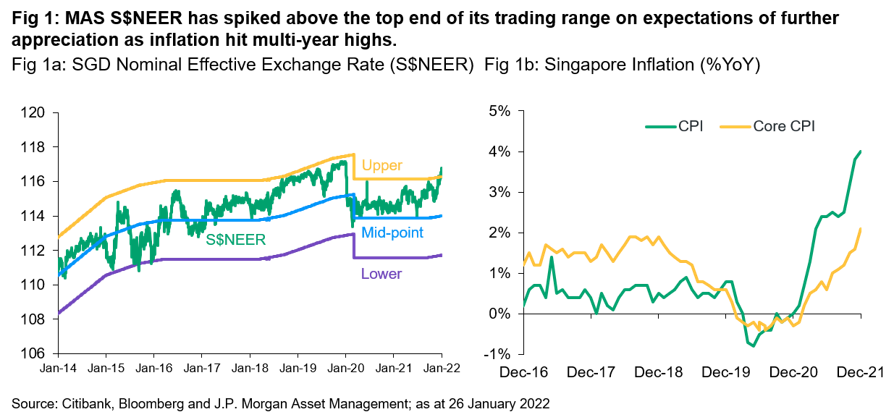

On January 25, the Monetary Authority of Singapore (MAS) surprised the market by announcing a pre-emptive, off-cycle tightening of its monetary policy (Fig 1a). Singapore’s de-facto central bank hiked the slope of the S$NEER1 policy band, increasing the pace of appreciation. The unexpected hike was triggered by the strong inflation uptrend in recent days (Fig 1b) as well as a reassessment of Singapore’s growth and inflation expectations in 2022 by the MAS.

This was only the second time in its history that the MAS has changed its policy rate at an off-cycle meeting, emphasizing the importance of the hike. While the actual size of the movement was not disclosed, economists estimated the “slight increase” equates to a 0.5% increase to the slope of the curve, suggesting a tangent of 1.00%. Meanwhile, the width and centre of the policy band remain unchanged.

In the accompanying policy statement, the MAS explained the movement was based on expectations of an above-trend 3-5% GDP rate in 2022. It projected core Consumer Price Index (CPI) to be 2-3% in 2022, significantly higher than the 1-2% estimation in last October when the bank pivoted from a neutral to a more hawkish policy stance.

Singapore’s latest inflation data was published earlier in the week and has surprised to the upside. The headline and core numbers jumped to a multi-year high of 4%y/y and 2.1%y/y respectively in December, with higher food and transportation costs being the main culprits. The recent inflation momentum has outpaced MAS’ expectations, forcing the central bank to act rapidly in order to prevent embedded inflation, especially when regional supply disruptions and expected GST tax hikes continue to buoy prospects of further price rises.

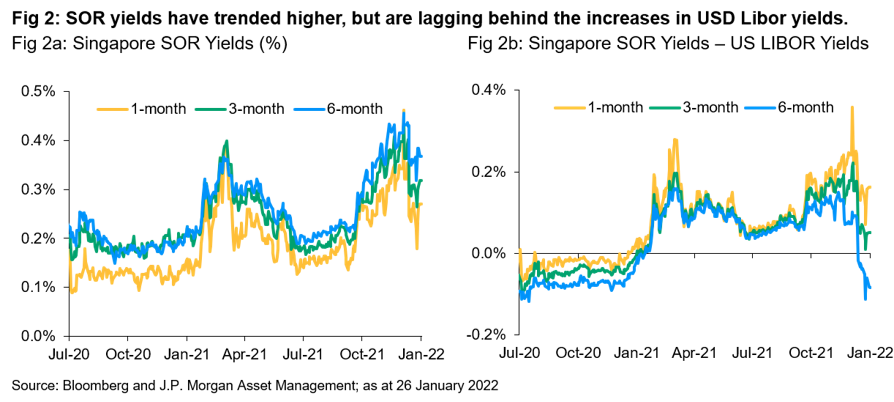

The previous Singapore Dollar Swap Offer Rate (SOR) yield uptrend (Fig 2a) stalled in December; with yields falling and the curve steepening as liquidity conditions eased against a global backdrop of weaker SGD, stronger USD and higher US LIBOR. Immediately following the announcement by MAS, SGD appreciated slightly while both SOR and longer tenor bond yields edged higher. However, with the mid-point of the S$NEER staying above the top of MAS’ target range for the past several days, the capacity for the SGD to appreciate immediately is limited.

Nevertheless, as the negative impact of the Omicron outbreak fades and Singapore’s economy recovers further, the market continues to expect the MAS will further steepen the S$NEER slope at their official policy meeting in April. The possibility of re-centering the band has also increased. Exacerbating the MAS’ challenge is the increasing likelihood of rapid U.S. Federal Reserve rate hikes, implying Singapore’s historically hawkish central bank many need to intervene faster than previously expected to be sufficiently impactful.

For SGD cash investors, short tenor yields should continue to trend higher in the foreseeable future, albeit with a lag relative to US LIBOR (Fig 2b). We believe efficient investment diversification across cash investment options and a focus on a robust ladder of maturities will become increasingly important to achieve an optimal risk-return strategy and outcome.

1 SGD nominal effective exchange rate

Diversification does not guarantee investment returns and does not eliminate the risk of loss. Yields are not guaranteed. Positive yield does not imply positive return.