In brief

- First rate cut since 2020: The Reserve Bank of Australia (RBA) reduced its overnight cash rate by 25 basis points (bps) to 4.10%, citing easing inflationary pressures and confidence in inflation moving towards the target range.

- Cautious approach amid uncertainty: Despite the rate cut, the RBA remains data dependent and cautious about further easing, highlighting tight labor market conditions and an uncertain economic outlook.

- Investment implications: The rate cut, alongside geopolitical uncertainties and market volatility, emphasizes the opportunity for Australian dollar cash investors to maintain diversification, with interest rates still offering relatively attractive yields.

Introduction

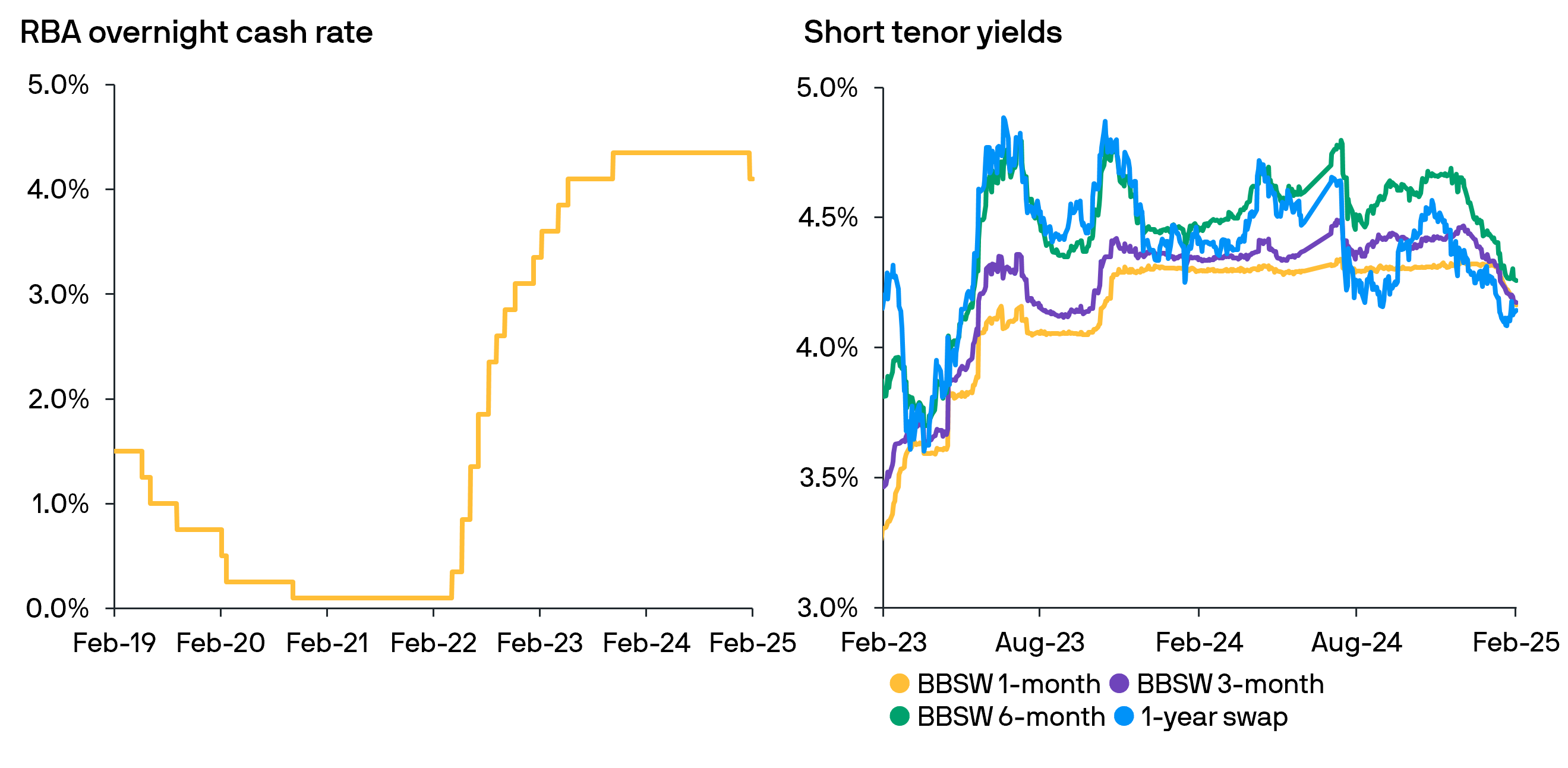

At its first monetary policy meeting of 2025, the Reserve Bank of Australia (RBA) decided to reduce its overnight cash rate (OCR) by 25bps to 4.10% (Fig 1). This marks the first rate cut since November 2020, lowering the base rates from a cycle high of 4.35%. The central bank justified its decision by noting that “inflationary pressures are easing a little more quickly than expected”, giving “the board confidence that inflation is moving sustainably towards the midpoint of the 2-3% target range”.

In the subsequent press conference, Governor Bullock confirmed the rate cut was not a foregone certainty and the decision did not imply further rate cuts are imminent. This indicates the bank has not decisively shifted to a dovish policy stance and will remain data dependent, underscoring the uncertainty surrounding the path and pace of future rate cuts.

Fig 1: The RBA adjusted its OCR for the first time since November 2023; yield curves have flattened in anticipation of central bank rate cuts.

Source: Reserve Bank of Australia, Bloomberg and J.P. Morgan Asset Management; data as at 18th February 2025.

Uncertain outlook, cautious stance

The RBA welcomed the news that “inflation has fallen substantially since the peak in 2022”. With a combination of subdued domestic demand, weaker output, slower-than-expected wage growth and falling housing cost inflation, the fourth quarter trimmed mean CPI printed at 3.2%y/y versus RBA’s expectations of 3.4%y/y. In the accompanying Statement on Monetary Policy, the central bank forecasts inflation to return to 2-3% target range by the end of 2025. It also anticipates a mild recovery in economic growth and continued labor market strength.

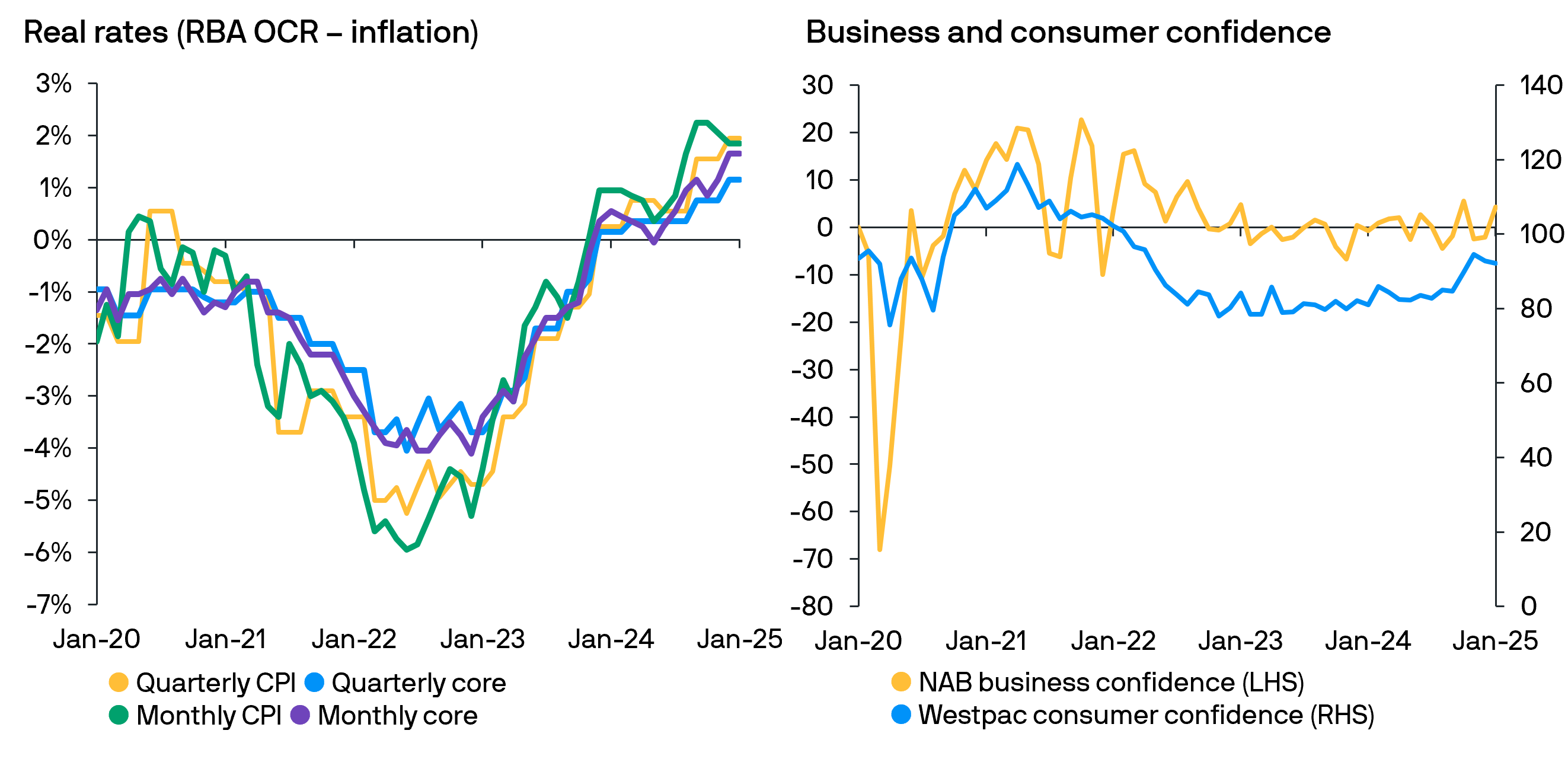

While the RBA believes “upside risks to inflation appear to have eased”, it remains “cautious on the prospects for further policy easing”. The bank noted that “labor market conditions remain tight” while uncertainty about the domestic and international outlook remain elevated. Attempting to bridge this dichotomy, the RBA confirmed its commitment to returning inflation to the target and noted that rates would remain restrictive (Fig 2a) following the rate reduction as “disinflation could stall” if “monetary policy is eased too much too soon”.

Fig 2: Australian real rates have moved positive as inflation declines; business and consumer confidence remains subdued due to elevated interest rates.

Source: Reserve Bank of Australia, Bloomberg and J.P. Morgan Asset Management; data as at 18th February 2025.

Investment implications

Lower than expected inflation enabled the RBA to begin its monetary policy easing cycle as it seeks to balance the need to support economic growth with the goal of ensuring inflation sustainably returns to target levels. However, the bank’s commitment to data dependence and the absence of any clear deterioration in economic data suggest the future pace of rate cuts and the eventual terminal rate remain uncertain.

A single, isolated rate cut is unlikely but given the lack of urgency and the RBA’s need to confirm the disinflationary trend, we believe the central bank will proceed very slowly with further rate cuts as a precautionary measure to prevent real rates becoming too restrictive rather than too stimulatory.

For AU$ cash investors, the RBA’s rate cut, coupled with an uncertain geopolitical backdrop and volatile markets underscores the importance of maintaining diversification across tenors and cash strategies. Fortunately, interest rates remain elevated by historic standards, which continue to provide relatively attractive yields for cash investors.