Core, what is it good for? Definitely something!

In this article, we (1) discuss the key considerations for insurers when allocating to alternatives and (2) make the case for core alternatives strategies, which can provide stable income and low total return volatility.

Mark Snyder

In a low yield, late-cycle environment, core alternative asset classes can provide insurance portfolios with stable income and low total return volatility.

Many insurers invest in alternative assets. Alternatives can provide portfolios with high returns while delivering low correlations to traditional asset classes. Within alternative assets, the two key features of core alternatives are a large percentage of total return coming from cash income and cash flows that can be forecasted accurately. In this article, we discuss the key considerations for insurers and make the case for core alternatives strategies in insurance portfolios. We distinguish core alternatives from alternatives that rely on price appreciation to drive most of the total return.

Compared to other institutional investors, insurance companies have to consider many more constraints when determining their alternatives allocations. Insurers must think about the capital requirements imposed by regulators and rating agencies, how alternatives impact earnings volatility, the liquidity and cash flow profiles of the assets, the total return and risk correlation characteristics between alternatives and their other assets, and how their peers invest. In this article, we (1) discuss the key considerations for insurers when allocating to alternatives and (2) make the case for core alternatives strategies, which can provide stable income and low total return volatility.

Capital requirements and capital-adjusted returns

Alternative assets usually have higher regulatory and rating agency capital charges than traditional assets. Higher expected returns on alternatives must offset these higher capital charges. Insurers could consider accounting for these capital charges by computing a capital- adjusted expected return for all asset classes. This measure relies on determining the total capital requirement for an asset class, reflecting the base cost of capital, target capital ratio and relevant diversification benefits. Given this total capital requirement, we then use a company’s target return on equity (ROE) to compute a pre-tax cost of capital, which we deduct from the corresponding asset’s pre-tax expected return to arrive at a measure of expected return that reflects the cost of the capital required to make an investment.

Earnings volatility

In the absence of impairment or realized gains, most fixed income and loan asset classes contribute to Generally Accepted Accounting Principles/International Financial Reporting Standards (GAAP/IFRS) earnings only through interest income and they are held at amortized cost on the statutory balance sheet. Conversely, many alternatives mark-to-market through GAAP/IFRS earnings and are held at fair value on the statutory balance sheet. Given this divergent accounting treatment, insurers are extremely sensitive to volatility in alternative assets. One benefit is that many alternatives provide what we refer to as “accounting diversification,” which comes from a valuation lag that results in market factors impacting some alternatives on a one-quarter lag. This results in lower correlation with liquid assets like public equity—at least as observed on the income statement (we do not mean to suggest that this provides an intrinsic economic diversification benefit and note that in a prolonged downturn the accounting diversification benefit would not be helpful). Generally speaking, insurers prefer asset classes that generate stable interest/dividend income that either do not mark-to-market through earnings or have very low total return volatility. Core alternatives do tend to mark-to-market through earnings, but they generally have lower total return volatility than alternative investments that rely on price appreciation for much of their total return.

We must distinguish between income as it is discussed by typical institutional investors as compared to GAAP net income and operating income. Investors typically refer to dividend income or other interest income paid out by alternative investment strategies as “income.” This is distinct from income as defined by U.S. GAAP or how most insurance companies calculate operating income. For these measures, the entire total return for most alternative assets impacts GAAP net income. Many insurers reflect total return on alternatives in their operating income as well.

Liquidity and cash flow predictability

Most alternative assets are illiquid, but this is not necessarily a problem because many insurance liabilities are highly predictable and of a longer-term nature. If an asset’s cash flows are known with a high degree of certainty, then it can be used to match longer-term insurance liabilities. The certainty of cash flows is a key feature of core alternative assets. Furthermore, core alternatives are generally available in open-ended funds which provide for quarterly liquidity in normal times. This is in contrast to closed-ended funds that can have lock-ups approaching ten years.

Total return diversification and risk exposure

Since most insurers do not mark-to-market investment grade fixed income and loans, total return diversification is not the key concern for insurers. However, volatility is still a relevant risk measure for insurance portfolios and it is useful to assess the volatility impact from initiating or adding to an alternatives allocation. Generally speaking core alternatives have lower standalone total return volatility than broad alternative asset classes, which reduces overall portfolio risk. When we think about asset diversification, we must understand existing risk exposures for insurers. Many life insurers are exposed to equity beta through variable annuities and large private equity portfolios, while P&C and health insurers often have large holdings in public common stock as well as private equity. All types of insurers have significant exposure to credit risk. Compared to broad alternatives, core alternatives have lower correlations to equity and credit investments and, therefore, provide enhanced diversification with respect to most insurers’ existing portfolios. One key explanation for this diversification benefit is that many core alternative investments derive much of their return from long-term contractual cash flows.

Peer comparisons

Insurers do not want to deviate too much from “normal” to avoid regulatory and rating agency scrutiny. The goal is often to size investment risk to be in line with peers and also to avoid earnings surprises.

Adding it all up

Core alternatives tend to have lower expected returns than more opportunistic or highly levered strategies, so the capital-adjusted return measure does not favor core alternatives. However core alternatives are more favorable with respect to earnings volatility, liquidity and cash flow predictability, total return diversification and risk exposure, and peer comparisons.

The comments mentioned above apply generally to all U.S. insurers. However, life insurers, property and casualty (P&C) insurers, and health insurers all have different constraints they must consider when setting their alternative asset allocations.

Considerations for Life Insurers

In our conversations with life insurers, we have found that the biggest constraint on alternatives allocations is their impact on increasing earnings volatility. The benefits of core alternatives with respect to earnings volatility should be appreciated by life insurers.

Life insurers often benefit from diversification in regulatory and rating agency capital models. This very much depends on the specific asset allocation, but many life insurers receive substantial covariance benefits from equity-like alternatives because their portfolios are heavily weighted toward credit risk and other underwriting risks. This makes capital-adjusted returns less of a factor for some life insurers.

Because of punitive capital charges for non-rated fixed income and fixed income funds, most life insurers do not invest in credit focused alternative strategies on Schedule BA. Insurers have found ways to invest in what would be considered illiquid credit alternatives via rated loans and notes that are held on Schedule D. Typical alternatives allocations for a life insurer consist primarily of private equity and smaller allocations to corporate mezzanine debt, infrastructure equity, real estate equity, real estate mezzanine debt, hedge funds and other asset classes. Historically, real estate mezzanine debt has been a relatively small asset class for U.S. insurers despite the fact that this debt (if held in the right structure) is extremely capital efficient and can have very limited impact on earnings volatility. In our experience, life insurance companies are more comfortable as senior real estate debt investors and avoid mezzanine debt because they do not want to take the chance that they may end up owning a property they are a mezzanine lender on. Similarly, real estate equity is not generally RBC capital efficient for life insurers to own, though capital efficient solutions have been developed for real estate equity.

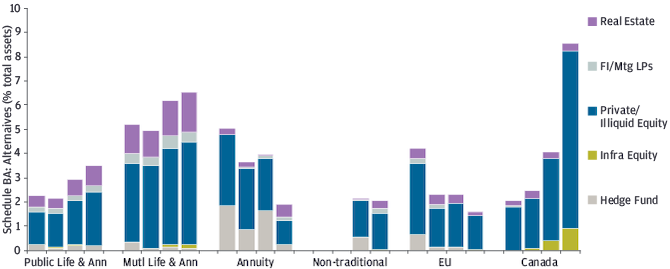

Different types of life insurers have different constraints that impact how they invest in alternative assets. In EXHIBIT 11 below we group life insurers by type of business or characteristics of the owner. Mutual insurers tend to have lower leverage as measured by invested assets as a percentage of statutory capital. A typical mutual insurer may be only eight times levered on this basis as opposed to twelve to fourteen times levered for a typical public insurer. The lower leverage, as well as the ability to share investment experience with policyholders, makes mutual insurers more likely to have a larger allocation to alternatives. Life insurance companies that have very long-term liabilities, such as structured settlements, or those that have unexpectedly expensive liabilities, such as long-term care, also use alternative assets, in particular to back liability cash flows beyond 30 years. These types of companies are generally within the public life and annuity category shown in Exhibit 1 and they have larger allocations to alternatives than a typical public life and annuity company. Insurers who focus on selling general account annuities (“Annuity”) do not typically invest much in alternative assets because policyholders may surrender their annuities and insurers have to be able to raise cash to meet these redemptions. We only show the non-traditional capital (“Non-Trad”) segment for YE2013 and YE2018 because much of their business consists of companies that were acquired and then rapidly expanded. These insurers have limited alternatives allocations and instead focus on direct lending, CLOs, and other securitized assets. EU linked life insurers have had their alternatives allocations fall dramatically since the financial crisis—it’s worth noting that several of these companies are no longer associated with an EU parent or have diminished ties. Insurers who have a parent company based in Canada tend to have much larger allocations to real estate equity, due to differences in capital treatment between US and Canadian regulatory capital. However this is typically direct real estate held on Schedule A and so is not shown in Exhibit 1. The Schedule BA alternatives allocations for Canadian owned life insurers has been growing due primarily to the activities of one large insurer.

EXHIBIT 1: SCHEDULE BA ALTERNATIVE ASSETS FOR LIFE INSURERS

LEFT TO RIGHT, YEAR-END 2007, 2009, 2013, AND 2018

Source: S&P/SNL Financial, J.P. Morgan.

Consideration for P&C and Health Insurers

P&C and health insurers have historically been more idiosyncratic in their use of alternative assets. Some P&C and health insurers prefer to generate their income via underwriting profits and, therefore, invest in stable and secure fixed income portfolios with little, if any, public equity and alternative assets. Conversely, other insurers come to the conclusion that their underwriting profits are not market sensitive and therefore provide good diversification versus the risks inherent in equities and alternative assets. P&C and health insurers who hold this philosophy may have large allocations to public equity and alternative assets.

P&C and health insurers often maintain extremely liquid portfolios either because it is necessary given their liability or because of requirements from rating agencies and other stakeholders. This preference for liquidity does limit alternative allocations and results in a greater allocation to public equity as compared to life insurers.

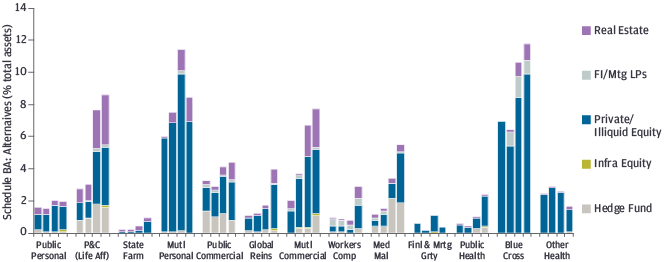

In EXHIBIT 22 we show average investments below for various composites in the P&C and health sectors. It is important to note that there is substantial variation in alternatives allocations among different P&C and health insurers within the same group. We observe that:

- Public companies (health and P&C) tend to have lower allocations to alternatives than mutuals

- P&C insurers that are affiliated with life insurers allocate more to real estate equity

- Financial and mortgage guaranty insurers tend to not take investment risk through alternatives

EXHIBIT 2: SCHEDULE BA ALTERNATIVE ASSETS FOR P&C AND HEALTH INSURERS

LEFT TO RIGHT, YEAR-END 2007, 2009, 2013, AND 2018

Source: S&P/SNL Financial, J.P. Morgan.

The Case for Core Alternatives

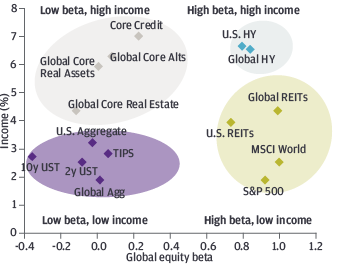

We refer to private alternative asset classes as “core” if a large percentage of total return comes from cash income and their cash flows can be forecasted for long periods of time with a low margin of error. For example, core real assets include well-leased properties in major developed markets; regulated utilities and other infrastructure sectors with transparent, predictable cash flows in developed markets; and large backbone transportation assets (maritime vessels, aircrafts, rail cars, etc.) that feature long-term contracts with high credit quality counterparties.

Income accounts for 60%–90% of the core alternative return, and core alternatives exhibit substantially lower total return volatility than their opportunistic or more highly levered counterparts. Due to the essential and often local uncorrelated nature of the return streams, core private assets exhibit a low correlation to broader markets and, to a great extent, each other. The lack of correlation across core private alternatives is key, as it further dampens volatility and reduces downside risks associated with any one category. Therefore, from an asset allocation perspective, we believe that not only are core private alternatives better, but also a broader, more diverse allocation.

Given how low yields are on long corporate bonds, the potential to use core alternatives to achieve high income with low beta is a powerful solution. Additionally core alternatives could be considered a good de-risking strategy for an insurer with a large public equity allocation.

EXHIBIT 3 breaks down major asset classes into four income-beta buckets: the bottom left is traditional safe assets, which offer protection in the form of low beta but at lower yields; the bottom right is major public equity categories that offer relatively moderate to low dividend yields, with liquidity and growth potential but with high market risk; the top right segment highlights high yield categories in fixed income that offer strong yields, though again at the cost of higher market risk; the top left includes the global core private market categories—private real estate, real assets and credit—that offer the best of both, i.e., high income with low beta. The cost, of course, is lower liquidity relative to traditional, public assets; at the same time, however, these core real assets have much greater liquidity when compared to long-life lock-up, closed-end private structures.

EXHIBIT 3: LOW BETA, HIGH INCOME FROM ALTERNATIVES: CORE REAL ESTATE, REAL ASSETS AND CREDIT

| 3A: MAJOR GLOBAL ASSET CLASSES | 3B: MAJOR CORE ALTERNATIVES ASSET CLASSES |

|---|---|

|

|

Source: ANREV, Bloomberg, Clarksons, Cliffwater, FTSE, INREV, MSCI, NAREIT, ODCE, S&P; data as of June 30, 2019. Sectors shown are represented by Bloomberg indices. U.S. HY: Corporate High Yield; TIPS: Treasury Inflation-Protected Securities (TIPS); Global HY: Global High Yield Index, Global Agg: Global Aggregate, U.S. REITs: FTSE NAREIT All-Equity REITs, Global REITs: FTSE EPRA NAREIT Global REITs. Yield and return information based on bellwethers for Treasury securities. The global core allocations are for illustrative purposes only and assume a simplified weighting scheme—asset allocation in private core markets in general should consider investor-specific objectives and constraints. The allocation for global core real estate is based on an equal allocation to U.S. core real estate, Europe core real estate and APAC core real estate. The allocation for global core real assets consists of 50% global core real estate, 25% global core infrastructure and 25% global core transport. The core credit allocation consists of 50% middle market direct lending and 50% U.S. core real estate mezzanine debt. The global core alternatives allocation consists of an equal allocation to global core real estate, global core infrastructure/transport and core credit. Yields for each public market asset class are a 12-month average. Yields for each private market core asset class denote range-bound income metrics that are representative of a portfolio of the illustrated well-diversified core asset classes. Yields and income are used interchangeably in the article. Betas for all asset classes are based on 11-years of annual returns for all sectors.

Core alternatives are appropriate for insurers given the importance that most insurers place on stable statutory book values for assets and mitigating GAAP earnings volatility and operating income volatility. Furthermore, many core alternative asset strategies are accessed via open-ended fund vehicles. Open-ended funds do not have the same J-curve that you find with other alternative asset classes. Investing in an open-ended fund allows for day one positive earnings as opposed to traditional private equity strategies or opportunistic real asset strategies that often involve a lengthy J-curve which results in negative earnings and reductions in capital.

Manager selection is extremely important when deploying capital in many parts of the alternatives market, especially in high-dispersion, non-core private market segments such as private equity, non-core real assets, credit and hedge funds. However, dispersion is relatively lower at the core end of the private alternatives spectrum. This points to a greater emphasis on intra-core asset class portfolio construction that maximizes return and diversification, but at the same time minimizes volatility and downside risks. EXHIBIT 4 is a summary of target return and expected income for four core alternative asset classes for consideration. All of these strategies have high and stable income, modest volatility, and are capital efficient.

EXHIBIT 4

| Asset class | Target return (net) | Expected income |

|---|---|---|

| Core global transportation leasing | 10–12% | 8–10% |

| Core global infrastructure equity | 8–12% | 5–7% |

| Core US real estate equity | 6.5–8.5% | 4–5% |

| Core US real estate mezzanine debt | 6–8% | 6–8% |

The target return shown is not meant to represent actual returns of the strategies.

The target return is provided for illustrative purposes only and is subject to significant limitations. An investor should not expect to achieve actual returns similar to the target return shown herein. The target return is the manager’s goal based on the manager’s calculations using available data, assumptions based on past and current market conditions, and available investment opportunities, each of which are subject to change. Because of the inherent limitations of the target return, potential investors should not rely on it when making a decision on whether or not to invest in this strategy. The target return cannot account for the impact that economic, market, and other factors may have on the implementation of an actual investment program. Unlike actual performance, the target return does not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact the future returns of the Strategy. The manager’sability to achieve the target return is subject to risk factors over which the manager may have no or limited control. Prospective investors should understand the risks factors associated with the strategy. No representation is being made that the strategy will achieve the target return or its investment objective. Actual returns could be higher or lower than the target return.

Expected income is not meant to represent JPMAM performance. Information shown is based on assumptions, therefore, exclusive reliance on these assumptions is incomplete and not advised.

1 Our definition of alternatives only includes Schedule BA alternatives and does not include Schedule A direct real estate and schedule B real estate mezzanine debt. Life companies are categories based on ownership structure (Public or Mutual) and based on business focus (Life & Annuities Focus or Annuities only). EU and Canada are categorized separately, which are insurers with currently or former European or Canadian parent companies. “Non-Trad” consists of non-traditional new entrants to the insurance industry, typically backed by private capital.

2 Our definition of alternatives only includes Schedule BA alternatives and does not include Schedule A direct real estate and schedule B real estate mezzanine debt. P&C companies are categorized based on ownership structure (Public or Mutual) and business focus (Personal, Commercial, Financial/Mortgage Guarantee, Worker Comp, Medical Malpractice, or Global Reinsurance). P&C with Life insurance affiliates and State Farm are categorized separately because they invest differently from the other categories. Health companies are categorized as Public Health companies (”Public Health”), part of the Blue Shield Blue Cross (“Blue Cross”), and other Health companies (“Other Health”).

0903c02a82769671