PBoC’s small, yet clear dovish signal

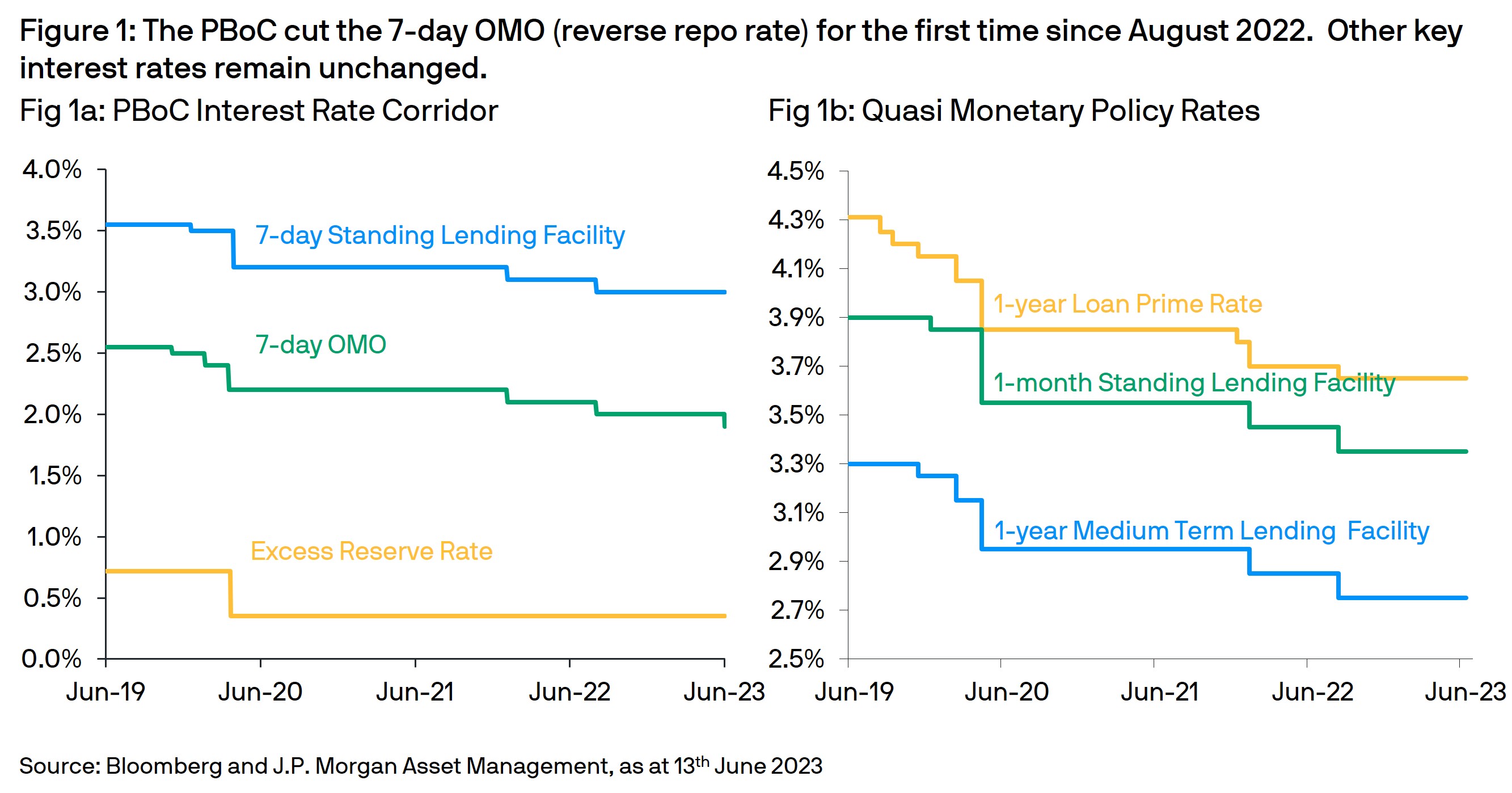

At its 13th June Open Market Operation (OMO), the People’s Bank of China (PBoC) cut its 7-day Reverse Repo Rate by 10bps to 1.90% (Fig 1). The repo rate is a key tool used by the central bank to ensure adequate market liquidity, this also represents the first repo rate cut since August 2022. With China’s reopening bounce fading and an economic recovery yet to be secured, investors were expecting additional monetary policy support – but the exact timing and method was uncertain. A recent article in the Economic Daily suggested the State Council believed that “monetary policy needs to do more to support the recovery”. The subsequent, weaker than expected trade and inflation data, was the likely trigger for the central bank’s small yet clear signal of monetary policy loosening.

Fading Momentum:

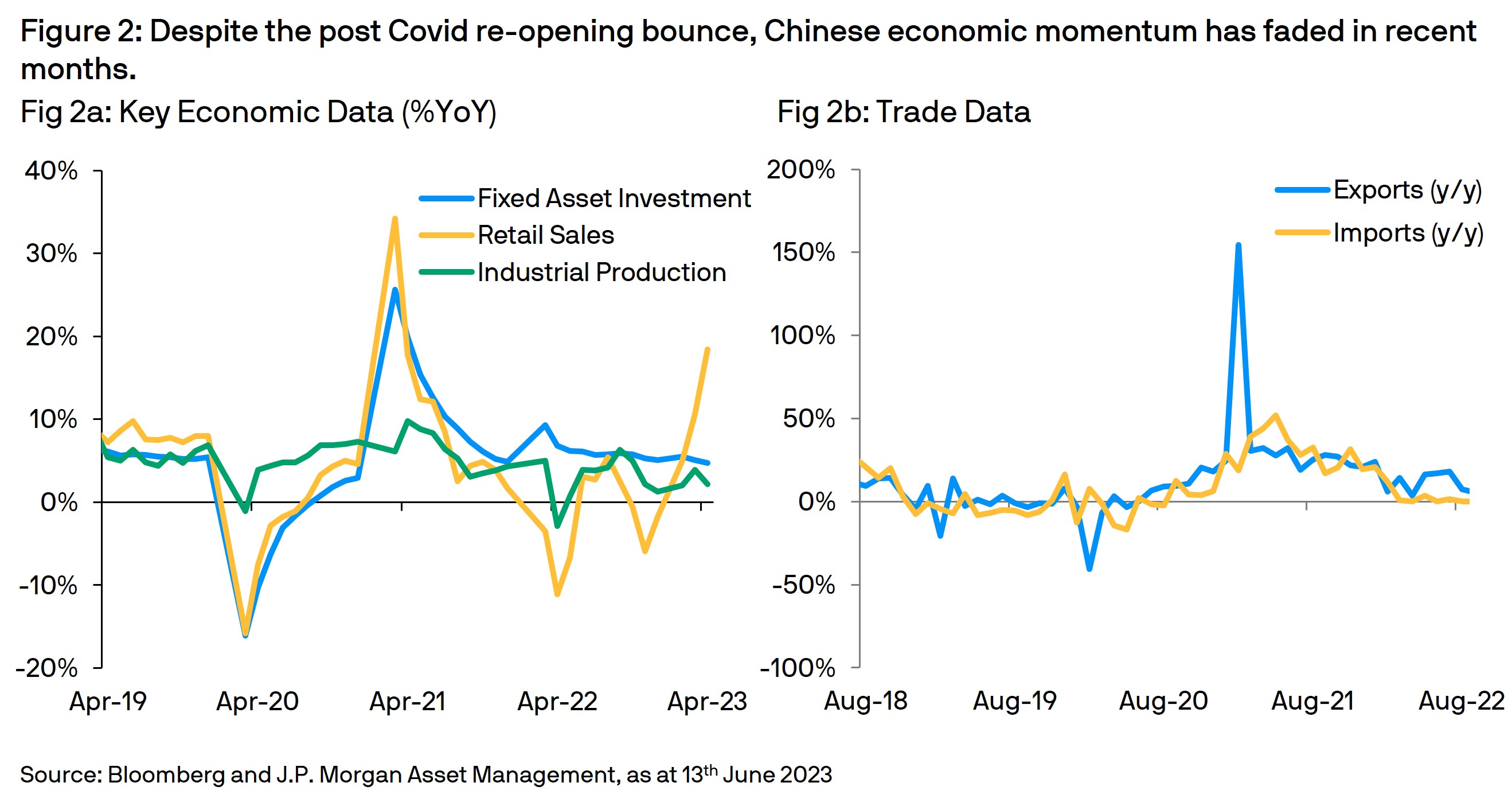

Recent economic data has been lackluster with both domestic (Fig 2a) and international (Fig 2b) demand weaker than expected. Fixed asset investment and industrial production, key drivers of growth, exhibited fading momentum while retail sales strength was based on narrow catering and luxury goods with softer demand across other goods. Meanwhile, export growth was sharply lower on broad based weakness across most sectors and markets as higher interest rates and cost of living worries weigh on global consumer sentiment. Fortunately, muted inflation, with CPI slowing to 0.2%y/y in April 2023, allows the PBoC the flexibility to pivot more dovish to support the economy.

Market Reaction

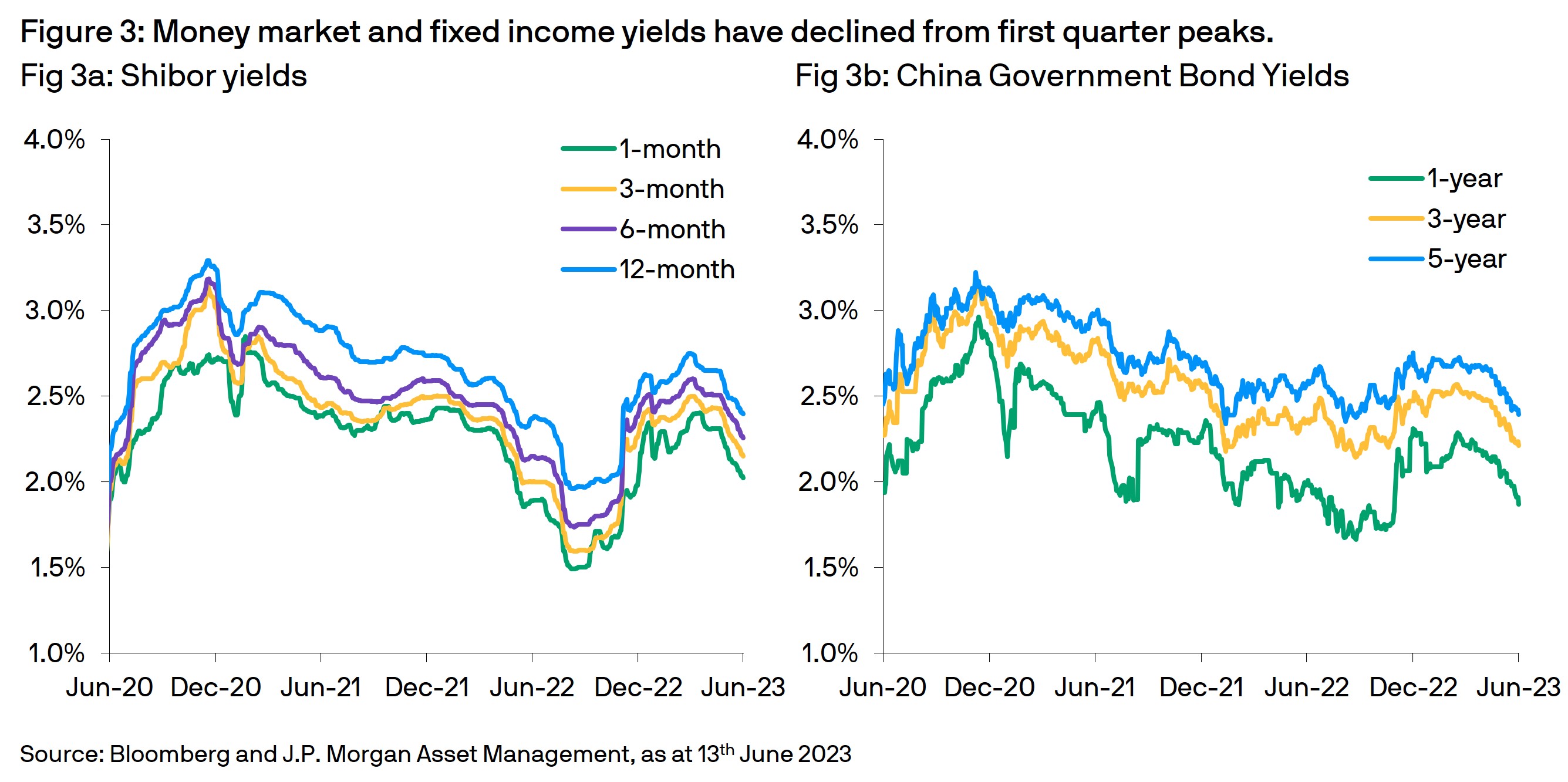

Since peaking in March 2023, short tenor interest rates (Fig 3a) have trended downwards, echoing fading economic momentum. Following the PBoC announcement, yields declined further, and the curve flattened (Fig 3b) as investors anticipate additional monetary policy support. The RMB after achieving post-reopening peak of CNY 6.70 versus the USD in mid-January 2023 has also continued its depreciation trend - recently breaking through the psychologically important 7 level.

Investors are now predicting additional monetary policy easing – although the timing and exact nature of any actions remains uncertain. Potential policy actions include: Cutting the Medium-Term Lending (MLF) facility rates and subsequently Loan Prime Rates (LPR) (which would directly impact lending costs), or cutting the Reserve Requirement Ratio (RRR) (which would free up more funds for lending). While cutting the official deposit and lending rates is a possibility, these rates are effectively dormant, having not been changed in several years.

Conclusion:

With increasing signs that China’s economic recovery is losing momentum, we believe additional fiscal and monetary policy is likely to ensure the government achieves its 2023 GDP target. While adding more liquidity would be helpful, cutting interest rates, especially for mortgage and corporate borrowers is the key to support economic growth - suggesting a MLF cut is a highly likely next step.

Unfortunately, for RMB cash investors, interest rates are expected to remain on a downward trend for the foreseeable future. However, in our opinion, a diversified strategy across different investment options and tenors – including liquidity and ultra-short duration strategies remains the high conviction option to present a relatively attractive return while balancing the needs for liquidity and security.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

This information is generic in nature provided to illustrate macro trends based on current market conditions that are subject to change from time to time. This generic information does not take into account any investor’s specific circumstances or objectives and should not be construed as offer, research or investment advice.