Considering active currency and the potential portfolio benefits

20-01-2023

Nigel Rayment

Nick Wall

Currency risk is often a secondary consideration when an investor decides to allocate capital overseas. Typically, the primary motivation of the investment is to take exposure in a particular asset (fixed income, equity, infrastructure, etc.) and, subsequently, the decision is then made whether to hedge the associated foreign currency exposure.

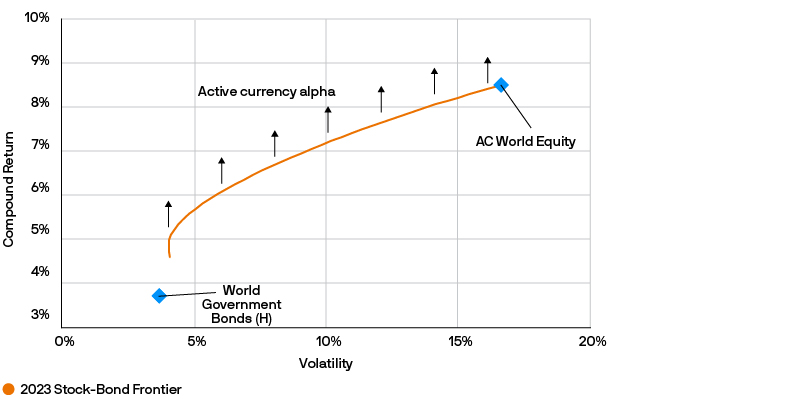

However, currencies can also be thought of as an additional source of investment return which is separate to other asset classes. The objective of actively managing currency in a portfolio is to provide diversified returns that enhance the efficient frontier of an investor’s overall portfolio, as illustrated in Exhibit 1.

Exhibit 1 – The potential to improve the efficient frontier of a portfolio with uncorrelated active currency returns

Source: J.P. Morgan Asset Management; Long-Term Capital Market Assumptions data as of September 2022. H – Hedged. AC – All Country.

Why consider active currency management?

We believe there are three potential benefits of allocating to active currency management:

Return enhancement – generating alpha in an inefficient market

Diversification – uncorrelated returns with traditional asset classes

Efficient implementation – flexible, tailored solutions with a low cost of implementation and minimal capital usage

1. Return enhancement

The currency markets are among the most liquid in the world, with total daily turnover of 7.5 trillion US dollars, according to the Bank of International Settlements’ April 2022 survey.

Usually, such high liquidity and turnover would suggest that the market is very efficient; however, this is not the case with currency markets because a significant portion of the participants are not directly seeking to generate profit from their foreign exchange (FX) transactions. Their motivation for exchanging currencies is to manage the cash from foreign purchases or sales of goods and financial assets. Their decisions are based on the relative price of goods and services and the expected returns on investment in different countries; they’re not specifically expressing a view on the exchange rate.

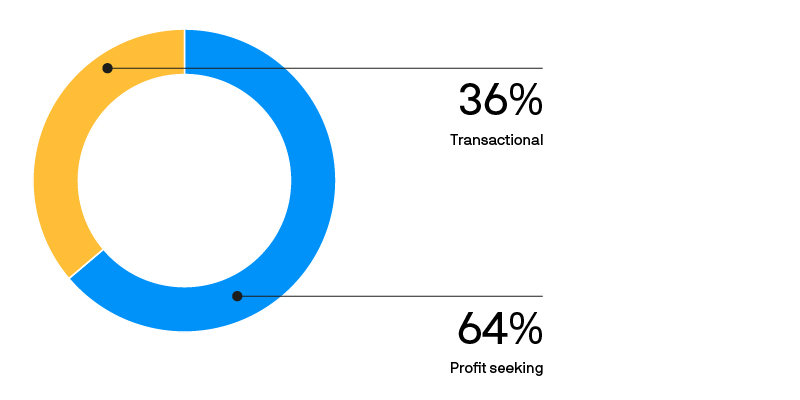

Our analysis would suggest that approximately two thirds of market participants in currency markets could be classed as profit seeking (i.e. explicitly taking directional views in currencies to generate returns) with the remaining third of market participants using currencies for transactional purposes. As these transactional market participants are price takers by nature – paying for liquidity via bid-ask spreads – there is a tremendous opportunity to capitalise on an inefficient market and generate a return through actively trading currencies.

Exhibit 2 – Market participants in currency markets

Source: J.P. Morgan Asset Management; Bank of International Settlements Triennial Central Bank Survey of April 2022.

The argument against active currency management is that the long-term expected return of a major currency is zero. We agree with this academic argument but would emphasise that valuation cycles can often play out over decades.

In the shorter term, currencies are typically driven by relative macroeconomic fundamentals in predictable ways. The resultant volatility, along with deep liquidity and market inefficiencies, make currencies an attractive medium for active management.

Exhibit 3 – Structural and cyclical trends in the value of the trade weighted US dollar

Sources: Bloomberg, JP Morgan Asset Management. Data as at December 2022. REER = Real effective exchange rate

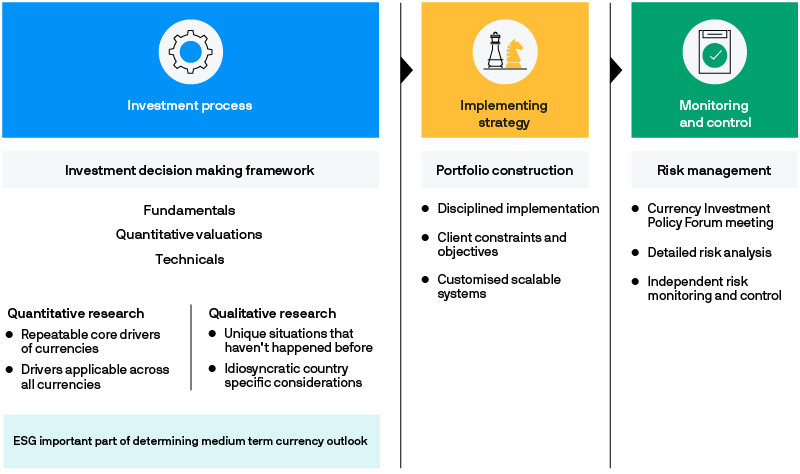

Currency managers use a variety of different methods and indicators to make active decisions. We believe that the medium-to-long-term driving forces which make goods and financial assets more or less attractive can be assessed using in-depth proprietary research. These factors can be combined in a risk controlled process to generate profit from currency market movements.

Additionally, in the short term, volatility caused by political news, shifts in market sentiment and events which have no precedent provide opportunities and can be captured by a well-resourced and experienced FX strategy team.

Exhibit 4 - Overview of J.P. Morgan Asset Management active currency investment process

Provided to illustrate team’s general investment process under normal market conditions, not to be construed as offer, research or investment advice. Risk management does not imply elimination of risks. We systematically assess financially material ESG factors amongst other factors in our investment decisions with the goals of managing risk and improving long-term returns. ESG integration does not change a strategy’s investment objective, exclude specific types of companies or constrain a strategy’s investable universe.

We employ a multi-factor process to capture these primary fundamental drivers of currencies as different factors typically perform well in different economic environments, thereby delivering more consistent returns than single factor approaches. We have found that this approach has added value to our clients’ portfolios over time. Over an economic cycle, our track record supported our expectation that an active currency strategy can achieve an information ratio of 0.5, meaning a typical risk budget of 2% could generate an average annual excess return of around 1%. That is not to imply that forecasts are guaranteed.

2. Diversification

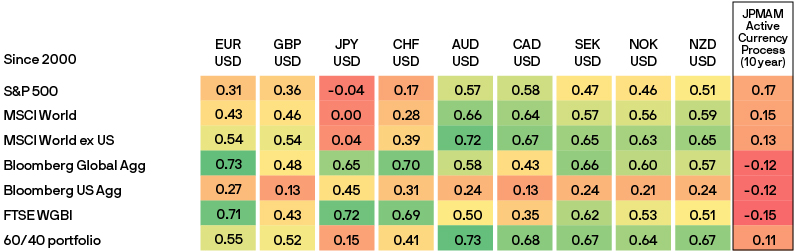

Currencies also provide the opportunity for diversification given their low correlations with other asset classes. As a result, the risk and return characteristics of the overall portfolio can be enhanced. Exhibit 5 shows the average monthly correlations since 2000 between G10 currency returns and those of different equity and bond indices. The long/short nature of currencies allows for actively managed currency portfolios to offer diversification compared to traditional asset classes.

Based on our experience, when the returns from an active currency strategy targeting 2% risk are combined with a 60/40 equity bond portfolio, the uncorrelated nature of active currency could improve the information ratio of the overall portfolio by up to 10%, if you were to allocate the notional equivalent of the overall assets of the plan.

Exhibit 5 – Correlations of currencies with traditional asset classes

Source: J.P. Morgan Asset Management; Bloomberg as of 30 November 2022. Diversification does not guarantee positive returns and does not eliminate the risk of loss.

3. Efficient implementation

The long/short nature of an active currency portfolio is a key differentiator as a source of alpha. Most other major asset classes (equities, fixed income, real assets) have their risk derived predominantly from the underlying market i.e. beta risk. Active currency portfolios operate differently, generating alpha with no expected beta risk to underlying asset markets and targeting a desired risk budget independent of the broader financial market environment.

Active currency portfolios utilise FX derivatives to take positions by selling one currency and buying another. The sizing of these notional positions can be scaled to take the appropriate level of risk in different volatility environments. If FX volatility is below average, then larger notional positions can be taken to target the same risk. Likewise, if FX markets are more volatile then smaller notional positions can be taken to target the same amount of risk.

The beta neutrality of active currency and the flexibility of implementation are attractive features and contrast to other traditional markets where risk reduction, without the use of derivatives, would require the liquidation of positions to cash and thereby no longer being invested.

Lastly, the nature of currency portfolios allows for cash to be utilised efficiently. As currency portfolios typically operate using FX forward derivatives, cash is only required for the settlement of the contracts which is typically once every 1-3 months based on the FX gain or loss made in the portfolio. Currency overlay portfolios are also unfunded and do not require an initial cash investment.

Recognising risks

The structure and specialist resources needed for an active currency portfolio means that opportunities for investors can be more challenging to capture. The research required to generate alpha consistently may mean that active currency is a distraction for some investors to implement themselves compared to focusing on more core investments. Many multi-asset style mandates incorporate active currency management as a source of diversified return. In this regard, active currency management can be bucketed with either hedge funds, given their diversifying nature to traditional asset classes, or cash enhancement, given that they operate as a notional overlay.

The following key features of an active process should help to mitigate any investment risks:

Adopt a global diversified process that incorporates a broad universe of both developed and emerging market currencies

Adopt a diversified multi-factor approach that combines the independent inputs in a consistent and transparent framework

Ensure disciplined risk management, utilising a dedicated and experienced FX team aligned with proprietary, specialist systems to effectively manage currency risk

Conclusion

We think active currency management should be part of an investor’s portfolio. However, the strategy is only suitable for sophisticated investors who already have the foundations of their wider portfolio in place. Core asset classes will likely have a greater impact on the overall portfolio risk and return, however, active currency management can be considered as an attractive enhancement to complement the portfolio with diversified return.

Currency portfolios are not a core part of investment plans in the same way as other asset classes, however, they offer a diversified, scalable source of return if executed correctly. Currency portfolios present many opportunities from a fundamentally inefficient market but require a tailored approach while ensuring the correct risk managed controls are in place.

0965231101162144