Slide Image

Global growth

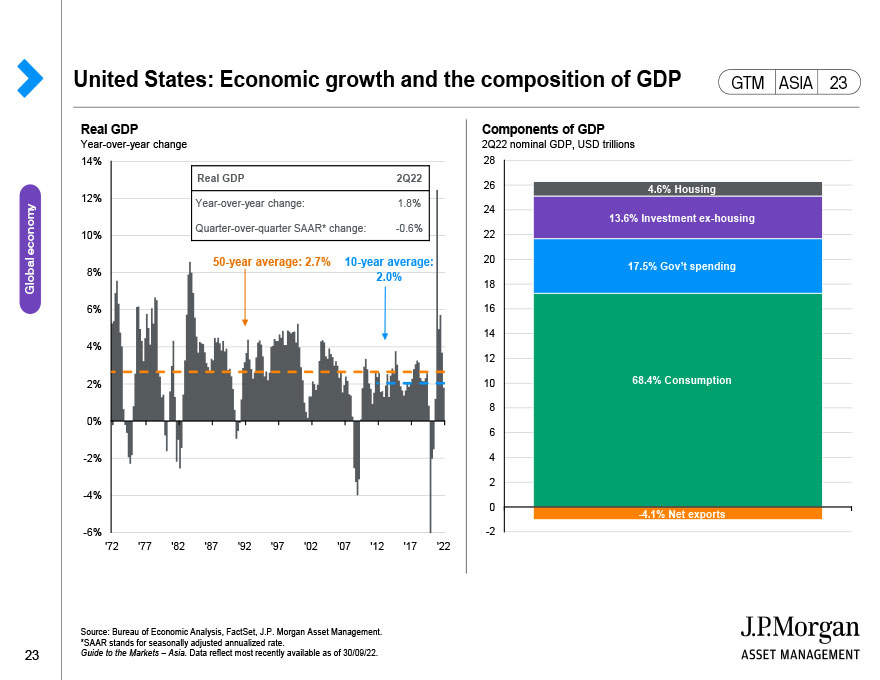

This page shows real gross domestic product (GDP) levels and growth for China, eurozone, Japan and the U.S. GDP fell sharply in the first half of 2020, but is forecasted to rebound in the second half with the economies gradually reopening. China appears to have been the first of the major economies to have felt the impact, but also the first to recover. The right chart shows that some countries may take some time to recover back to pre-virus outbreak growth trends.