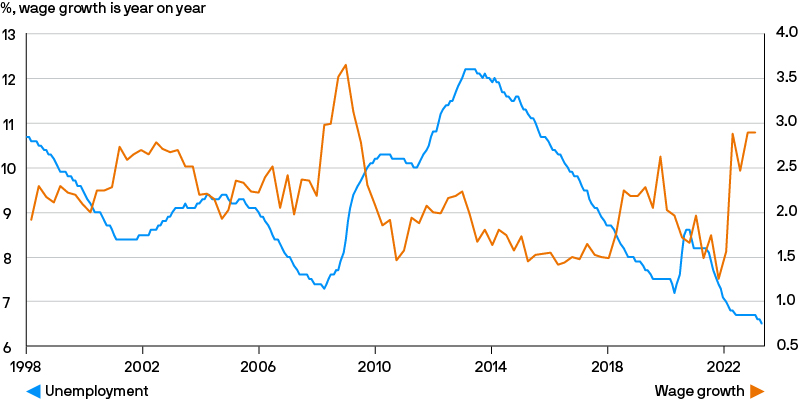

Eurozone economic data remains modestly positive with advanced GDP indicating the eurozone economy grew by 0.1% in the first quarter, helped by lower energy costs, easing of supply bottle necks and fiscal policy support for firms and households. Although the manufacturing sector remains weak, the services sector is growing faster, supported by improving consumer confidence and higher household spending as a result of record low unemployment.

Meanwhile, headline inflation rose marginally to 7%y/y in April but remains significantly below its fourth quarter peak of 10.6%y/y. However, core inflation has proved sticky at 5.6%y/y, due to persistently high food prices and higher services inflation.

Figure 2: Eurozone unemployment remains low while wage growth has accelerated.

Source: ECB, Eurostat, Refinitive Datastream, J.P. Morgan Asset Management, as at 31 March 2023. Wage growth is based on negotiated wages.

Figure 3: Headline inflation is falling but less volatile core inflation continues to rise

Source: Eurostat, European Central Bank, Bloomberg, as at 5 May 2023.

Implications for euro cash investors

The latest rate increase is good news for cash investors. J.P. Morgan Asset Management’s liquidity funds are well positioned to benefit from higher rates, given the high levels of short-dated cash they carry. Deposit and repo rates should refix higher at the start of the new reserve period on 10 May, providing an almost immediate boost to the fund’s yield. Higher reinvestment yields for term securities will also benefit the fund over the coming weeks.

Conclusion

The May ECB meeting contained few surprises but in opting for a slower pace of hikes, the ECB acknowledged that a lot of the monetary policy heavy lifting has already been done and that the full impacts of previous rate hikes are still feeding through. Nevertheless, highlighting upside risks to inflation, the ECB clearly thinks that further rate increases will be necessary, although the peak level of rates will be data dependent and is far from certain. Against this backdrop, markets are likely to remain volatile and we believe investors will be well served by our active approach to cash management, prioritising diversification and liquidity.

09xe230705063159

NOT FOR RETAIL DISTRIBUTION: This communication has been prepared exclusively for institutional, wholesale, professional clients and qualified investors only, as defined by local laws and regulations. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited ABN 55143832080) (AFSL 376919). For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. Copyright 2023 JPMorgan Chase & Co. All rights reserved.