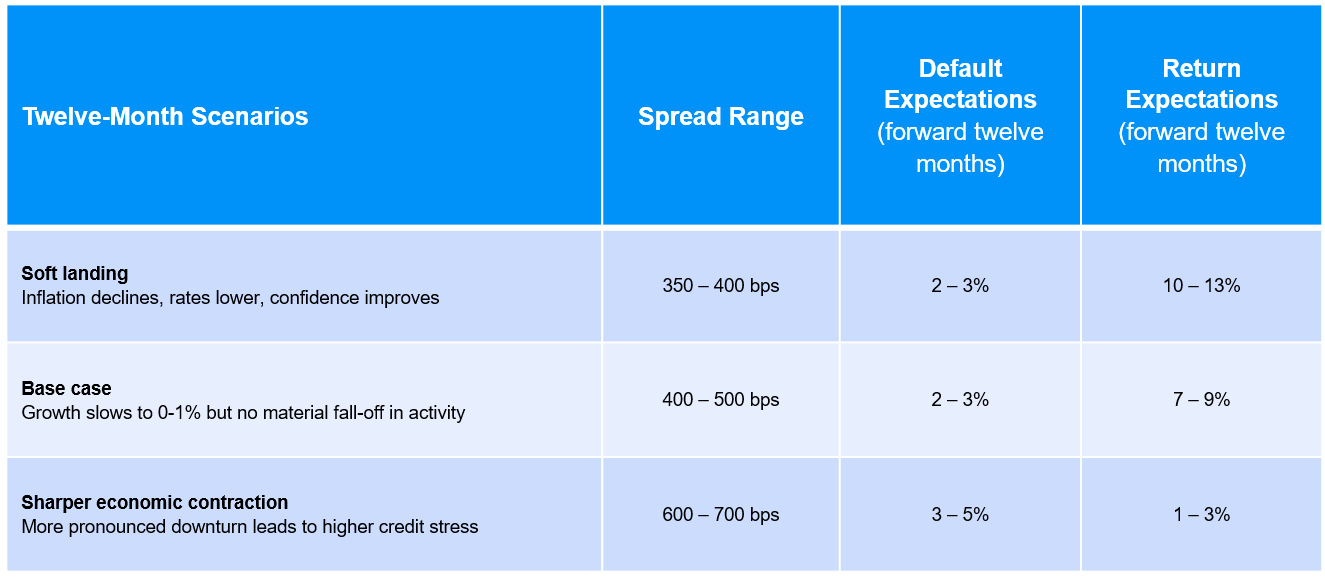

High Yield Return Scenarios

Elevated starting yields provide cushion for default and maturity wall concerns

27-11-2023

Garrett Cargin

Amidst an evolving macroeconomic backdrop, high yield offers compelling forward return scenarios under most economic environments. Following the dramatic increase in interest rates in 2022, the market has settled in between 8 – 9.5%, and like other areas of fixed income, is offering an attractive opportunity to invest in the asset class. Concerns around elevated defaults and the maturity wall are perhaps overblown (and priced into credit spreads), and the combination of healthy fundamentals, a better-quality market, and low bond prices point to a forward-looking return profile that is balanced.

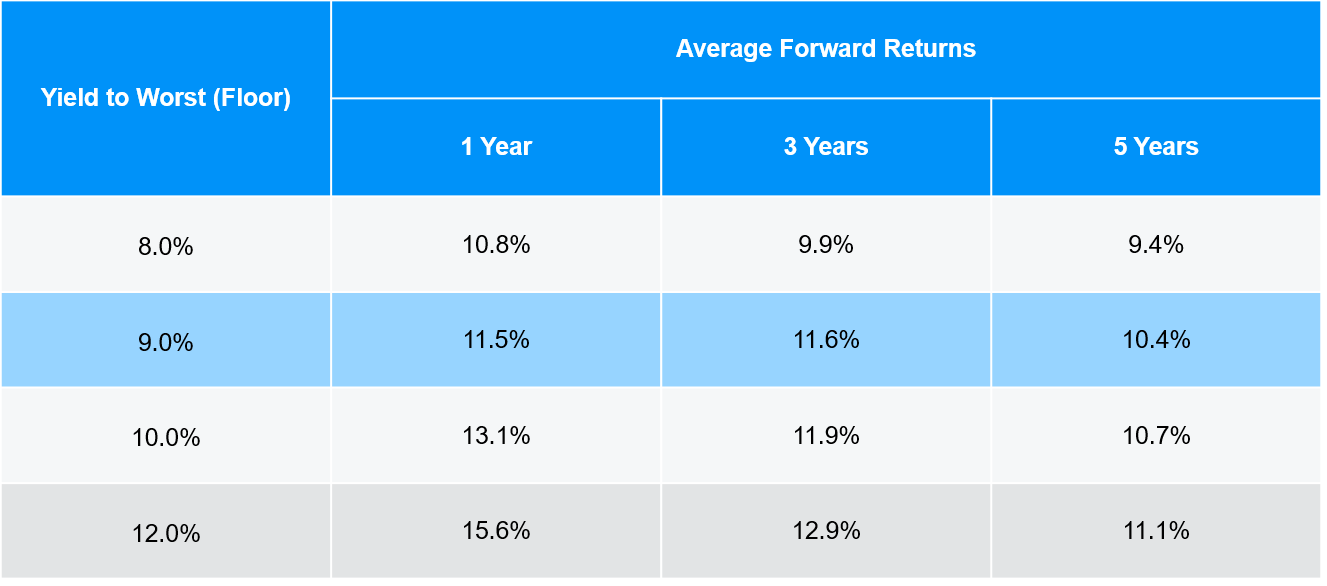

Since the turn of the millennium, investors have been rewarded for investing in high yield when yields are greater than 9%. For institutional clients with a medium-term investment horizon (3 – 5 years), the asset class appears attractive. Since 2000, at a starting yield of 9% or greater the average 3- and 5-year annualized forward return is 11.6% and 10.4%, respectively. In only one case the 3-year return been negative, and there has never been a negative return in the 5-year period, with the lowest annualized return 6.6%.

Source: ICE BofA US High Yield Constrained Index (HUC0); data 12/31/99 - 10/31/23.

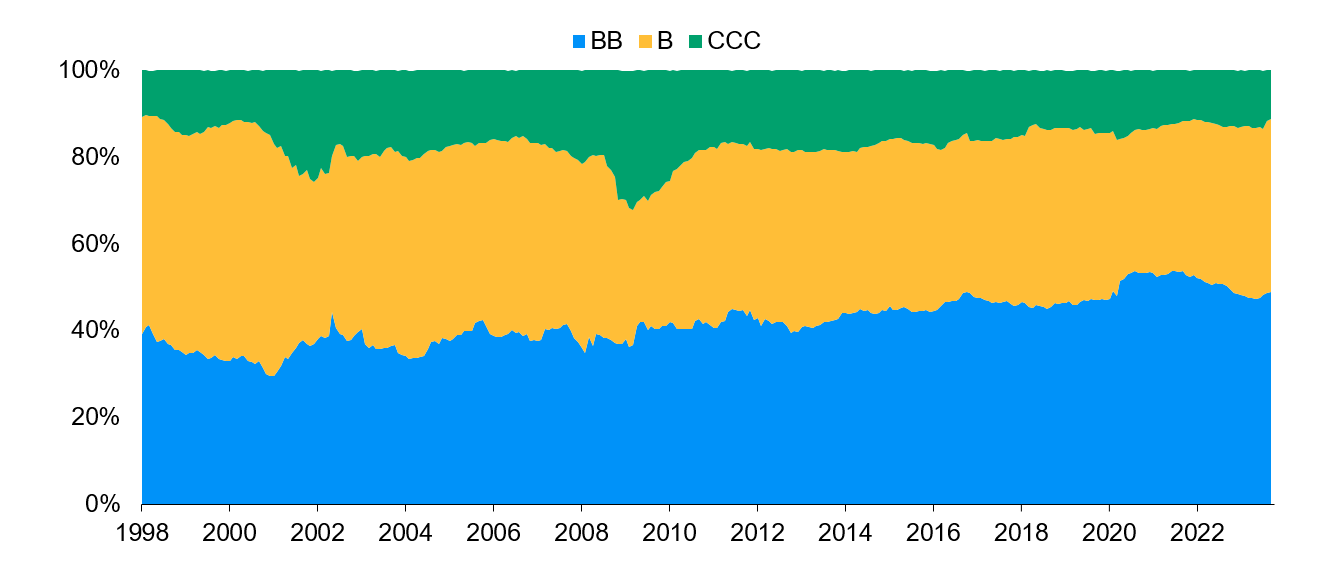

The high yield market has significantly evolved over the past twenty years. Gone are the days of an illiquid market, price inefficiencies and small, highly levered companies dominating the space. Today, 75% of the market has public equity, the median issuer realizes more than $600mm in EBITDA and CCCs account for a much lower percentage of the overall market. While these changes have provided the high yield market with a nice face-lift, all-in returns will likely be modestly lower given less credit and liquidity risk. However, it also provides better downside protection, as defaults are expected to be modest compared to other late cycle periods, limiting credit loss.

HY credit quality

Source: HUC0 as of 10/31/23.

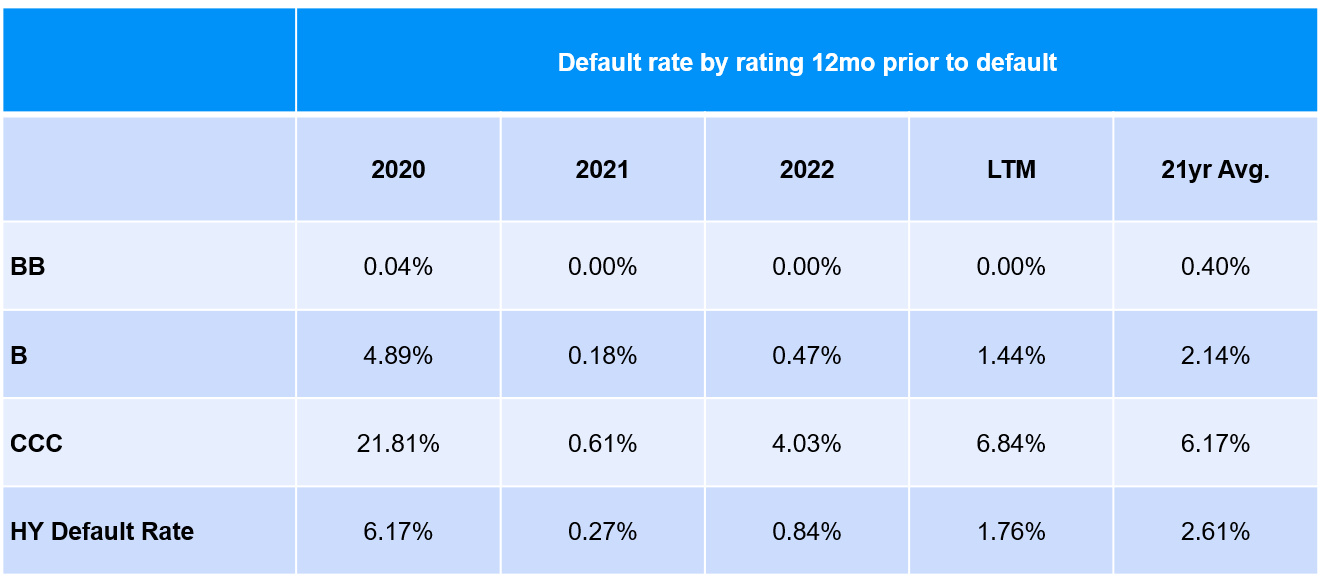

Recall that most defaults are rated CCC twelve months prior to default, and CCCs account for only 12.5% of the par value of the asset class, which compares to 20.5% at the end of 2007. Note that the high yield trailing twelve-month par-weighted default rate is currently 1.8%, compared to the long-term average default rate of nearly 3%.

Source: JPMorgan CIB as of 10/31/23

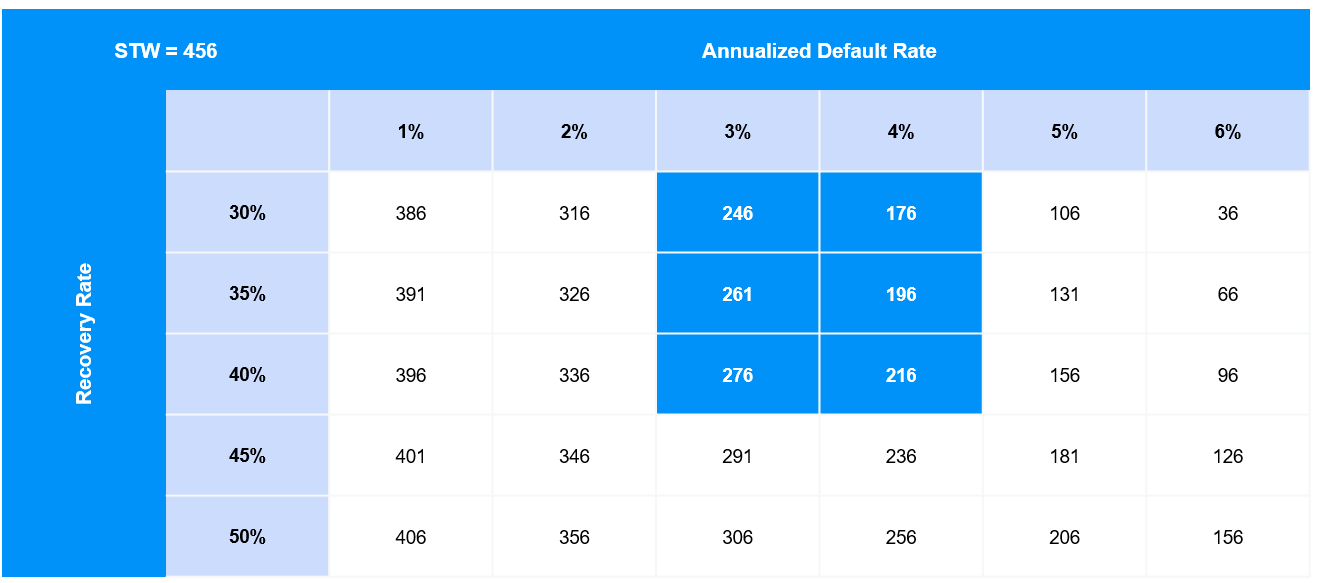

This default rate excludes distressed exchanges, corporate defaults that sit outside of the US high yield market, and is par-, not issuer-, weighted. We believe it is the most accurate default rate when evaluating the high yield market, specifically when trying to quantify credit loss. At the current spread-to-worst, the market is pricing in a default rate of 3.3% and our base case is for the default rate to end 2024 at approximately 3%. Said succinctly, investors are being compensated for default risk at current valuations.

Implied Excess Spread

Source: HUC0 as of 10/31/23. Implied Excess Spread = Spread-to-Worst – ((Default Rate * (1 – Recovery Rate))

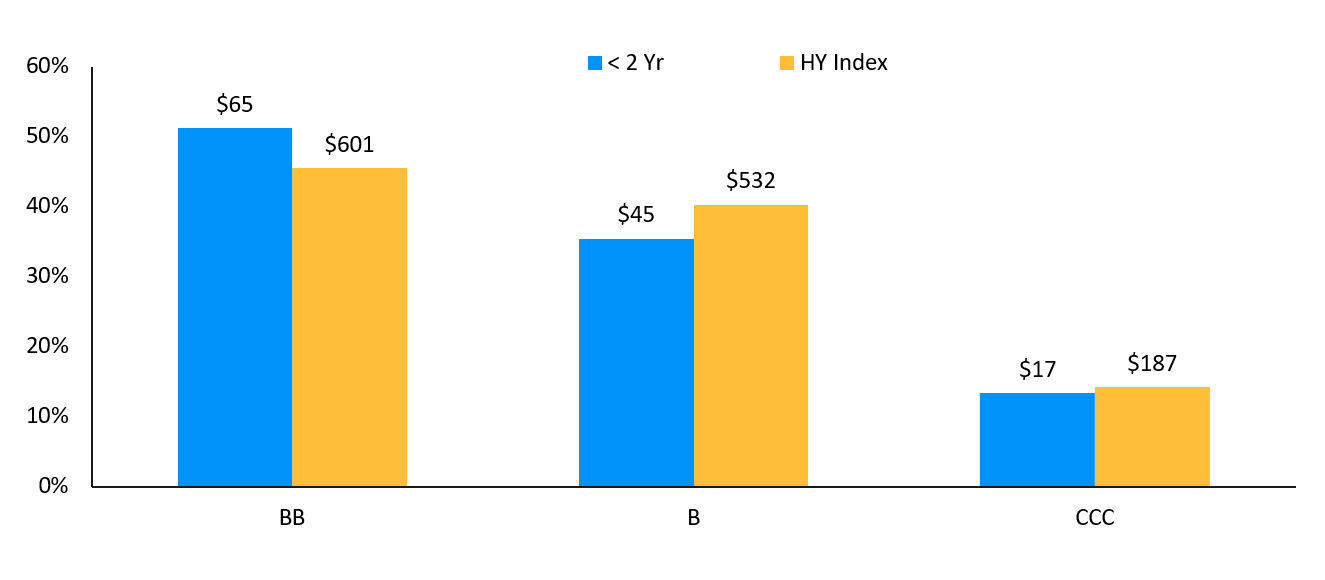

Finally, more than $900bn of high yield bonds were issued in 2020 and 2021 at historically low interest rates and were predominantly refinancings. This, in conjunction with elevated interest rates and a dried-up M&A/LBO market, has resulted in very low issuance in 2022 and 2023. This is intuitive, as the average high yield coupon is 6% vs the yield-to-worst of 9.5%; companies that can afford to be patient have been. Less than $200bn of high yield bonds mature in the next two years, and over 85% are BB or single-B rated. The new issue market has been open in 2023, and over 40% of CCCs have addressed their near-term maturities. So, while it is true that the maturity wall is as at an all-time high, we believe this is a weighted average cost of capital exercise and is not a cause for concern as high quality issuers will be able to refinance.

Maturity wall skews higher-quality

Source: Barclays Research as of 11/10/23.

In summary, the high yield market is once again offering high yields. Historically, investors have been compensated for investing in the asset class at these valuations. Volatility is inherent in high yield, but investors that can withstand short-term volatility have been rewarded with double-digit annualized returns.

Source: J.P. Morgan Asset Management as of 10/31/23.

09sk232111164330