Today’s low interest rates could spell trouble for those who are saving for the future in cash – and women in particular are primed to benefit from taking the step into investing.

Despite the hazards that low interest rates present to our long-term financial security, many savers remain reluctant to consider investing as a way to boost returns. This is particularly true of women, who are traditionally less likely to invest than men. In conducting our recent Women and Investing survey, we questioned 4,000 women across 10 European countries with the aim of learning why.

The survey, conducted in January 2021 revealed that two-thirds of female respondents across 10 European countries identified as investors, compared with three-quarters of men. And fewer than one in five women invest regularly, compared with three in 10 men.

Among the main reasons why so many women—and a large proportion of men—do not invest regularly is a strong perception that investing is difficult. Many women believe investing requires a lot of commitment, as you’ll need to keep a close eye on how your investments are performing. Investing is also deemed to be a complex pastime, or no different from placing a bet. In truth, getting started with investing is much less daunting than you think.

1. You don’t have to do lots of research to understand investments

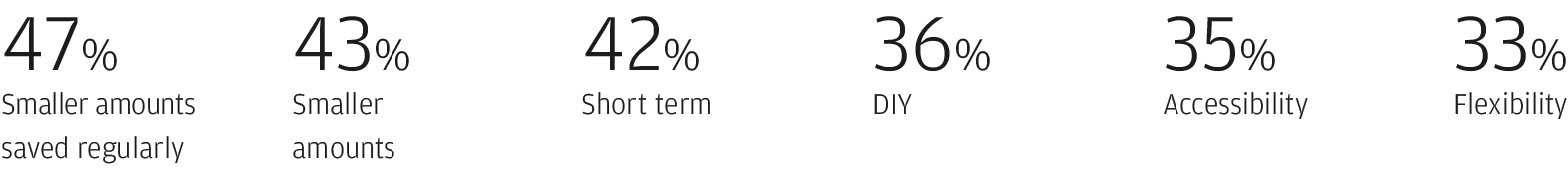

Our study revealed that flexibility, accessibility and the ability to invest smaller amounts regularly were the main attractions of cash savings to women. In contrast, investing is associated with complexity and gambling, and something you need to keep a close eye on.

Women perceive investing as difficult compared to saving

Most associated with investing

Most associated with cash savings

Source: J.P. Morgan Asset Management Women and Investing Survey, January 2021.

These are timeless challenges, and as such have been thoughtfully addressed by the investment industry. Pooled funds, in which a sum of money from numerous people is invested into a fund managed by a professional investor, can be a great place to begin. In fact, you may already invest in one as part of your pension savings. These are ready-made diversified portfolios with holdings of varying risk levels (for example, equities and more traditionally steady bonds) that are actively managed to reflect the prevailing market backdrop.

2. You don’t have to be an investment expert

Nearly two thirds of women who don’t invest said complexity was a key challenge to investing. But a diploma or degree in economics is entirely unessential. The important thing is to have a clear plan of your objectives and a firm idea of how long you have to achieve your financial goals (such as retirement or the down payment on a home). And if it is experience you’re after, the burden doesn’t lie solely with you: as mentioned above, a clear advantage of choosing a professionally managed investment vehicle over a savings account is that financial professionals are there to manage your investment through changing markets.

3. You don’t have to be rich to start investing

It’s a common misconception that you need a large lump sum to invest. Risk is an often-cited reason for not investing, as it’s mentally linked with not having enough money to make the process worthwhile, or to cover a worst-case scenario. In fact, 60% of women who don’t invest associate the practice with gambling. In reality, you don’t need to be wealthy. For as little as €25 a month you can access the benefits of investing through a regular savings plan, which means you can invest any cash you may have left over each month, no matter how small. And savings plans can also help to smooth market fluctuations, as you will buy more shares if markets fall, while your investments will be worth more when markets rise.