Is hedging leading to an alpha opportunity for the yen?

03-06-2020

In Brief

- We believe the yen can be an attractive portfolio hedge and could potentially appreciate because of this.

- While reduced trade flows exert less appreciation pressure on the yen than in the past, Japan still owns a huge stock of foreign assets that could be hedged.

- Hedging costs have now fallen following interest rate cuts and liquidity provisions in the US, while domestic assets also now appear relatively more attractive. Hedging activity could significantly support the yen.

- The yen’s valuation is still reasonable and the BoJ are limited in their ability to lower rates further. The main risk to this view is an increase in Japanese purchases of foreign equities.

- While some of the conditions for a broader US dollar downtrend are in place, we still see some key obstacles to breaking out of the rangebound environment in the near term.

The yen has been a popular currency to own over the last few months; it tends to exhibit a negative correlation to equity markets so it has been used to speculate on the worsening global growth outlook. As equity markets have recovered amid significant easing of both monetary and fiscal policy, we believe there is an opportunity to now own the yen for idiosyncratic, alpha-related reasons. As currency investors we look to pair yen longs with positions in higher-beta, fundamentally attractive currencies, such as the Australian dollar. For those with a wider opportunity set, yen longs could also complement any holdings of equity-like assets.

We believe the yen has been able to maintain relatively weak levels against the US dollar for an extended period of time, as greater competition with the rest of Asia has reduced the Japanese current account surplus, while the US current account deficit has shrunk thanks to the shale revolution. While the reduction in these trade flows has dampened the appreciation pressures on the yen, there remains a huge stock of Japanese financial investment in US assets, particularly fixed income assets.

It is the currency hedging activity relating to the stock of foreign assets that we believe has the potential to cause the yen to appreciate. Over the last few years, the Federal Reserve set interest rates significantly higher than the rest of the world and currency volatility remained low, making a compelling case to own US assets. The move to zero rates in the US, combined with the increasingly apparent limits of negative rates policies abroad, has reduced the cost to hedge the currency exposure of US assets for Japanese investors, and at a time when currency volatility has picked up from historically low levels.

EXHIBIT 1: ANNUALISED HEDGE ON A LONG THREE-MONTH USD POSITION VS JPY (%)

Source: Bloomberg, data as of May 2020.

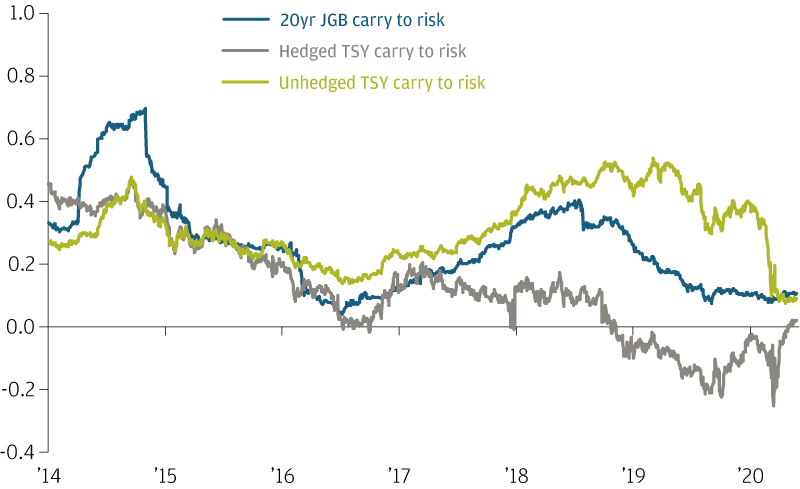

Our research shows the balance of risk and reward from unhedged US Treasuries is now inferior to Japanese government bonds. While US credit is somewhat more attractive on an unhedged basis, the risk savings from hedging the currency exposure at close to zero cost make hedged US credit appear more favorable still on our metrics (EXHIBIT 2). Indeed, our research around optimal hedge ratios for Japanese clients suggests a high hedge ratio is the optimal strategy for equity investments too. While hedging flows have been slow to materialise we believe this relates to the distortions in money markets over the last two months, which have now normalised following the widespread expansion of US dollar liquidity facilities at foreign central banks.

EXHIBIT 2: CARRY TO RISK FOR 20-YEAR JAPANESE GOVERNMENT BOND, HEDGED US TREASURY BOND AND UNHEDGED US TREASURY BOND

Source: Bloomberg, data as of May 2020.

We remain aware that the move up the value chain of the Chinese manufacturing sector may affect the long-term value of the yen. Our approach to valuation is always to look for confirmation of misvaluations in the trend of balance of payments, which we currently see as consistent with our purchasing power parity metrics that show the yen as slightly undervalued. While the yen may not be as cheap as the consensus believes, we still see room for appreciation.

The key risk to our view is increased Japanese investment in foreign equities. There has been a trend towards greater foreign equity allocations in the publicly available targets at institutions such as the Japanese Government Pension Investment Fund (GPIF), along with much media coverage of Japanese foreign direct investment (FDI) into the unlisted technology sector. While further new investment may be slower than the past amid higher uncertainty due to COVID 19, we continue to actively monitor these flows.

Going forward, we expect hedging activity to rise over coming months and support the yen. It is likely that the yen remains correlated to equity performance and may therefore struggle to appreciate if global asset markets continue to rally. Our investment case centers on the alpha we believe is available in long yen positions on top of the negative beta, making this a particularly attractive portfolio hedge.

The fall in US interest rates has reduced hedging costs against a wide range of currencies, with traditional rate-spread relationships suggesting the dollar should weaken. At the same time, the valuation of the dollar is quite expensive on traditional metrics. We are highly focused on the potential for a broader downturn in the dollar, but for now we see several barriers to an exit from the rangebound environment for the dollar against other major currencies. Until non-US assets are able to deliver comparable returns to US markets and investment flows return to global markets, we prefer to focus our short dollar exposures in currencies where we see idiosyncratic alpha, such as the yen.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD342 billion (as of 31 March 2020) in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 18 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic “intelligent” currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active “alpha” currency overlay offers passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There is no guarantee they will be met. Provided for information only, not to be construed as investment recommendation or advice.

0903c02a828efb98