Slide Image

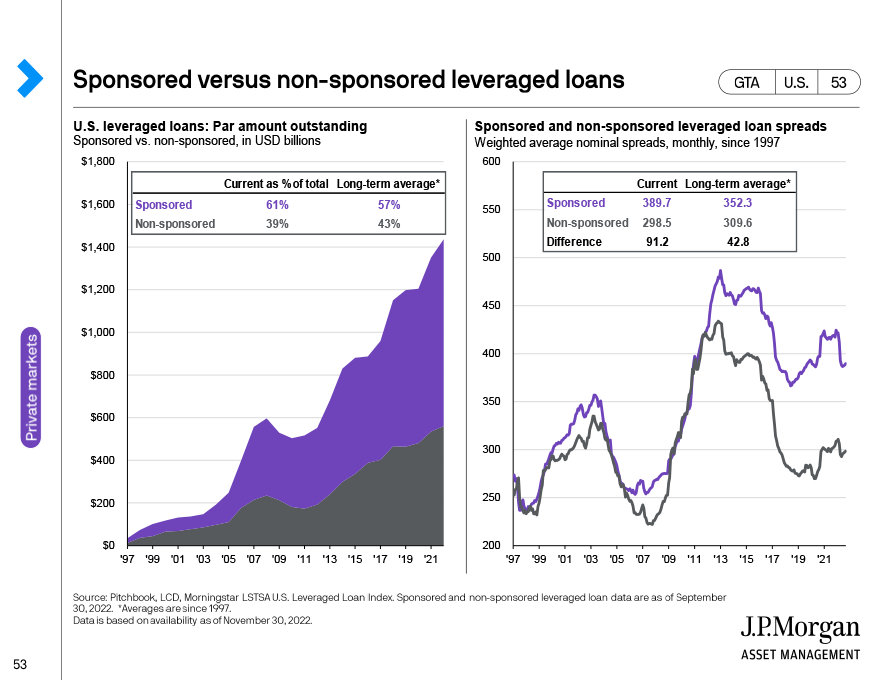

Sponsored versus non-sponsored leveraged loans

Currently, sponsored-backed leveraged loans represent 61% of the U.S. leveraged loan market. The steady increase in sponsored-backed loans as a % of the total market can primarily attributed to a decade of near-zero interest rates, which pushed PE-backed companies to load up on cheap debt. Additionally, 90% of loans rated B-minus or lower backed sponsored companies. In other words, sponsored leveraged loans not only represent an outsize share of the market but also represent the riskiest parts of the markets. As a result, it is no surprise that the spread differential between sponsored and non-sponsored leveraged loans has widened. As of 9/30/2022, sponsored companies paid, on average, 91 bps more than non-sponsored companies versus a historical premium of 43 bps.