The UK Financial Conduct Authority (FCA) released its final Policy Statement (final rules) on Sustainability Disclosure Requirements and investment labels (PS23/16) on 28 November 2023, together known as the UK SDR.1 This final set of rules updates the consultation paper issued in October 2022 and the original proposal of November 2021. Accordingly, the FCA updated its Environmental, Social and Governance sourcebook with the final rules in January 2024.2

The UK SDR introduces a set of sustainability-related product labels, product- and entity-level disclosures, an anti-greenwashing rule, and naming and marketing rules regarding sustainable investing for the UK. The current UK SDR is only applicable to UK-domiciled funds. Whether and how UK SDR could be expanded to also capture overseas funds, such as undertaking for collective investment in transferable securities (UCITS) funds domiciled in the European Union (EU), is still to be confirmed.

In April 2024 the FCA also published a consultation paper CP24/8 on extending the Sustainability Disclosure Requirements (SDR) regime to Portfolio Management.3 The proposals to extend the regime are primarily aimed at wealth management services for individuals and model portfolios for retail investors. In September 2024, the FCA informed, that it would publish a Policy Statement and further details about the implementation timetable for portfolio managers in Q2 2025.

The UK SDR builds on both the UK implementation of the Task Force on Climate‑related Financial Disclosures (TCFD), which came into effect in April 2022, and the FCA’s “Dear Chair Letter” from July 2021 that addressed greenwashing concerns, warning firms against exaggerating the sustainable characteristics of their products and services and providing a regulatory framework to mitigate these issues.

The FCA’s stated goal for the UK SDR is to ensure that “financial products that are marketed as sustainable should do as they claim and have the evidence to back it up”.4 The sustainability labels are intended to clearly distinguish between products that can be considered sustainable and achieve a label, versus those products that refer to environmental, social and governance (ESG) characteristics in their name or marketing but do not use a label, and non-ESG products.

For products that meet the associated requirements and elect to opt into a sustainability label, the UK SDR offers 4 new labels, “Sustainability Focus”, “Sustainability Improvers”, “Sustainability Impact” and “Sustainability Mixed-Goals”. These sustainability labels aim to recognise different types of investment products based on their sustainability‑related objectives and features. Together with the associated disclosures, which apply at both a product and entity level, the labels are designed to give consumers the information they need to make informed choices with regards to which products meet their needs and sustainability preferences.

The UK SDR introduces three key elements related to ESG and sustainable investing:

1. Sustainability labels: Funds that meet the requirements can opt into one of four new sustainability labels (link to section What are the sustainability labels).

With the creation of the sustainability label, funds in the UK will now fall into three broad categories related to their level of sustainability and disclosure:

- Sustainability-labelled funds meet the requirements for and use one of the four new sustainability labels

- Non-labelled ESG funds use ESG terms in their names or marketing but are not adopting sustainability labels

- Non-ESG funds do not adopt sustainability labels and are not marketed as ESG funds

2. Product- and entity-level disclosures: Detailed rules on specific product-level disclosures (consumer facing, pre-contractual and ongoing) and entity-level sustainability reports

3. Anti-greenwashing rules: Intend to ensure that sustainability claims are clear, fair and not misleading.

The UK SDR includes several additional rules and requirements related to sustainable investing:

- Naming and marketing rules restrict the use of certain sustainability-related terms in product names and marketing materials for products that qualify to use a sustainable investment label.

- Requirements for distributors ensure that product-level information (including the sustainable investment) is made available to consumers.

The UK SDR includes regulations and disclosures that will apply to many financial services entities as well as many of their products and activities. Importantly, UK SDR currently only applies to UK entities, including most types of asset managers and distributors, and the investment products they offer. A consultation on the treatment of overseas funds, such as EU-domiciled UCITS funds, is expected in the future.

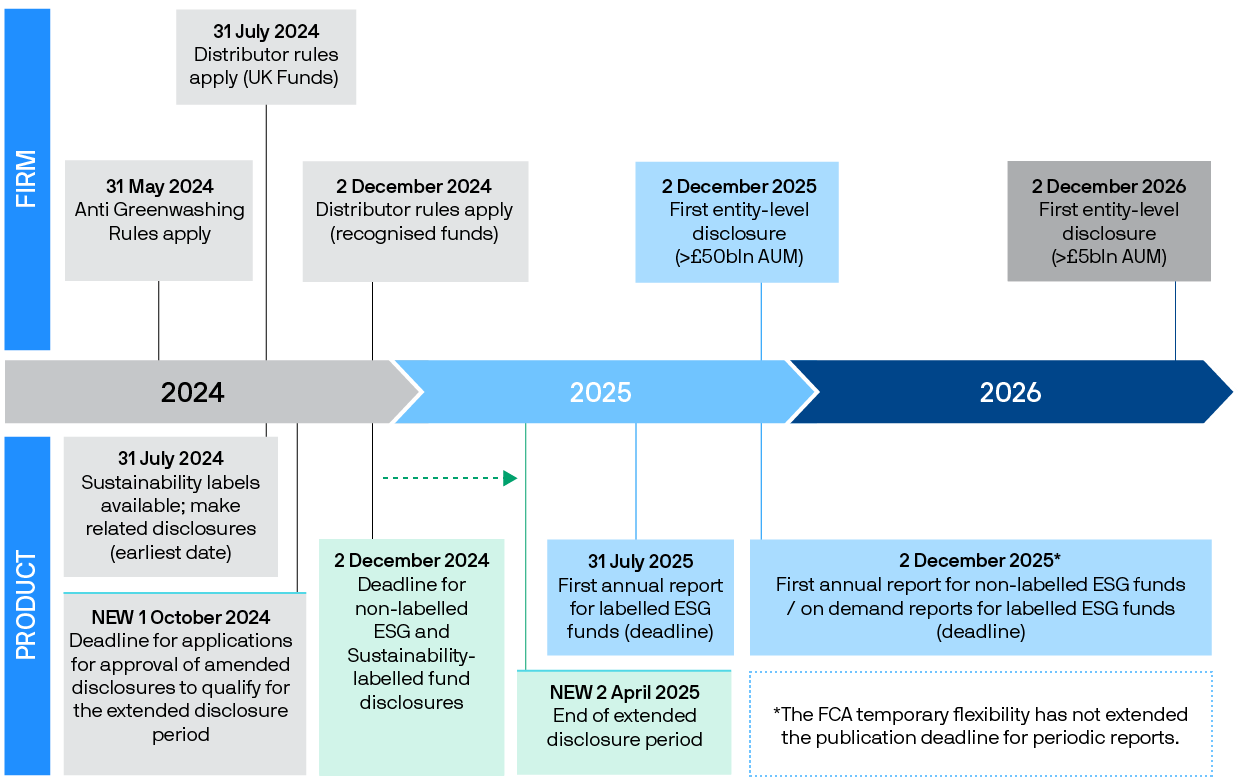

Elements of the UK SDR related to firms and products will come into effect over the course of 2024 and the next couple of years, as detailed in the timeline below. Importantly, firms have been able to start using sustainability labels for qualifying funds effective 31 July 2024, if they have met the qualifying criteria and issued the related disclosures.

Note that in September 2024, the FCA set out measures offering limited temporary flexibility, until 5pm on 2 April 2025, for firms to comply with the ‘naming and marketing’ rules of the FCA’s ESG Sourcebook in relation to certain sustainability products, where those firms and products meeting the related FCA conditions, namely

- Having submitted a completed application for approval of amended disclosures by 5pm on 1 October 2024; and

- Where that product is currently using one or more of the terms ‘sustainable’, ‘sustainability’ or ‘impact’ (or a variation of those terms) in its name and is intending either to use a sustainability label, or to change its name.5

If these conditions are not met, the 2 December deadline continues to apply.

The UK SDR creates four sustainable investment labels to help consumers navigate the investment product landscape and enhance consumer trust. The FCA does not rank any of the above labels over the other or suggest one label is of greater worth. The four labels are differentiated as:

- Sustainability Focus - This is for products with a sustainability objective consistent with an aim to invest at least 70% in assets that are environmentally and/or socially sustainable, determined using the robust, evidence-based standard that is an absolute measure of environmental and/or social sustainability.

- Sustainability Improvers - This is for products with a sustainability objective consistent with an aim to invest at least 70% in assets that have the potential to improve environmental and/or social sustainability over time, and that are determined by their potential to meet the robust, evidence-based standard of sustainability. Firms must obtain robust evidence for selecting those assets.

- Sustainability Impact - This is for products with a sustainability objective consistent with an aim to achieve a pre-defined positive, measurable, impact in relation to an environmental and/or social outcome (and invest at least 70% of their assets in accordance with that aim).

- Sustainability Mixed Goals - This is for products with a sustainability objective to invest at least 70% in accordance with a combination of the sustainability objectives for the other labels. Firms must identify (and disclose) the proportion of assets invested in accordance with any combination of the other labels. However, requirements for each of the other labels must be met.

These sustainable investment labels are accompanied by implementing guidance, which includes five overarching principles and associated key considerations covering what firms must do and the expected sustainability‑related features of each sustainable investment label. As described in the UK SDR, the overarching principles cover:6

- Sustainability objectives: All products using a label must have a sustainability objective to improve or pursue positive environmental and/or social outcomes as part of their investment objectives. Firms must identify and disclose whether pursuing the positive sustainability outcomes may result in material negative outcomes.

- Investment policy and strategy: Ordinarily, at least 70% of the product’s assets must be invested in accordance with its sustainability objective, with reference to a robust, evidence-based standard that is an absolute measure of environmental and/or social sustainability. Firms must also identify and disclose any other assets held in the product for other reasons (for example, cash or derivatives), including why they are held.

- Key performance indicators (KPIs): Firms must identify KPIs to measure progress of the whole product or individual assets against the sustainability objective. Firms must also set out an escalation plan to be able to take action when assets within the 70% threshold do not demonstrate sufficient progress towards the sustainability objective and/or KPIs.

- Resources and governance: Firms are responsible for appropriate resources, governance and organisational arrangements to support delivery of the sustainability objective.

- Stewardship: Firms must identify and disclose the stewardship strategy needed to support the delivery of the sustainability objective, including activities they expect to take and outcomes they expect to achieve.

The UK SDR establishes several sustainability-related disclosures that build on the TCFD product and entity disclosures.

For products using a sustainability label or ESG-related terms in product names or marketing, firms are required to provide:

- A statement that explains the purpose of the label or why the product does not have a sustainability label.

- Consumer‑facing disclosures to help retail consumers understand the key sustainability-related features of the product. These disclosures must be no longer than two pages, located in a prominent place on a relevant digital medium, such as a webpage or mobile app, and reviewed and updated annually.

- Detailed product-level disclosures with further information to assist a wider audience, including institutional investors and consumers. These include:

- Pre-contractual disclosures of the products sustainability-related features made in a fund prospectus, prior disclosure document or sustainability product report (Part A), depending on the type of firm producing the disclosures.

- Ongoing disclosures of key sustainability-related performance indicators and metrics in a Sustainability Product Report (Part B), which builds from the TCFD product report for firms that are in scope for the TCFD-aligned disclosure requirements.

Some clients may require the information in the detailed product-level disclosures for their own sustainability disclosure requirements and the public disclosures may not be appropriate. For these clients, firms must respond to one on-demand request per 12-month period (though they are not required to produce on-demand disclosures before 2 December 2025).

- Entity-level disclosures consistent with the four pillars of the TCFD and International Sustainability Standards Board (ISSB): governance, strategy, risk management, and metrics and targets related to managing sustainability-related risks and opportunities.

Currently, the proposed UK SDR and the EU SFDR, share some features, including mandating product- and entity-level disclosures. However, there are key differences between the two regulatory regimes, both in approach and scope. Notably, the UK SDR does not include the concept of double materiality or cross-product asset-level definitions, such as “sustainable investment”, including the concept of “do no significant harm”, which exist in the EU SFDR. The UK SDR also does not mandate specific disclosure templates that must be completed to adhere to the disclosure requirements.

The UK SDR does, however, explicitly introduce new sustainability labels and related conditions, such as an evidence-based standard that is an absolute measure of environmental and/or social sustainability. The UK SDR also introduces two levels of disclosure (consumer vs. institutional).

Further information

J.P. Morgan Asset Management is proud to help clients achieve their sustainable investing goals. If you have questions about the UK SDR or sustainable investing, please contact your local J.P. Morgan Asset Management representative.

1 https://www.fca.org.uk/publication/consultation/cp24-8.pdf

2 Financial Conduct Authority, “Environmental, Social and Governance sourcebook,” Release 32, January 2024.

3 Financial Conduct Authority, “Implementing the Overseas Fund Regime,” CP23/26, December 2023.

4 Financial Conduct Authority, “Sustainability Disclosure Requirements (SDR) and investment labels,” Policy Statement PS23/16, November 2023.

5 Financial Conduct Authority, “Guidance on the Anti-Greenwashing rule,” GC23/3, November 2023.

6 The Financial Conduct Authority, “Sustainability Disclosure Requirements (SDR) and investment labels,” Policy Statement PS23/16, November 2023.

For Professional Clients/ Qualified Investors only – not for Retail use or distribution.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

09kz231207125032