Greetings. We look forward to seeing you back on campus, although you will not be allowed to gather in groups larger than five, which we expect to reduce COVID transmission and cut down on excessive alcohol consumption and related misbehavior1. Since 85% of you experienced declining grades during online learning last year2, we’ve doubled up your coursework and will require you to take eight classes this semester. Your Fall 2021 syllabus appears below. Update: Biology BI66 “The Origins of COVID” scheduled to be taught by Professor Peter Daszak has been cancelled until further notice. No additional information is available at this time.

[1] Addictive Behaviors AN103 (Anatomy): The Prefrontal Cortex and External Stimuli

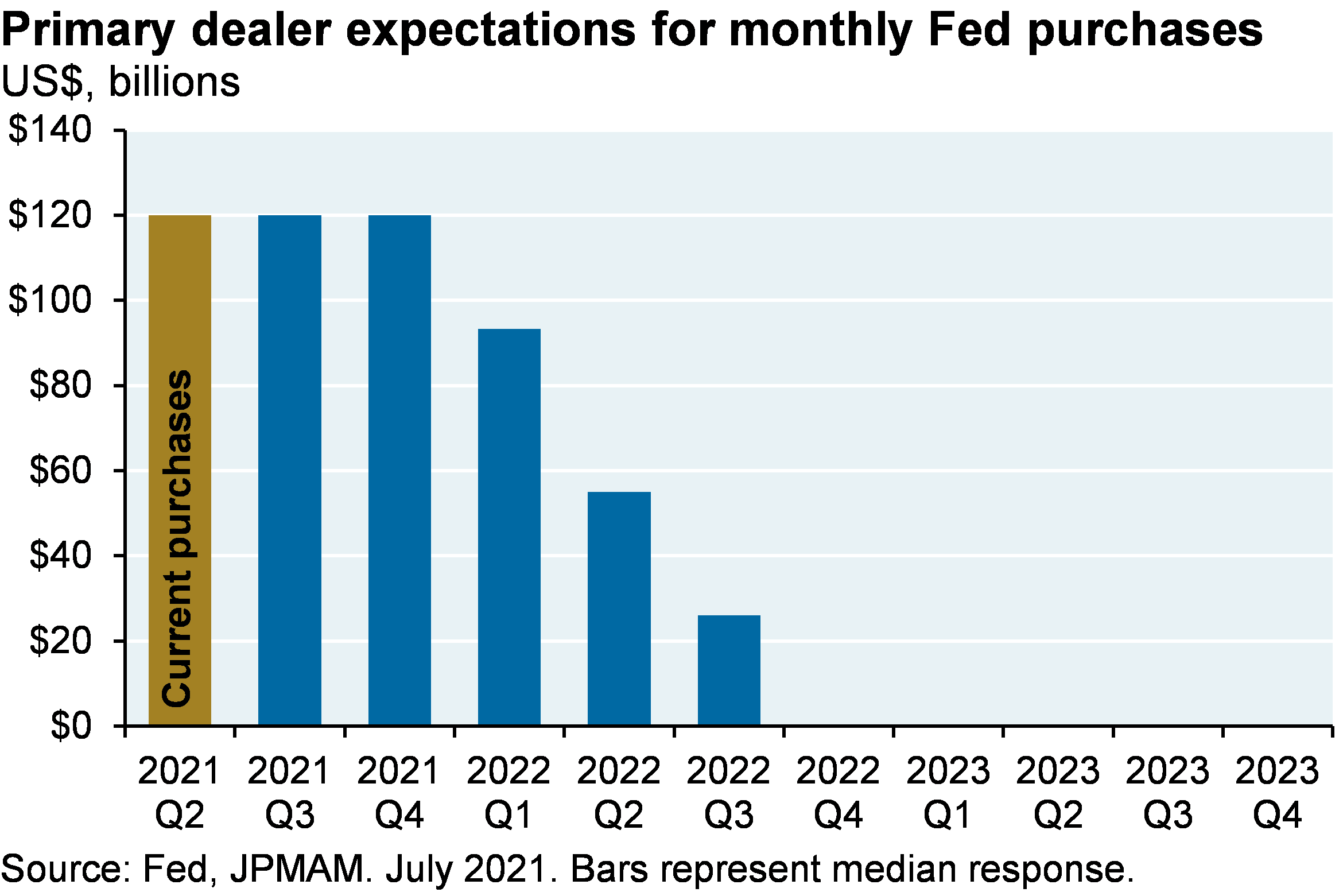

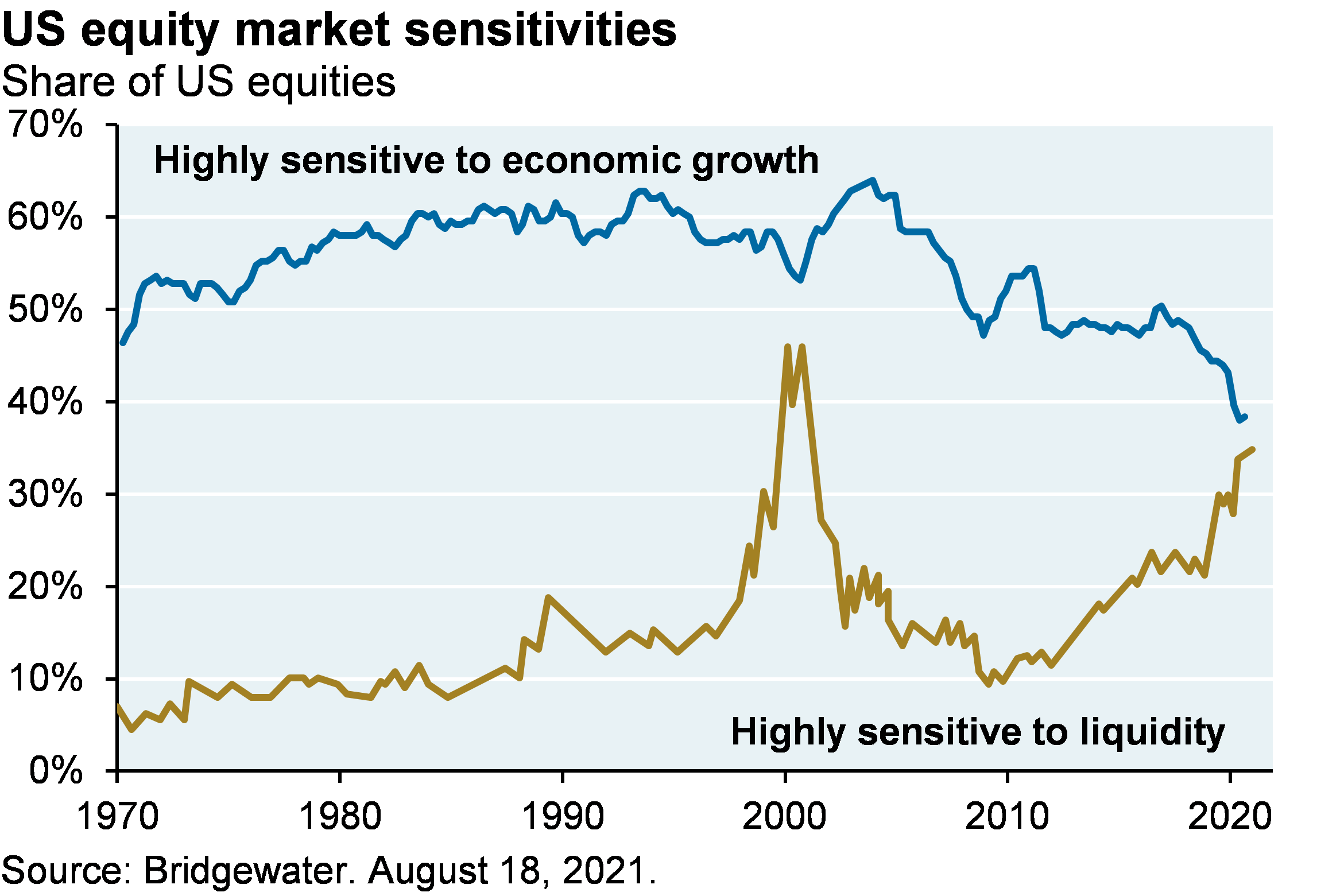

Students will explore the addictive consequences of Fed liquidity on the stock market now that the Fed is about to slow its asset purchases, and as the share of US equities more sensitive to liquidity conditions than to economic growth keeps rising. Background reading includes data on Treasury demand from foreign central banks that own 30% of the Treasury market, as well as Treasury demand from banks, pension funds and insurance companies for regulatory and liability management reasons; these demand sources may mitigate the impact of reduced Fed purchases on long term interest rates.

[2] Mechanical Engineering ME89 (Engineering): Dynamics of coiled springs

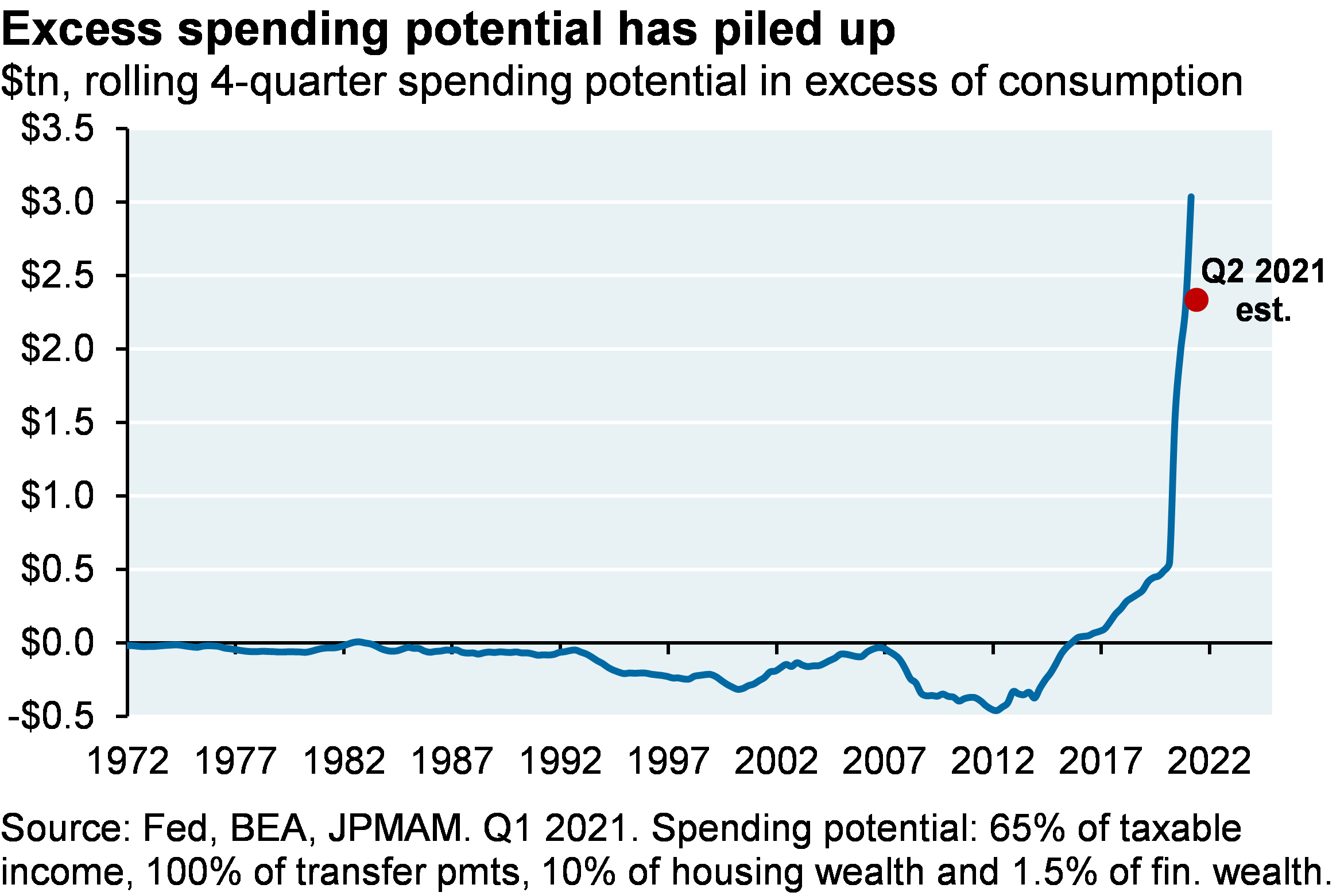

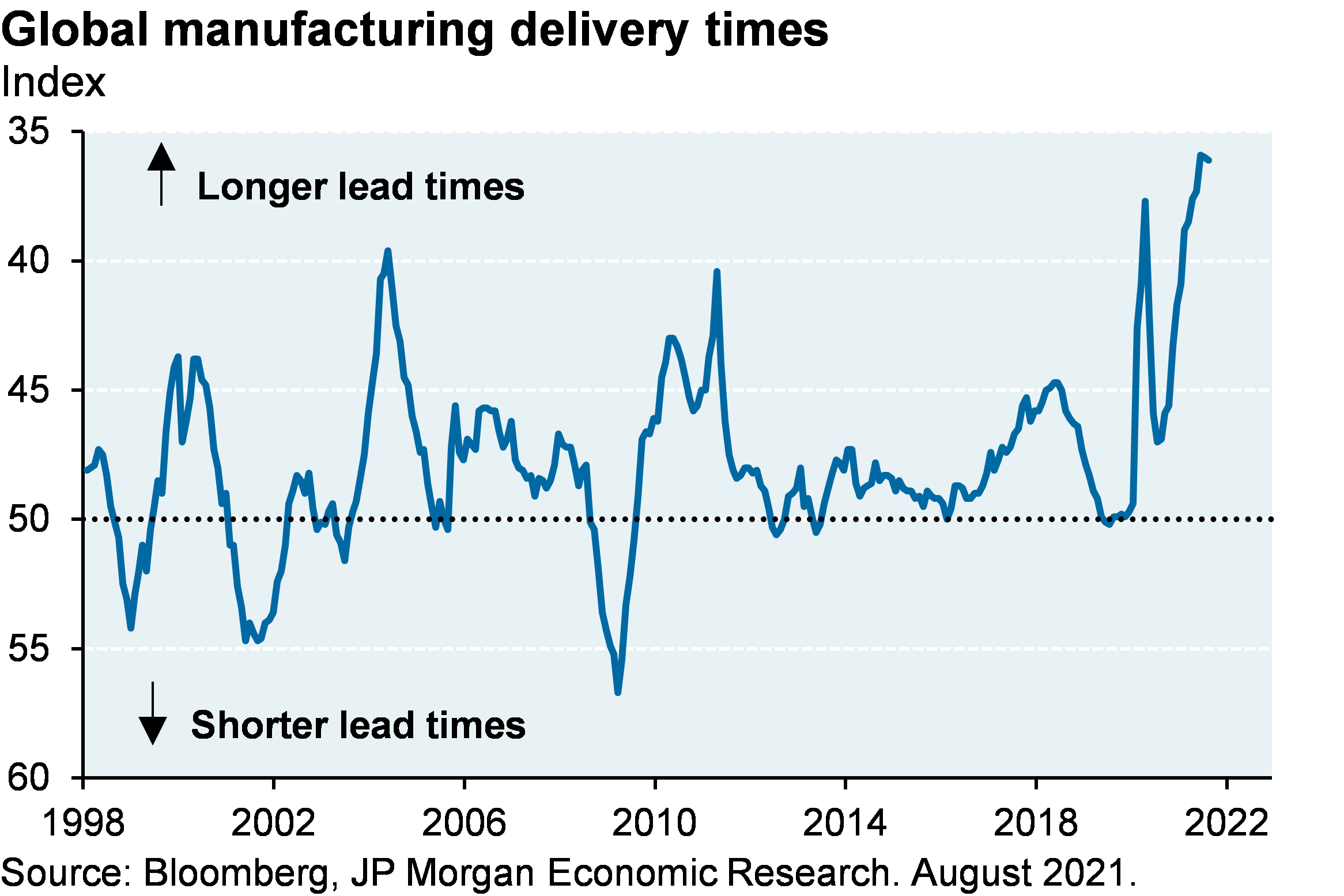

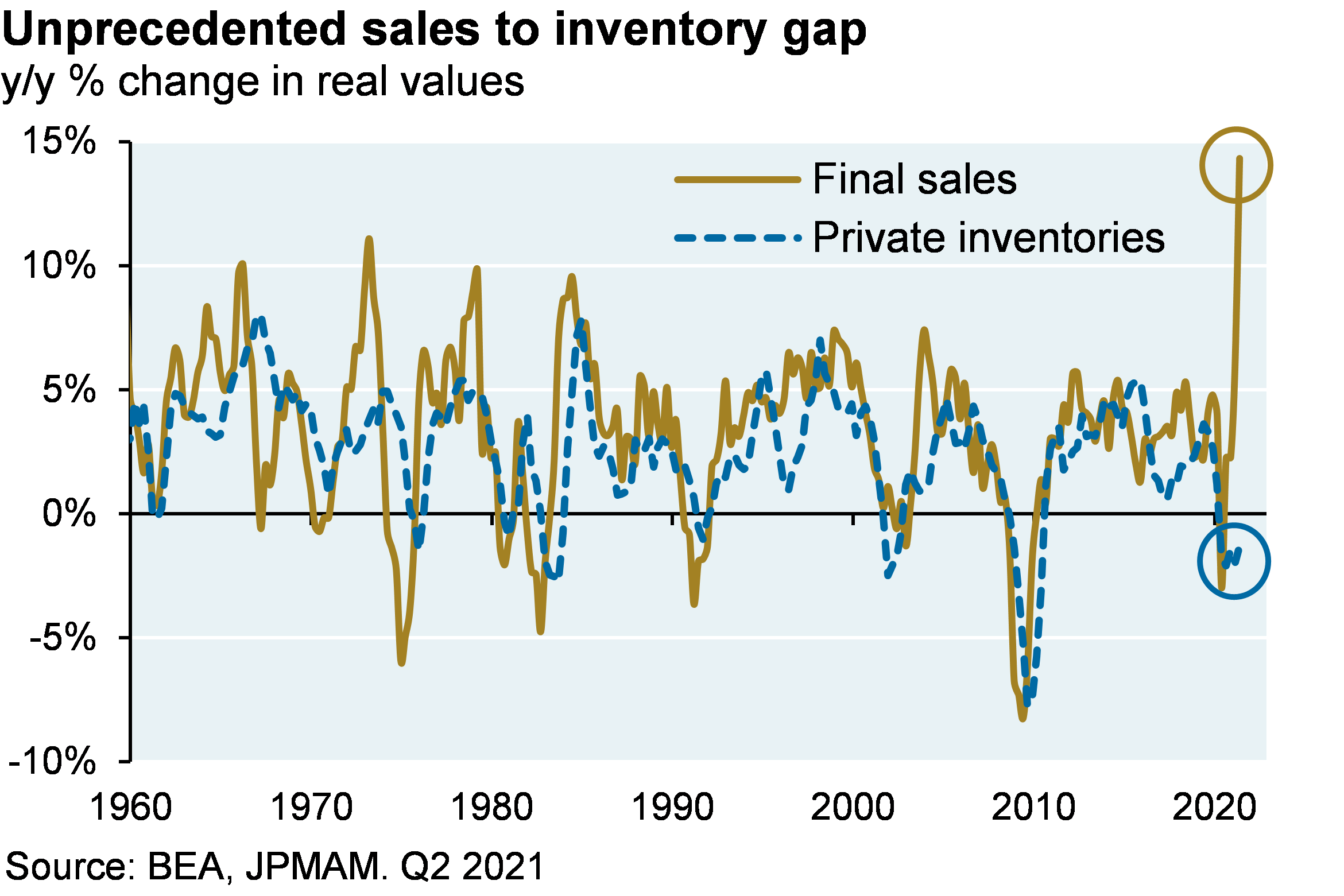

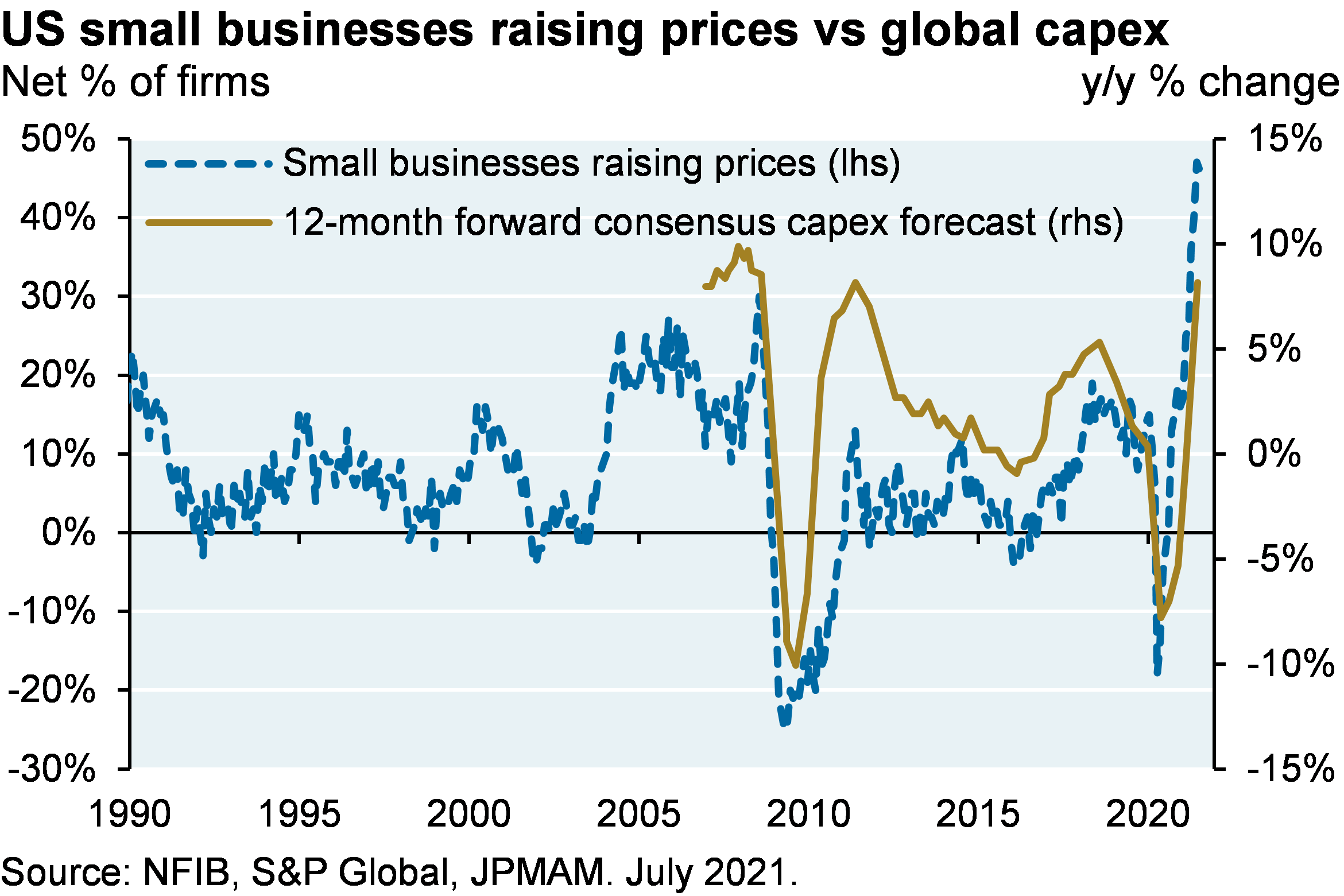

Students will review Hooke’s Law3 and its application to US growth, spending, inventories and inflation. Some leading indicators have weakened recently, a reflection of intense supply chain issues which include a temporary but pronounced semiconductor shortage4. However, look at the big picture: rising wages, government transfers and pandemic issues have boosted pent-up consumer spending, and there’s unprecedented pent-up demand when looking at the gap between low inventory growth and high sales growth. Both of these coiled springs will eventually spring back. So will housing, which is now constrained by soaring prices and the tightest supply conditions since 1990 (2-3 months). There’s consumer resistance to higher prices for durables, cars and homes, but ammunition for healthy US consumer spending is firmly in place particularly given improved household balance sheets. As drags from supply constraints and the Delta variant eventually fade, US and global growth should be supported by reopening dynamics, inventory restocking and a lot more capital spending.

While these dynamics all point to higher GDP growth as production rises to meet demand, it’s also hard to see how inventory vs sales gaps can be closed without higher prices as well. Many companies agree, as indicated by the all-time high 45% of small business respondents planning to increase prices.

[3] Military Strategy HS233 (History): The Art of War

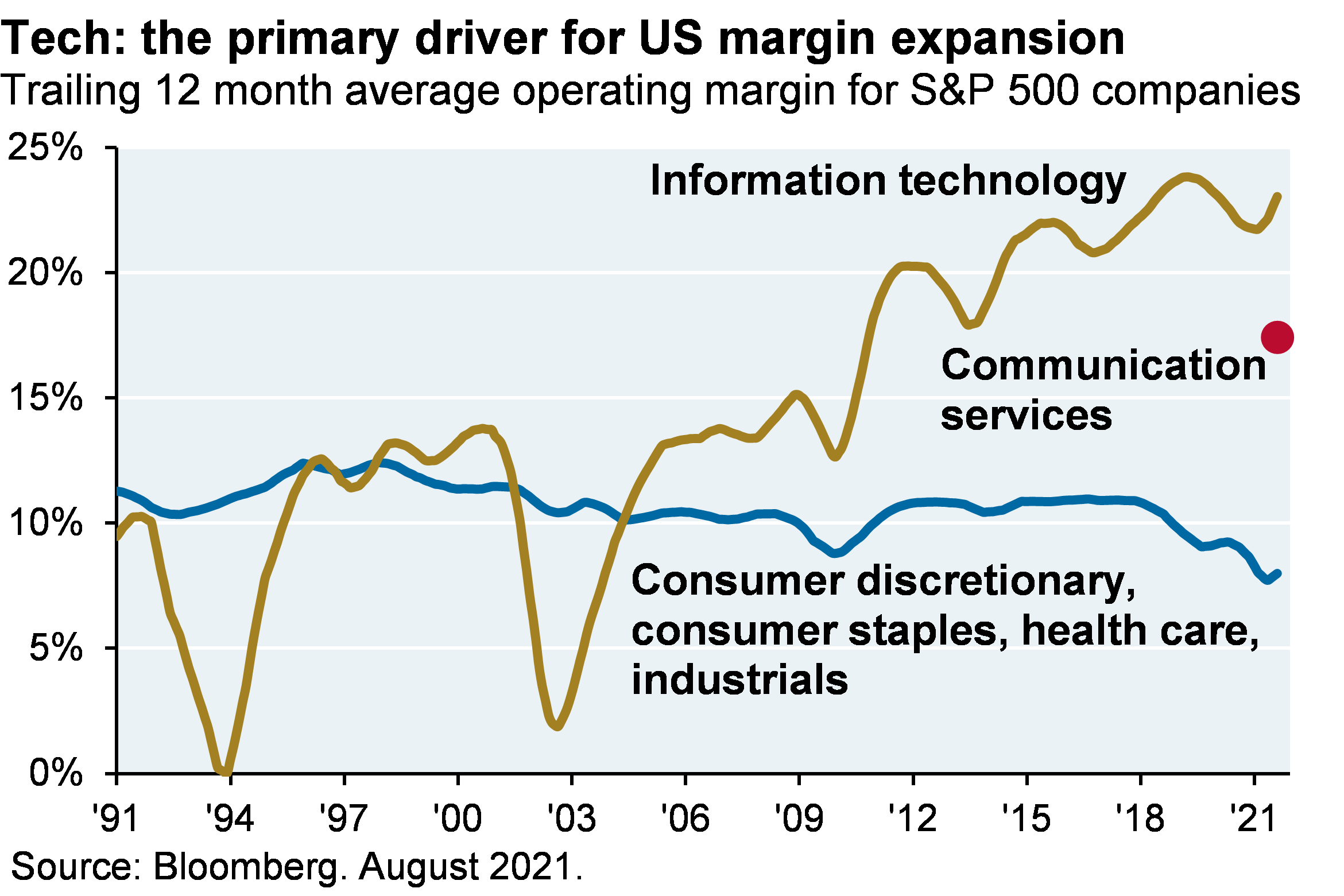

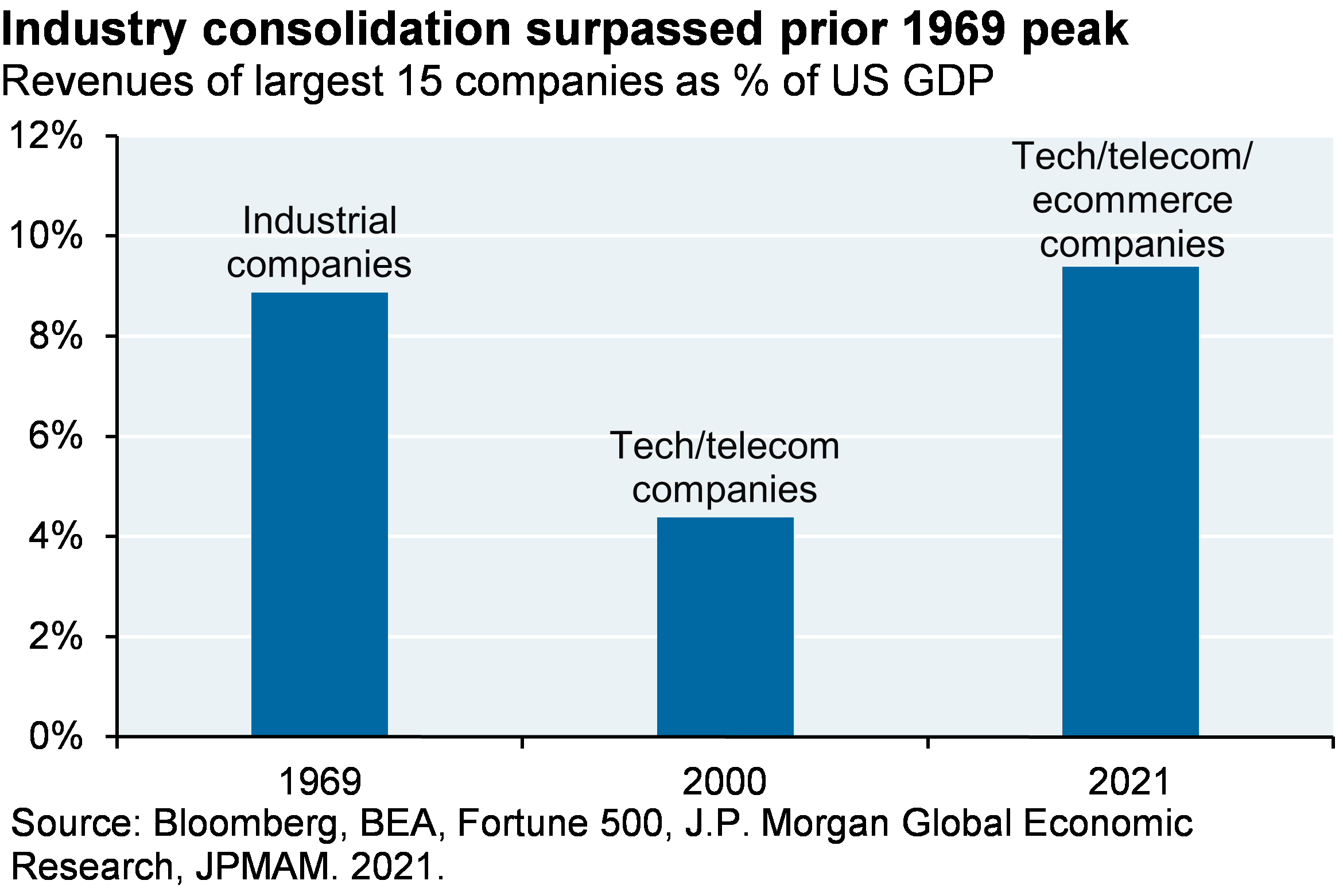

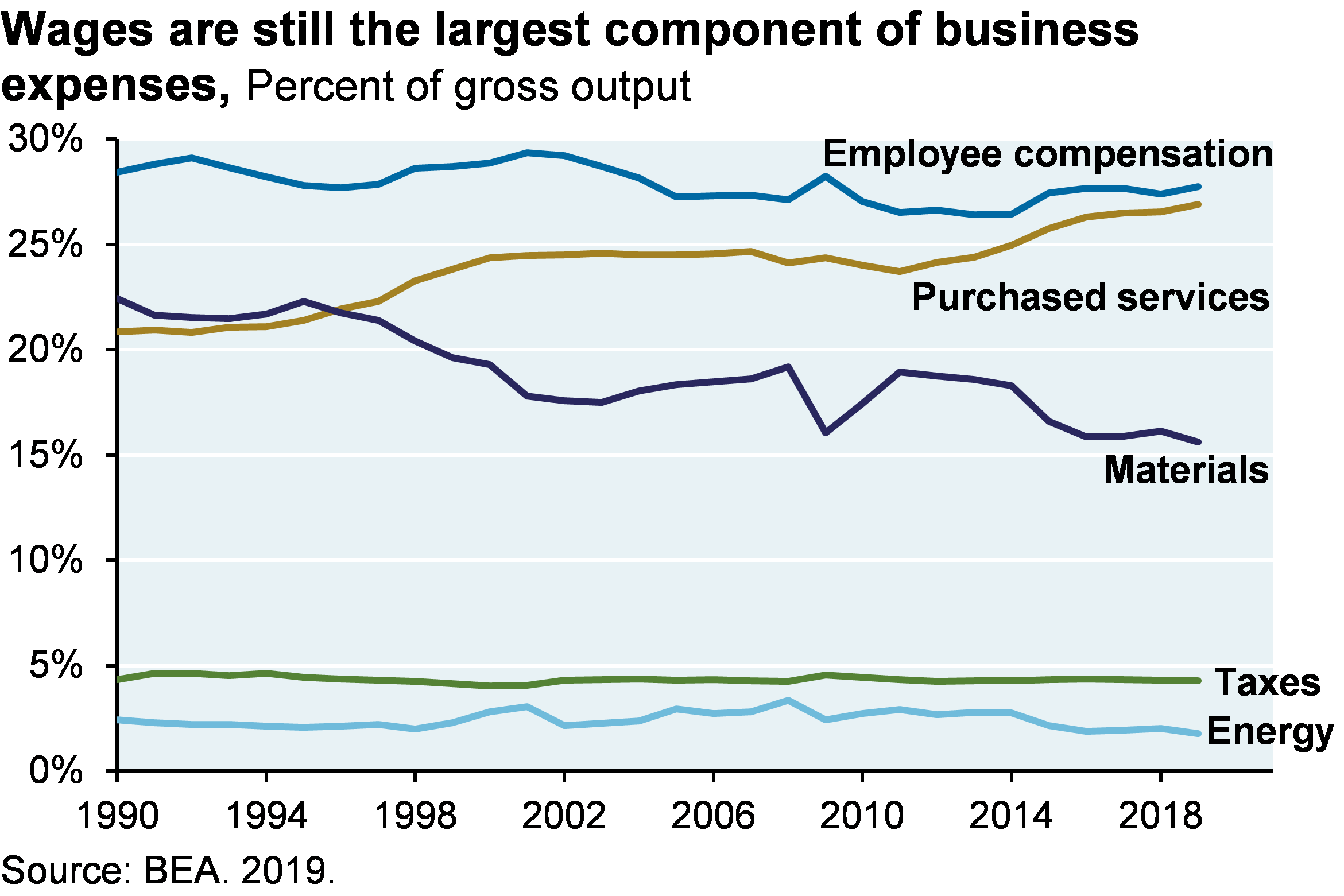

Students will learn how tech and communication services companies conquered US equity markets. Readings include David Autor’s “The Fall of the Labor Share and the Rise of Superstar Firms” (MIT, 2019). Implications for investors include the superior risk-reward characteristics of growth equity and venture capital investments focused on software and other high-margin businesses with low labor intensity.

Industry concentration is at an all-time high and is attracting antitrust attention. But the tech/communications services opportunity set is much bigger than the 5 megacap firms: secular growth tech stocks we discussed in our 2021 Outlook are performing in line with the megacap stocks this year, and carry a lot less antitrust baggage. As long as wages are the largest component of overall business expenses (last chart), the corporate sector will look to tech companies to help reduce their unit labor costs and improve productivity. In other words, we expect strong demand for technology goods and services to continue, and do not expect any mean reversion in sector profit margins.

[4] Chinese History CH04 (History): The Creation of a More Just Society

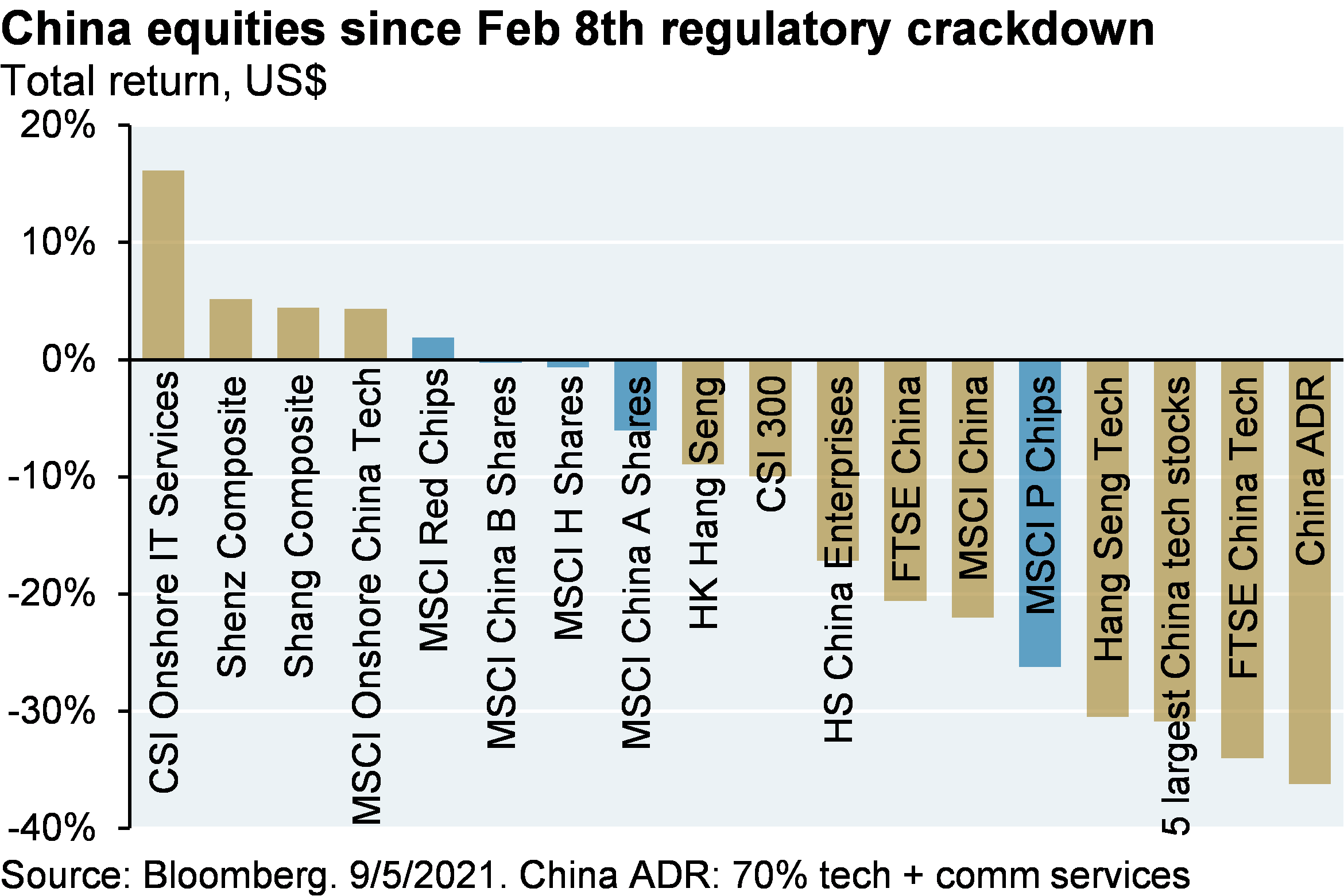

Students will review The Great Leap Forward and The Cultural Revolution as prior examples of Chinese leaders imposing sacrifices in the pursuit of societal goals. Many Chinese stocks have been clobbered after new rules and critical gov’t commentary on the internet5, e-commerce, for-profit tutoring, data sharing, overseas equity listings, cryptocurrency, online finance, real estate, labor practices, anti-trust and competition, drug prices, food product disclosure and corrosive Western decadence such as celebrity-watching, social media and gaming.

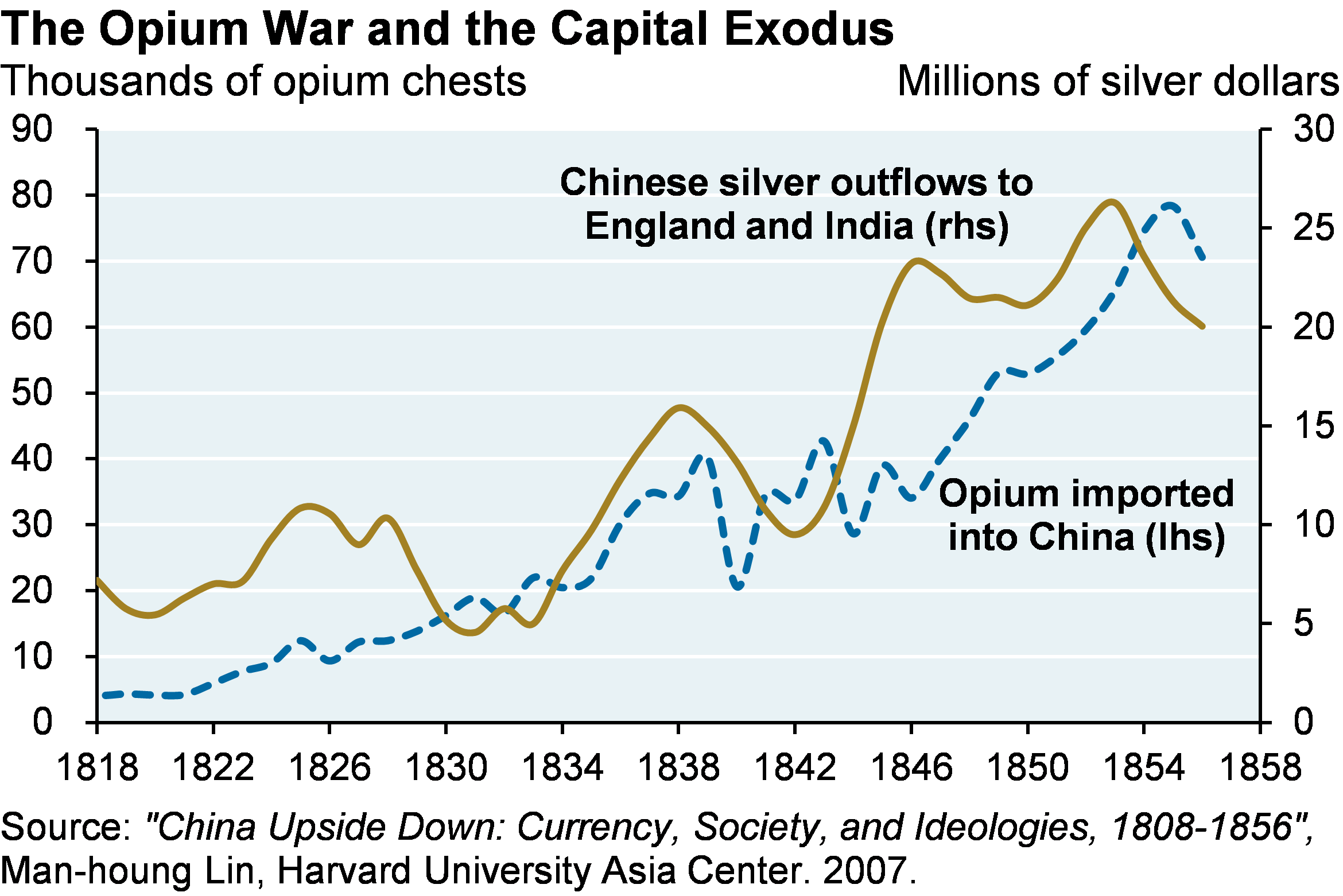

Since the Chinese government described online gaming as “spiritual opium”, students will also revisit materials on the Opium Wars of the 1840’s and its consequences: a proliferation of drug addicts and opium dens, a surge in corruption and other criminal behavior, a breakdown in public morality and an exodus of silver shipped abroad by addicts. Around 25% of China’s adult males were addicted to opium, a level of mass addiction not equaled by any nation before or since6. From 1820 to 1870, China’s share of global output fell in half, from 33% to 14%.

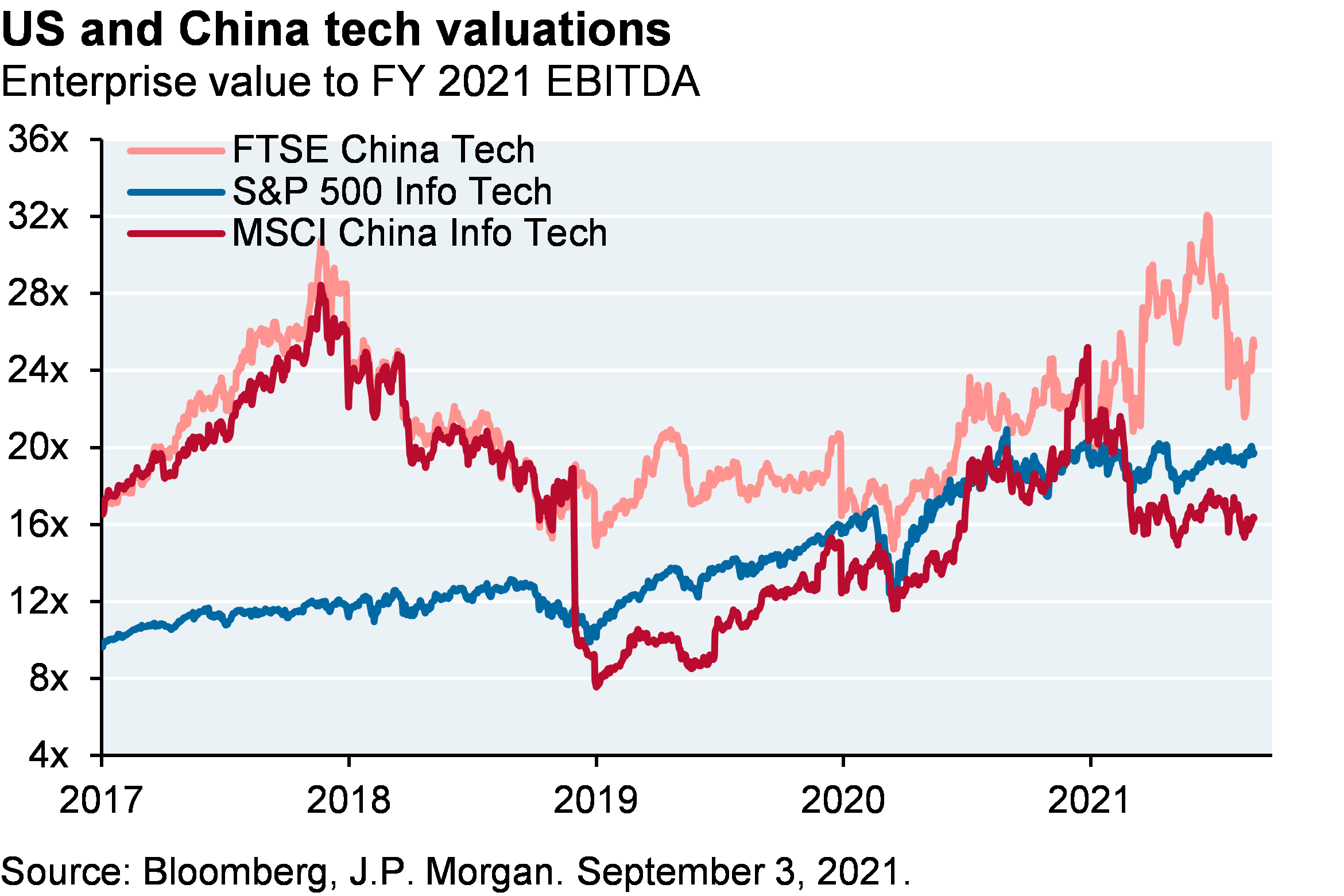

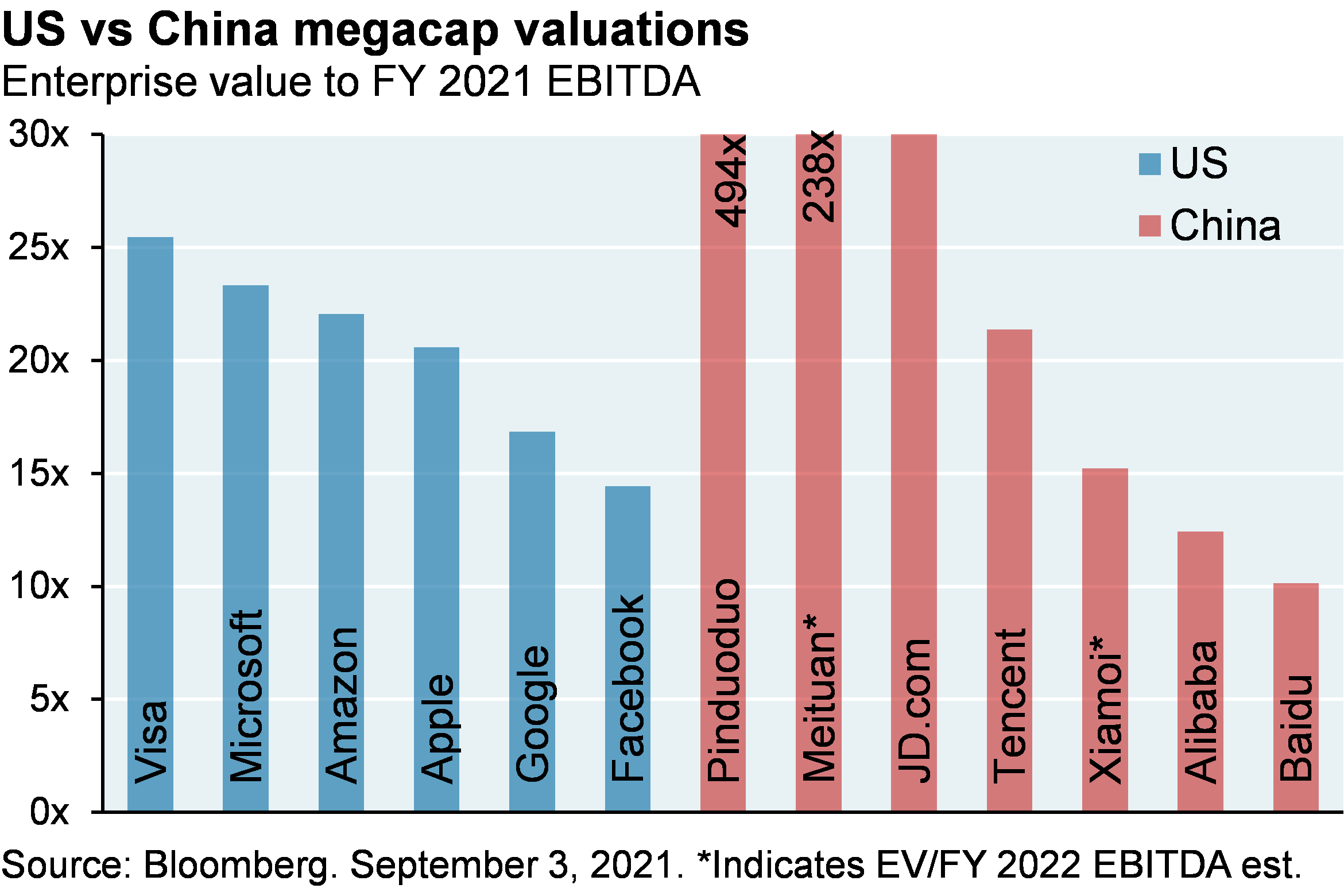

For long term investors with patience, there are some attractive opportunities here, but selectivity is key. Despite the large selloff in Chinese equities, the valuation gap vs the US shown in the last 2 charts is not as large since China traded at higher multiples before the crackdown began. We use enterprise value to projected free cash flow to minimize the impact of regional accounting differences and to capture the impact of new rules on future company profits, even though it is probably too early to expect analysts to fully adjust their forecasts.

[5] Progressivism in Film FA08 (Arts): Raiding the Temple Granaries

Students will re-enact one of the most progressive scenes in film history: when Moses raids the temple granaries in Cecil B DeMille’s Ten Commandments. The class will then pivot to the current Administration’s progressive plans to raise corporate taxes to pay for infrastructure and other initiatives (clean energy and EV subsidies, child care, family leave, pre-K education and Obamacare premium expansion). At the time this syllabus was prepared, Democrats had not reconciled their competing visions. The most likely scenario is an infrastructure bill with ~$1 trillion in new spending and a reconciliation bill with ~$2 trillion in new spending.

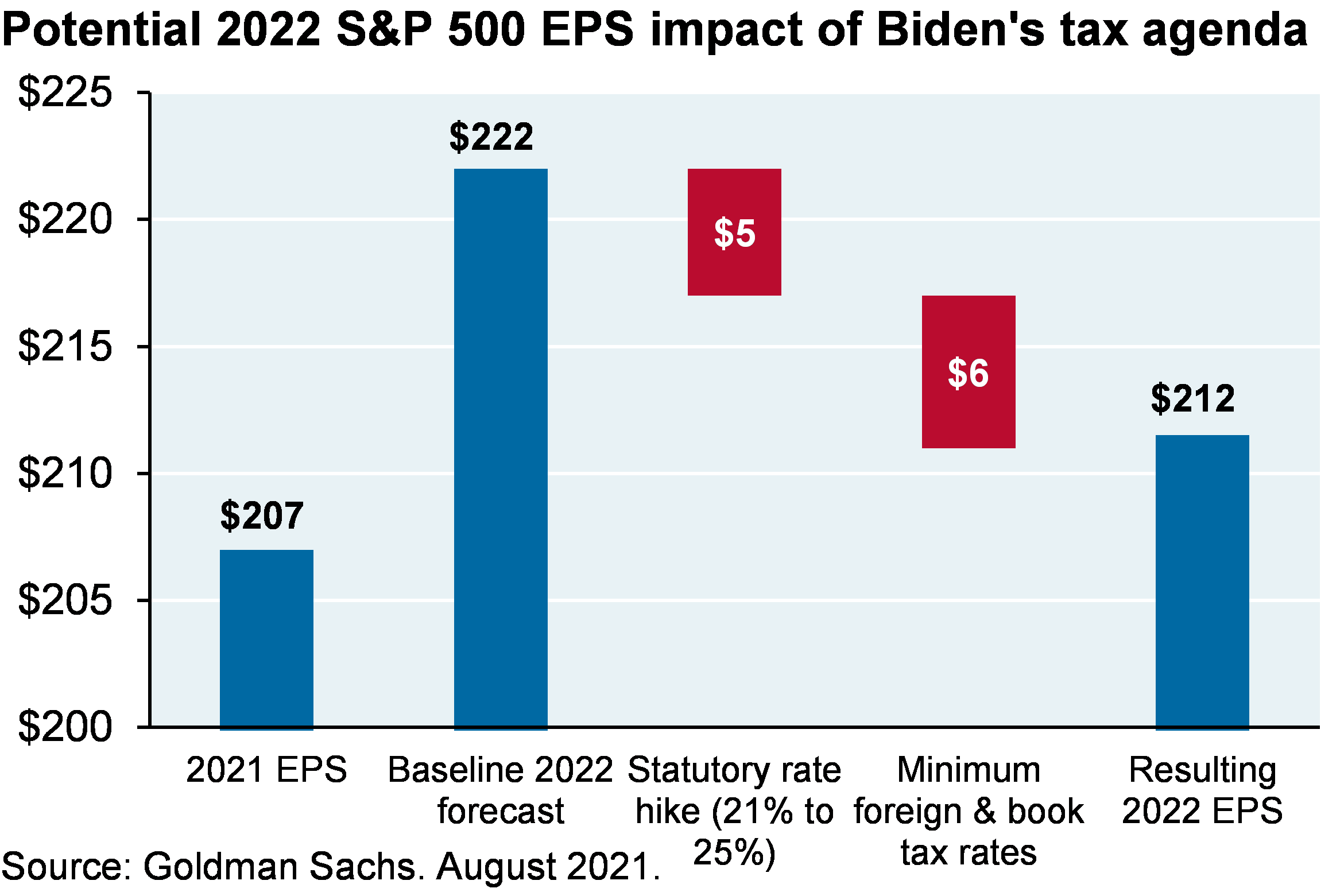

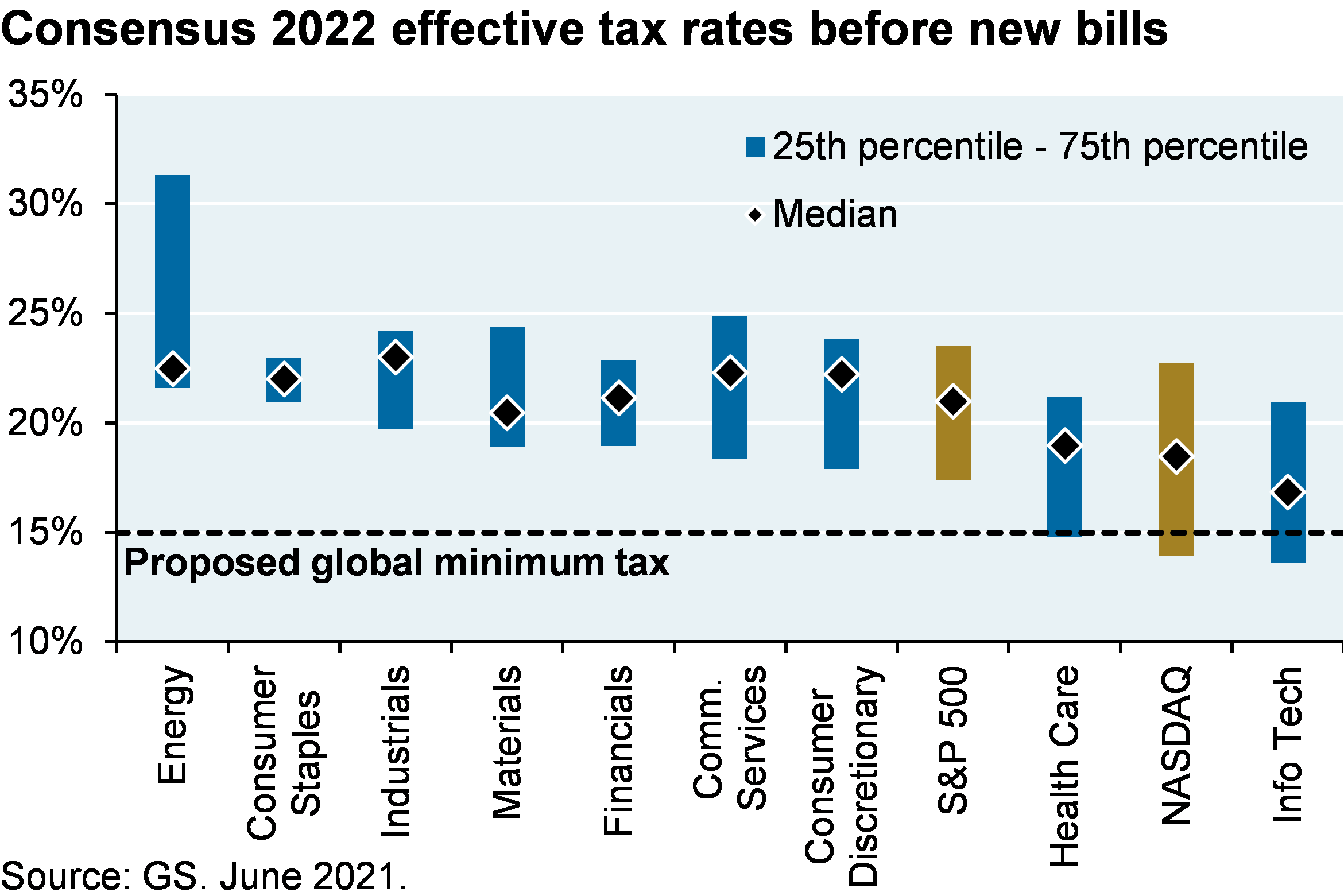

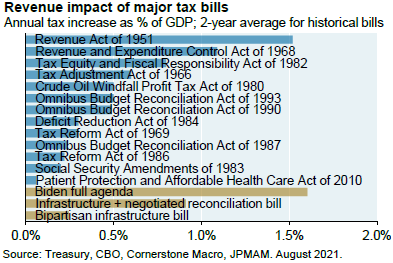

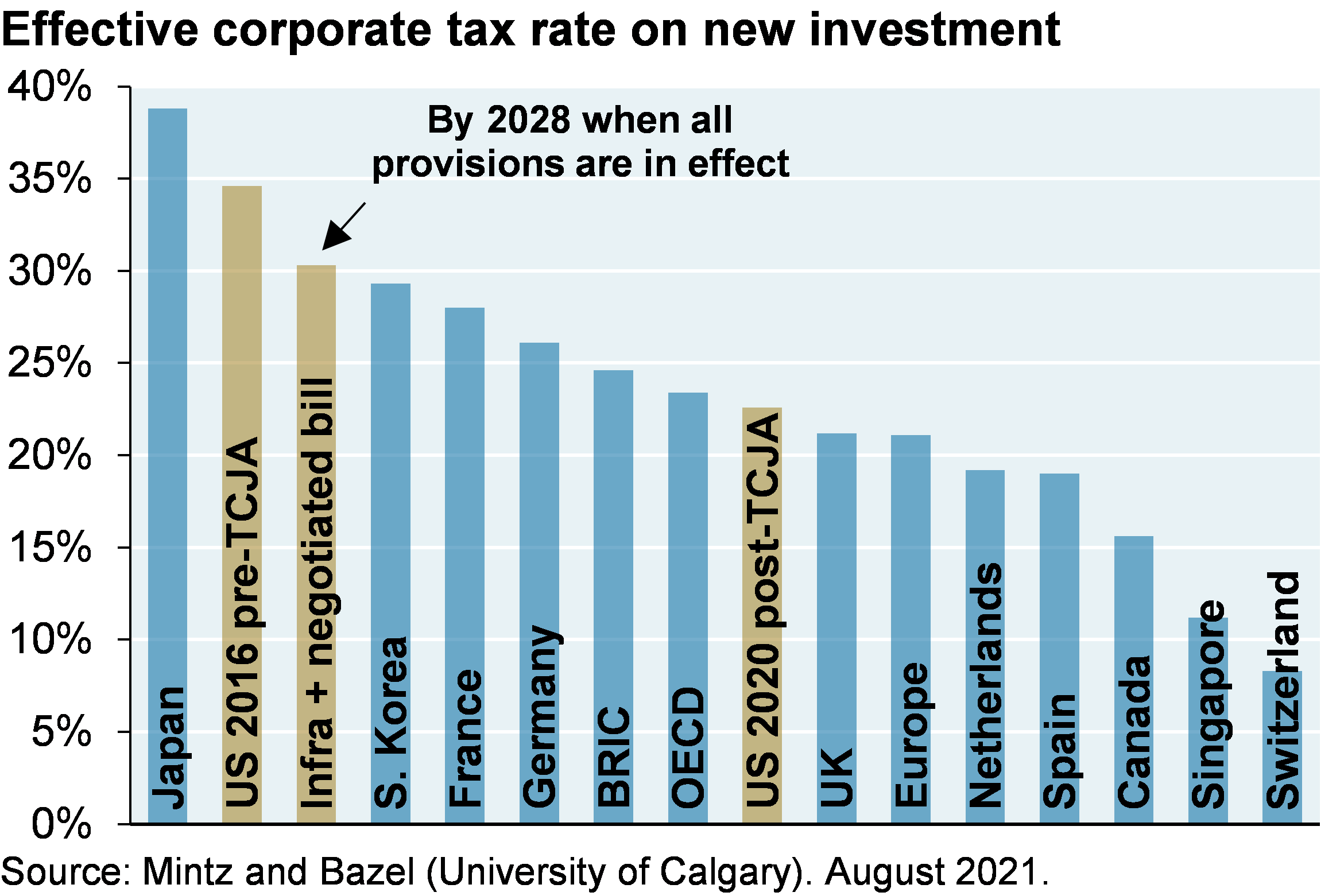

Students will review the base case scenario for corporate taxes: 25% corporate tax rate (up from 21%); an increase in the effective tax rate applied to low tax jurisdictions from 13% to 18%-19% (GILTI tax); a minimum book tax of 15% on large US companies that is unlikely to have much bite given prevailing effective tax rates (see second chart); and partial commingling of foreign tax credits. The bottom line is a modest 5% hit to 2022 S&P earnings per share, with slightly higher tax hikes for tech, healthcare and communication services. While the tax impact on S&P earnings appears modest, students will review the overall cost of the two bills (including tax increases on individuals and pass-through entities), which is large compared to tax bills in the post-war era; see third chart “infrastructure + negotiated reconciliation bill” and fourth chart on marginal effective corporate tax rates across countries, and the impact of the proposed bills.

Note from the Dean: we cannot guarantee film majors anything resembling a viable financial future; you will have to hit the jackpot. One example: recent film graduates of Columbia University who took out student loans had median debt of $181,000, and two years after earning master’s degrees, half earned less than $30,000 a year. Recent Columbia film alumni had the highest debt compared with earnings among graduates of any major university master’s program [WSJ, “Hobbled for Life”, July 8, 2021].

[6] American Literature of the 1970’s AL400 (English): Fear of Flying

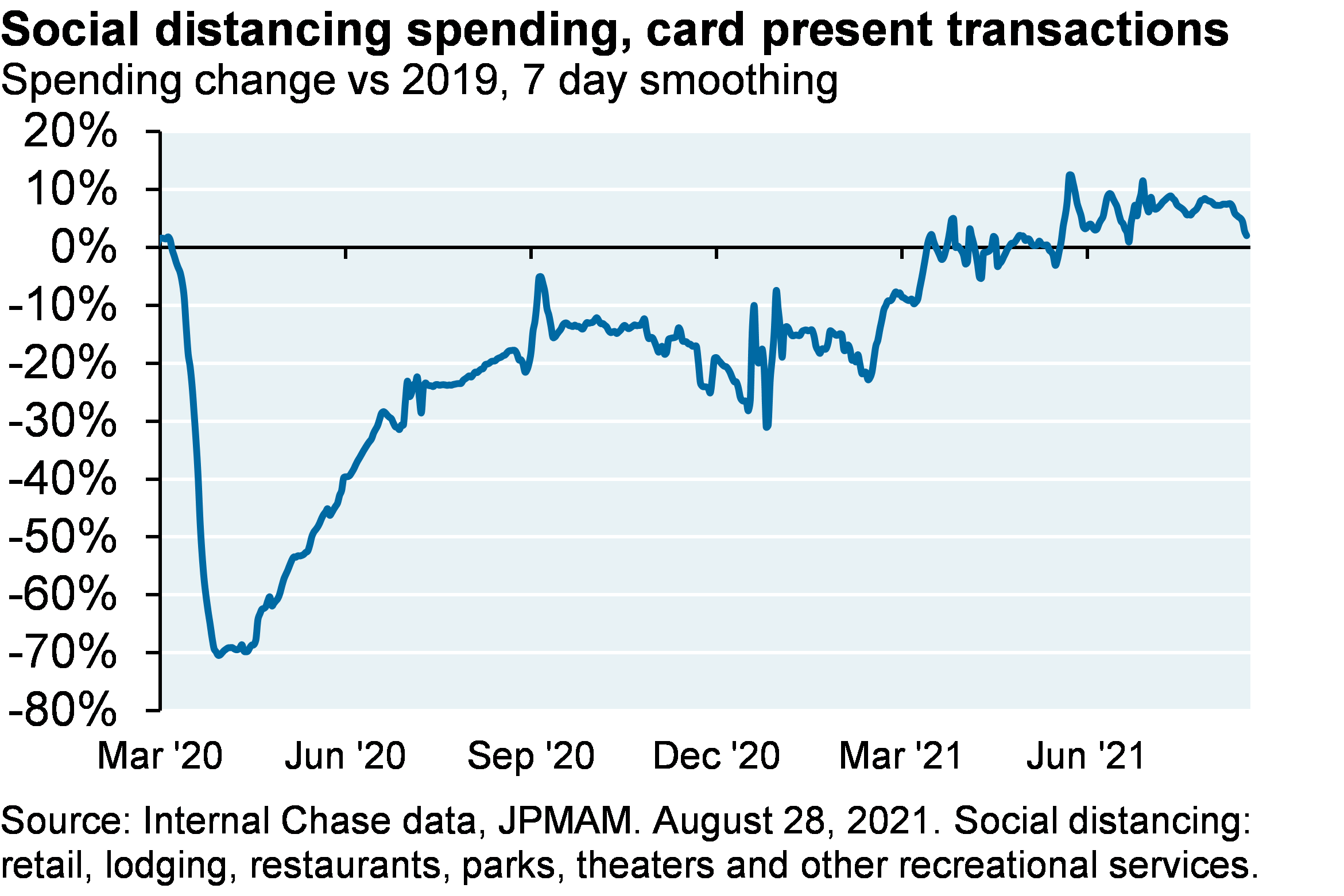

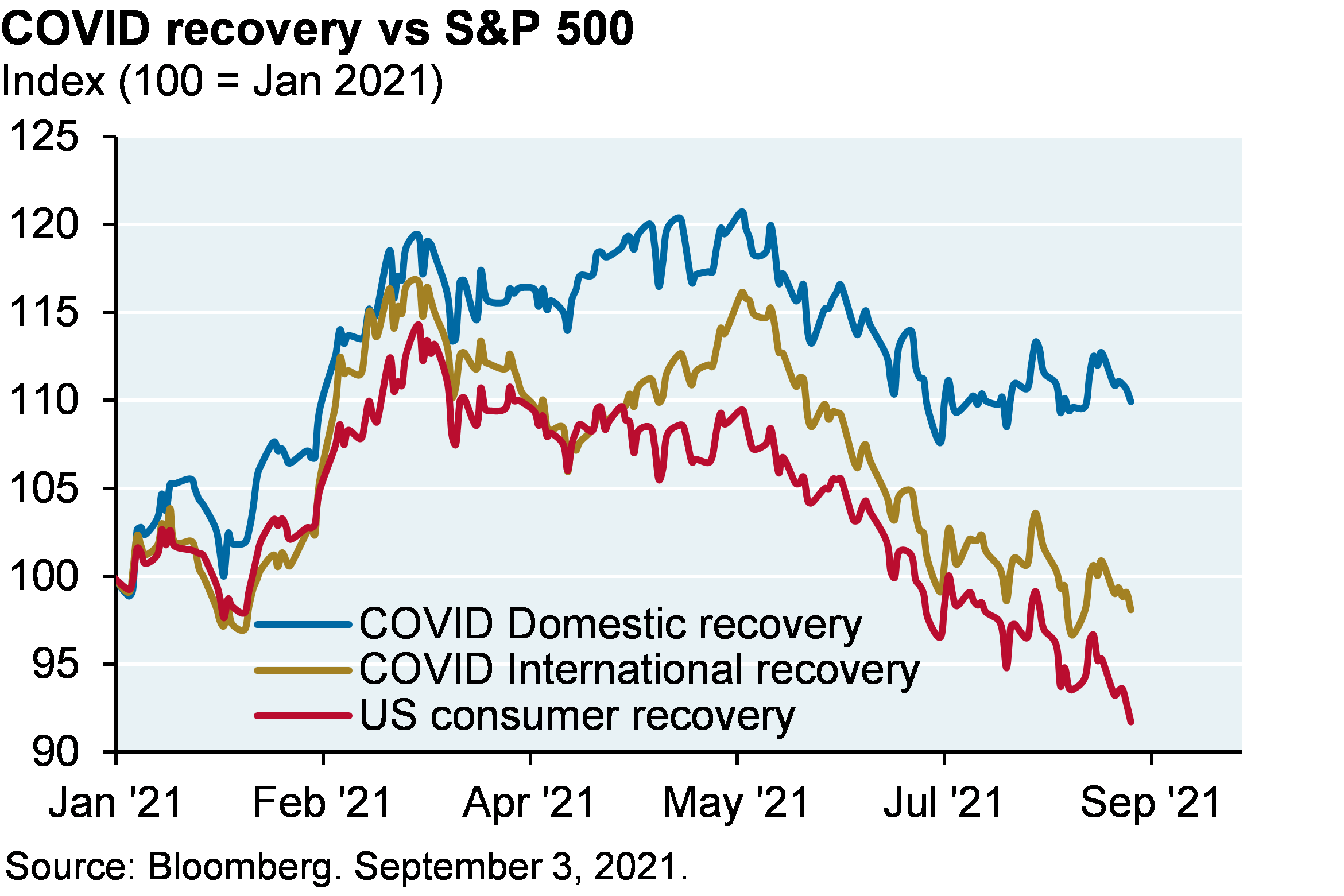

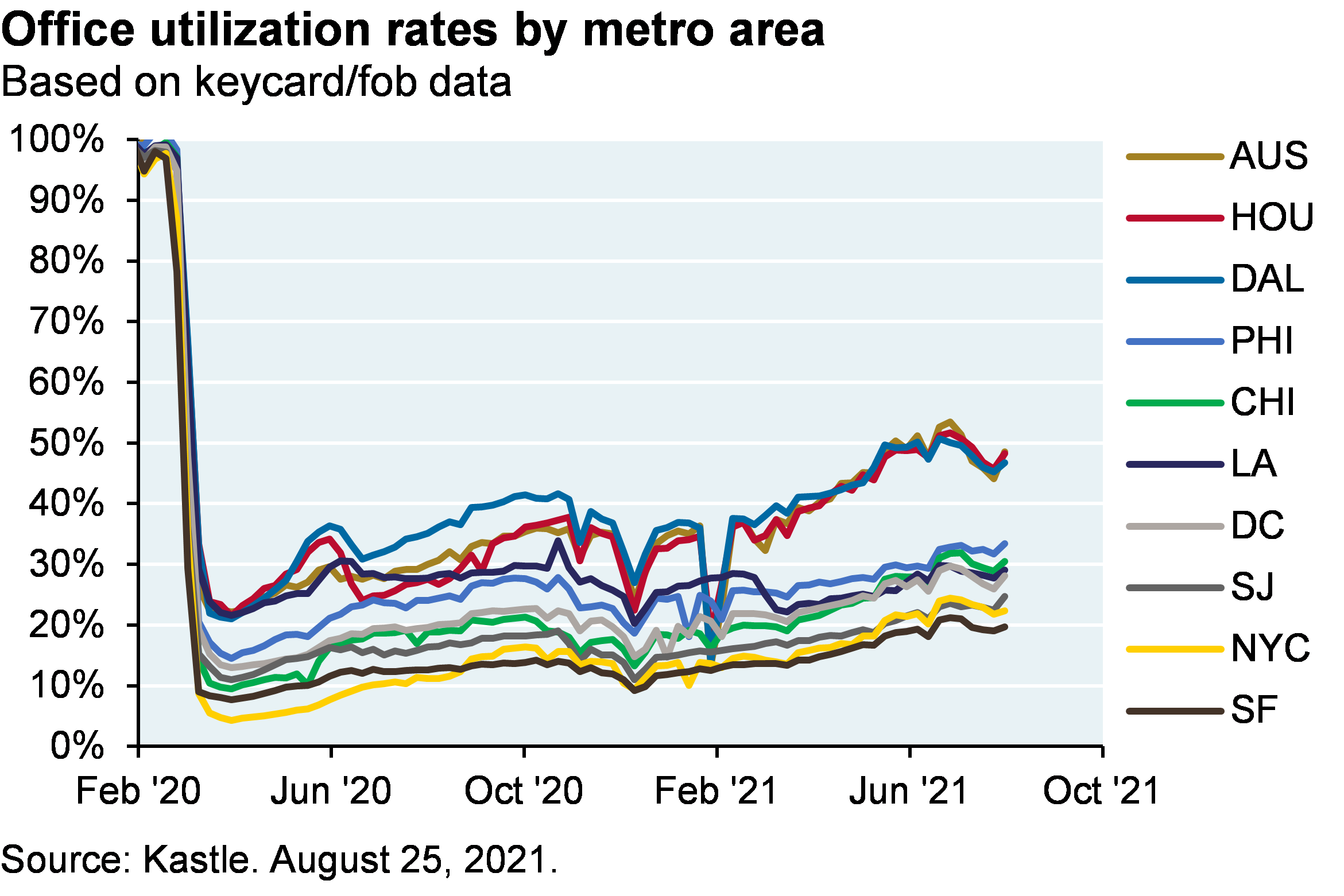

After discussing Erica Jong’s 1973 second-wave feminist novel Fear of Flying, students will analyze consumer reactions to the Delta variant, which so far also indicate a revived fear of flying7. Other social distancing categories such as bars, restaurants, lodging, parks and theaters are starting to decline as well, but not by nearly as much. As a result, the sharp decline in “COVID recovery” stocks shown in the third chart might represent an interesting opportunity as the Delta variant eventually fades and booster shots rise. While social distancing spending indicates that Americans are circulating and spending in large pre-pandemic numbers, they’re still demonstrating a pronounced aversion to office settings as shown in the last chart.

On aviation, challenges are not just a fear of flying but electronic means for companies to now avoid it. A Bloomberg survey showed 84% of companies expect to spend less on aviation, with budget declines of 20%-40%. While corporate customers normally only represent 12% of seats, they can represent as much as 75% of airline profits. Hotels could see revenue declines of 15%-20% as virtual meetings replace one quarter of corporate travel volumes (mostly internal non-client trips). A Conference Board survey cited reduced business travel as the most likely long term impact of the pandemic.

[7] Fundamentals of Organisms BIO50 (Biology): Natural Selection and its rare deviations

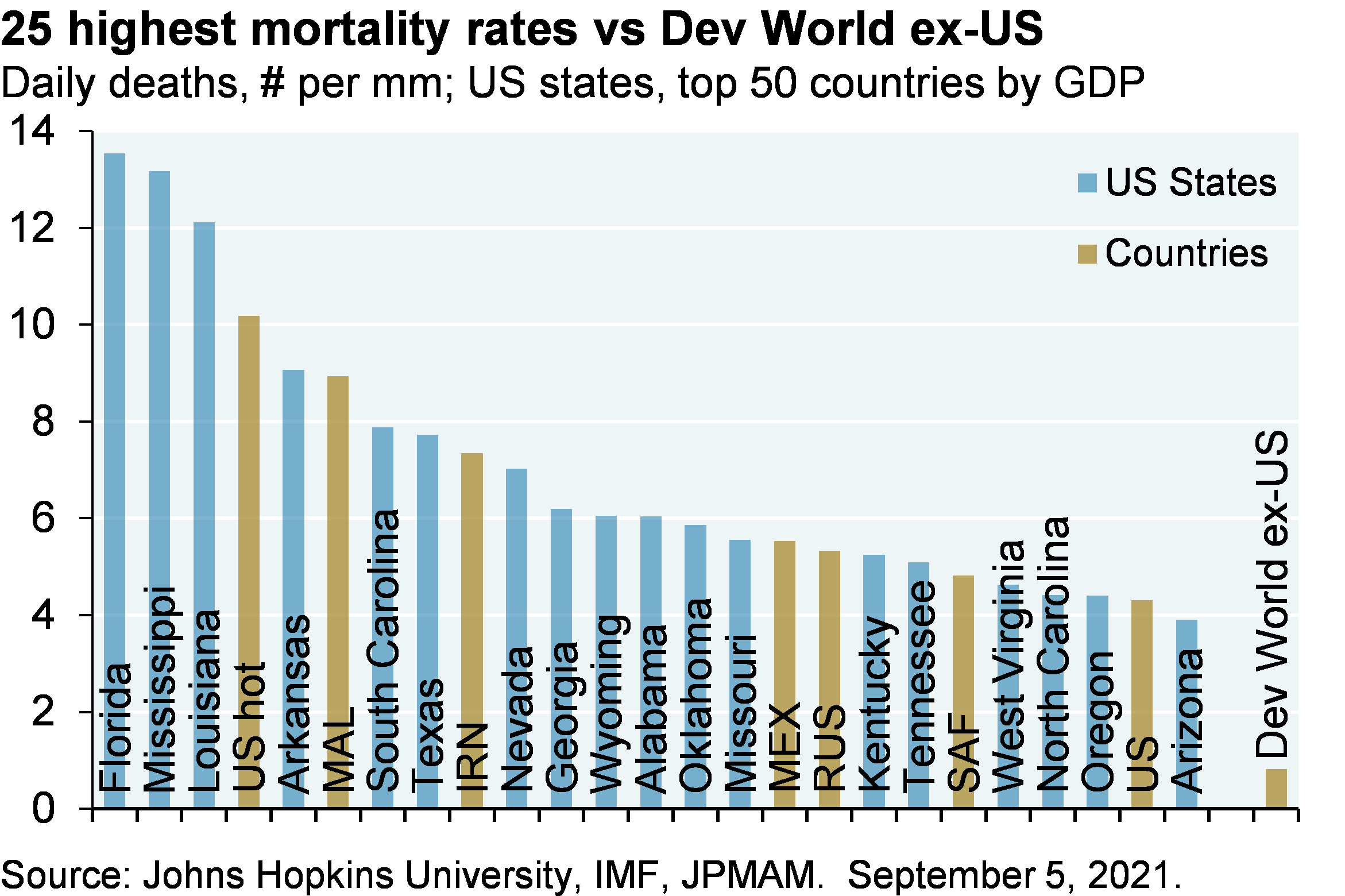

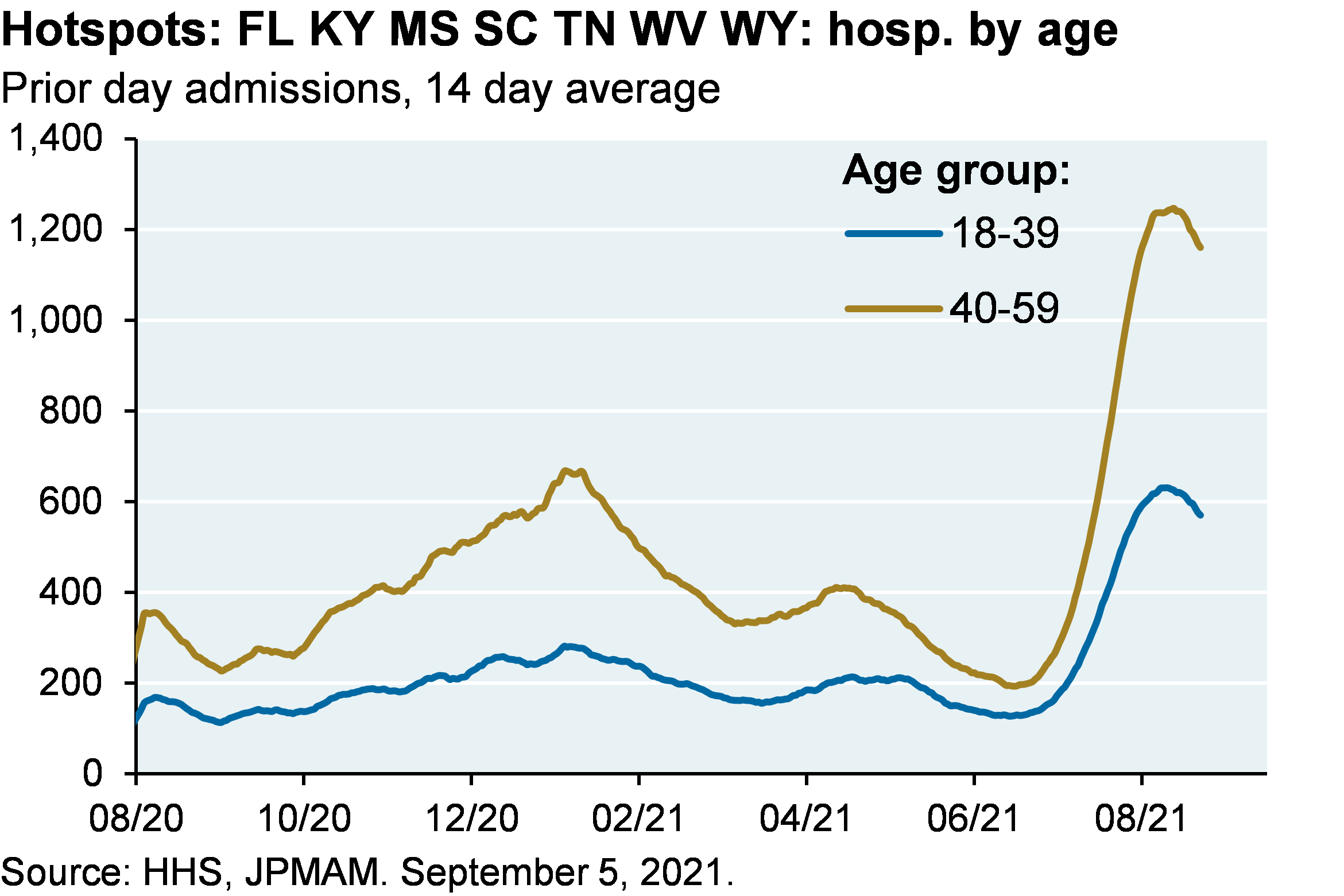

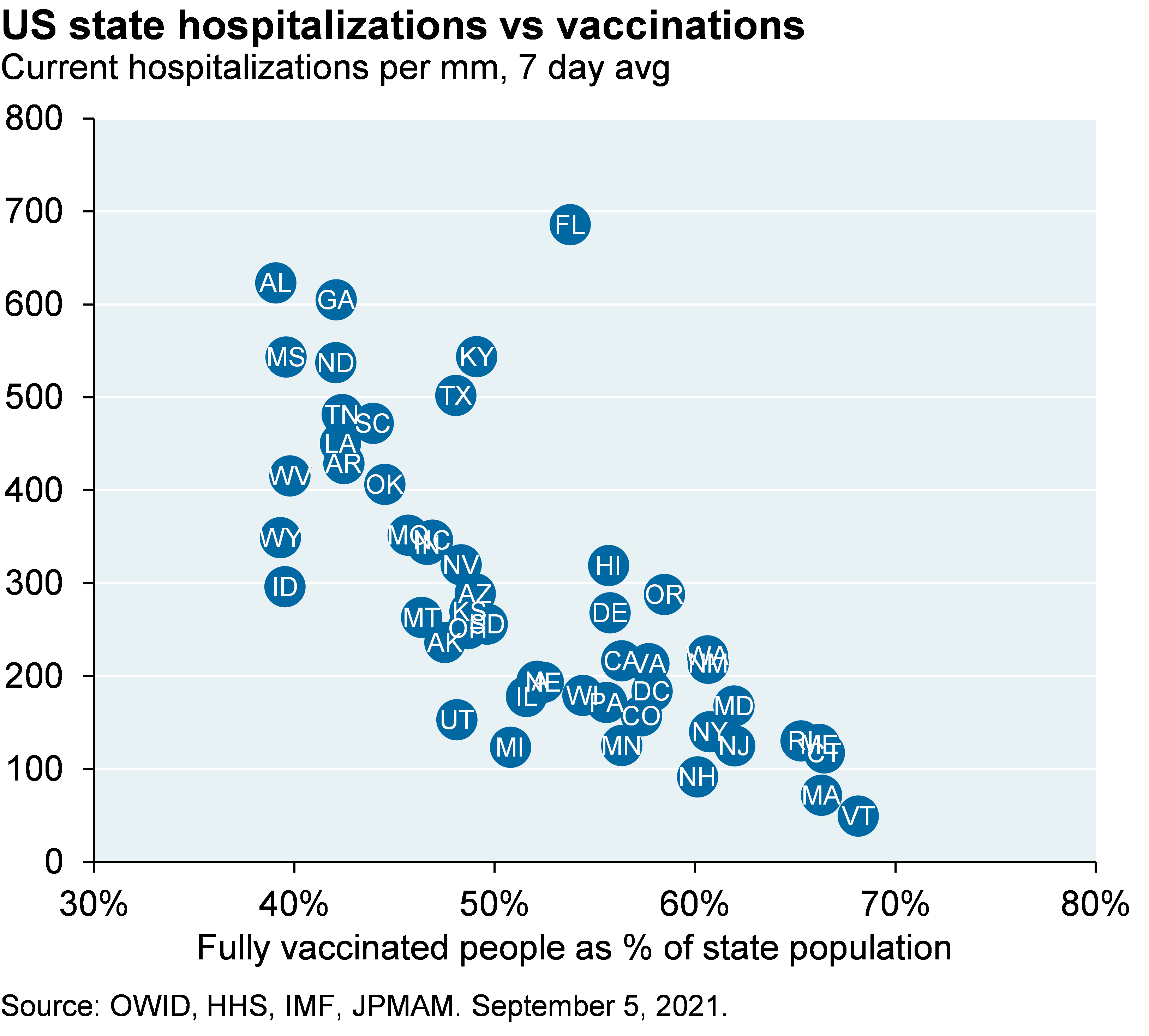

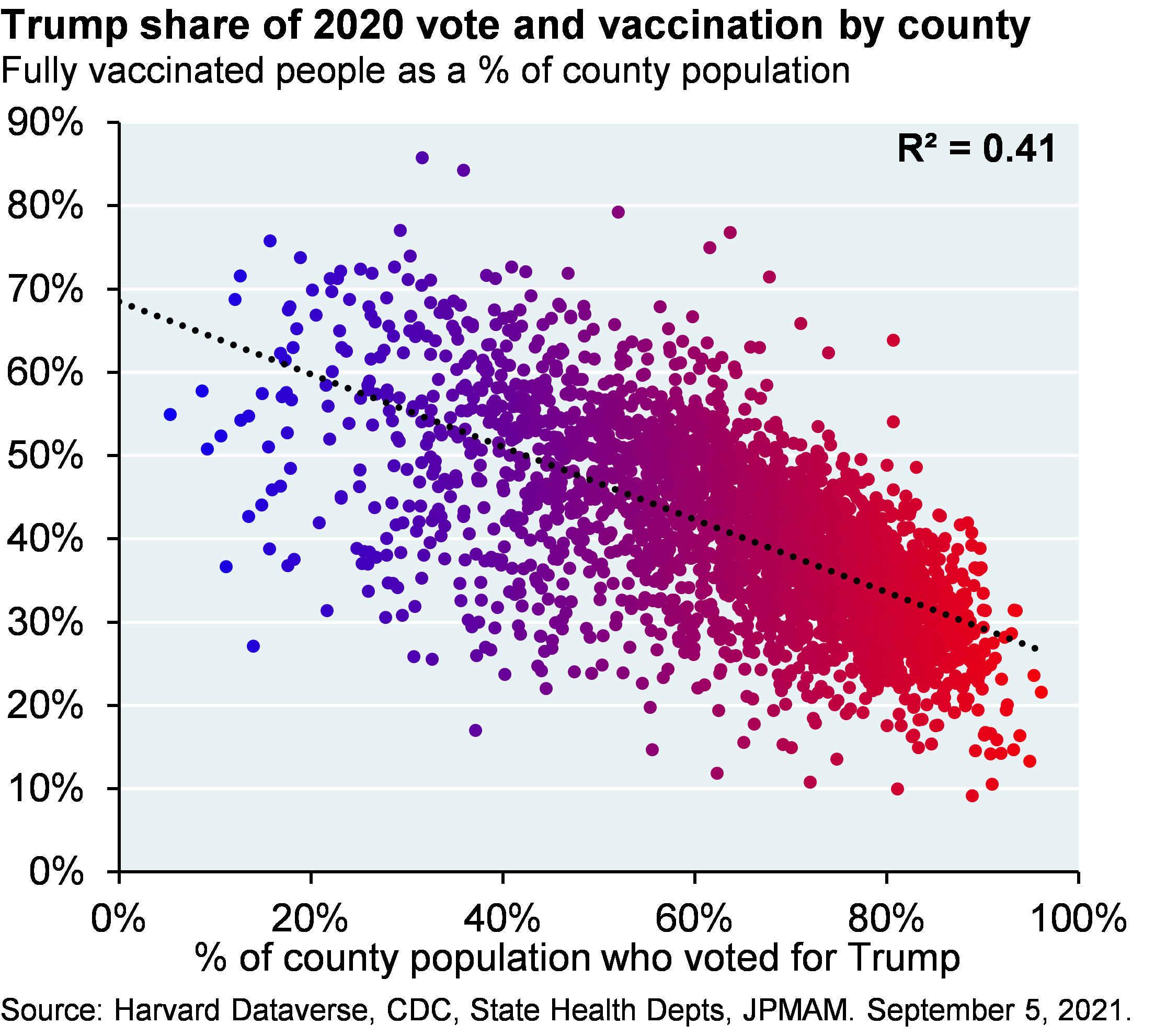

Students will review examples of natural selection (peppered moths, rat snakes, Galapagos finches, warrior ants) and rare examples of reverse natural selection, in which species adapt behaviors that are contrary to their own survival. Examples of the latter include COVID vaccine-resistant communities in the United States, where hospitalizations are rising sharply for unvaccinated people and for younger people as well. US hotspot mortality rates are now the highest in the world, alongside Malaysia and Iran, and are 10x higher than mortality rates in the rest of the developed world. Of US states, Florida now has the highest mortality rate, edging out Mississippi and Louisiana.

[8] Poetry PY51 (English): Emily Dickinson and mortality

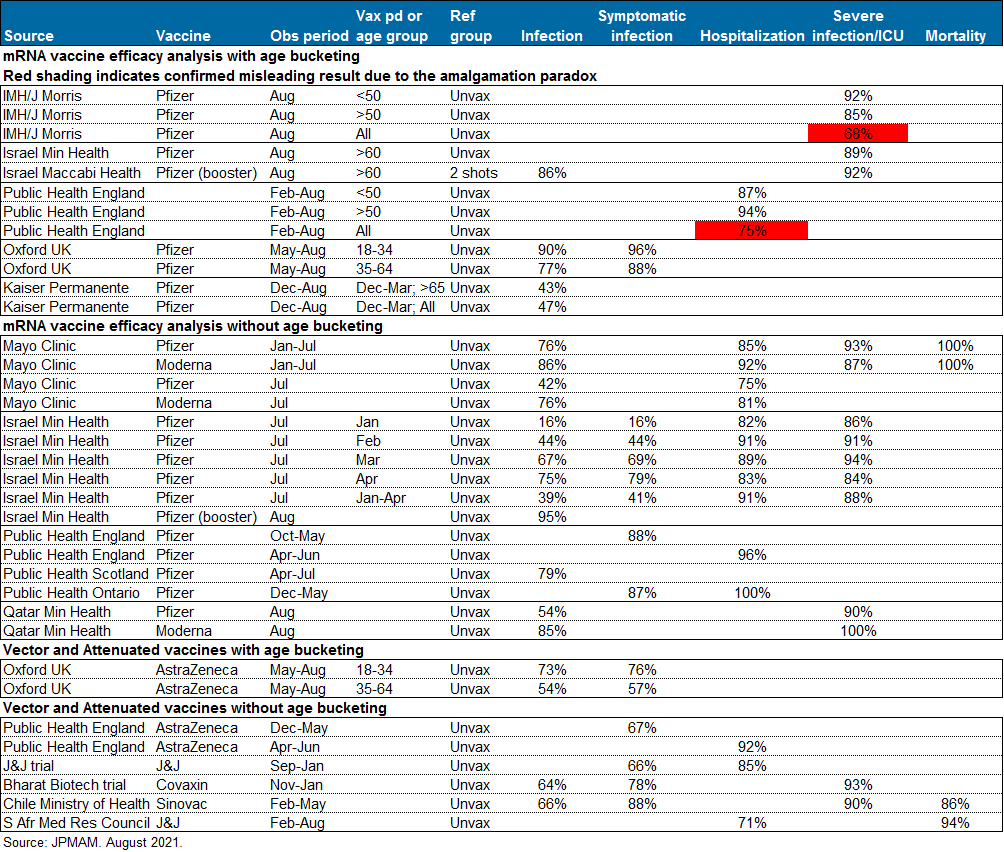

Students will analyze Dickinson’s famous poem “Because I could not stop for death”. For most vaccinated people, you won’t have to either, at least based on the latest vaccine efficacy data. While there is evidence of declining vaccine efficacy over time, such data has to be analyzed carefully to avoid an amalgamation paradox which can produce misleading results when applied to heterogeneous populations with “hidden” variables that explain results more accurately8. In the case of COVID, the hidden variable is age.

The most useful efficacy information comes from studies with data on specific age groups. As shown below, age-specific data from Israel and the UK show that efficacy vs hospitalization and severe infection remain high vs the Delta variant (85%-95%); results for total populations in these studies is misleading (red shaded values due to the paradox cited above). Even so, as with other vaccines, COVID appears to require a three shot regimen for maximum efficacy. I recommend getting a booster as soon as you are eligible: early evidence from Israel shows a 10-fold reduction in infection risk with a booster shot compared to a 2-shot regimen, and shows an increase in implied Pfizer efficacy against severe infection for people aged 60+ from 80% to 93%.

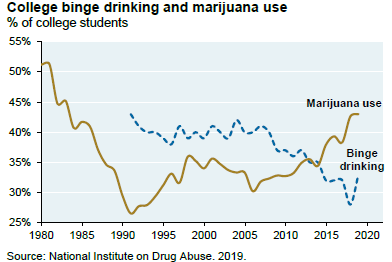

1 33% of US college students engaged in binge drinking in 2019 (5+ drinks in 2 hours for men). College binge drinking has declined since the early 1990’s, and is being substituted/accompanied by rising marijuana use.

2 Inside Higher Ed, January 2021

3 Hooke’s Law: the force of a coiled spring being released is linearly proportional to the distance from its equilibrium length

4 The semiconductor shortage. Most chip shortages are related to older and simpler 200-mm silicon wafers used in cars, computers, monitors, laptops, TVs, refrigerators and washing machines. Demand for many of these items soared during the pandemic as people built out home offices and related projects. There’s limited economic incentive to build new 200-mm chip plants given wafer-thin margins; only a handful of new ones are planned for 2022. Even so, there’s a few billion dollars being invested to expand capacity by ~20% in existing plants, in which case the semiconductor squeeze should start to ease by Q2 2022. Auto manufacturers are also discussing longer term contracts with Tier 2 suppliers that might incent them to build out new 200-mm capacity. A by-product of the semiconductor shortage: Ford is offering customers faster delivery if they agree to “lower feature content”, which translates into fewer semiconductors.

5 Fang Xingdong (Director of the Center for Internet and Society at Zhejiang University) explains the motivation: the Chinese government needs to prevent internet platforms from “breaking the existing institutional framework and challenging the power and governance capacity of the state” [Source: Gavekal Research]

6 Alfred McCoy, University of Wisconsin-Madison Center for Southeast Asian Studies

7 I flew to Canada last week for 3-days of sturgeon fishing. Direct routes from NYC to Vancouver are gone, so you have to connect through Montreal or Toronto and plan for missed connections due to delays related to COVID document checking. My largest catch was a massive 9-foot Fraser River sturgeon near the town of Hope.

8 For more details, see our August 19, 2021 Eye on the Market “Spaccine Efficacy"

Your Fall 2021 syllabus

Greetings. We look forward to seeing you back on campus, although you will not be allowed to gather in groups larger than five, which we expect to reduce COVID transmission and cut down on excessive alcohol consumption and related misbehavior

[START RECORDING]

FEMALE VOICE: This podcast has been prepared exclusively for institutional, wholesale, professional clients, and qualified investors only as defined by local laws and regulations. Please read other important information which can be found on the link at the end of the podcast episode.

MR. MICHAEL CEMBALEST: Good morning, students. This is your dean speaking. We look forward to seeing you back on campus, although you're not going to be allowed to gather in large groups, which we think will reduce COVID transmission and also cut down on all of your excessive drinking. Since most of you experienced declining grades last year, we've doubled your coursework and so your syllabus is going to be eight classes this semester instead of four. One brief update to the syllabus, the course, the Origins of COVID that was supposed to be taught by Professor Peter Daszak has been cancelled until further notice.

Anyway, here's a quick overview of the eight courses in your syllabus for this fall. The first one is on addictive behaviors and the prefrontal cortex and external stimuli, where we're going to look at the consequences of Fed liquidity on the stock market. Fed's about to slow it to asset purchases, and the share of U.S. equities that are very sensitive to liquidity conditions keeps rising. There's still a lot of demand for long-duration Treasury from banks, pension funds, and insurance companies for regulatory reasons and liability management, but we will have to explore over the next few months the implications of reduced liquidity on the stock market.

One of the most important courses you'll be taking this fall is the Dynamics of Coiled Springs in the Mechanical Engineering Department and its application to U.S. growth, spending, and inventories. So some leading indicators have weakened recently, mostly a function of really intense supply chain problems, including a semiconductor shortage that's very pronounced and may not resolve until early next year.

But if you look at the big picture, rising wages, government transfers, and pandemic issues of boosted pent-up consumer spending, and so, and there's also a lot of unprecedented pent-up demand when you look at the gap between low inventory growth and high sales growth, both of these coiled springs will eventually come back and so will housing, which is now constrained by soaring prices and very tight supply conditions.

So the bottom line is as drags from the supply constraints and the Delta variant eventually fade, U.S. and global growth should be supported by a bunch of reopening dynamics, inventory restocking, and more capital spending. That said, in the near term, it's hard to reconcile inventory and sales gaps and how they could be closed without higher prices, which is why so many companies are indicating that they are planning to increase prices at this point.

On the semiconductor shortage, just a few comments. Most of the chip shortages are related to these older, simpler, 200-mm silicon wafers that are used in cars and computers, laptops, refrigerators, and washing machines. Demand for these items soared during the pandemic as people built out home offices and other related projects. And so the problem is there's not a lot of economic incentive to build these new plants. Their margins are wafer-thin, sorry for the pun, and only a handful of new ones are planned for next year. Even with that, there's a few billion dollars being invested to expand capacity by around 20% in existing plants, which should start to soften some of this shortage by Q2 of next year.

The third course you'll be taking is on military strategy and the art of war, and you will be focusing on how the tech and communication services companies have conquered U.S. equity markets. When you look at industry concentration and margins, the tech and communications services opportunities, that is really where most of the gains have been. And there are some important applications here you can read about for investors that translate into much better risk/reward characteristics for growth, equity, and venture capital investing for the software and other high-margin businesses with very low labor intensity. So you can take a look at that.

We have a course in Chinese history on the creation of a more just society, where you'll be reviewing the Great Leap Forward and the Cultural Revolution as examples of how Chinese leaders in the past imposed sacrifices in the pursuit of broader societal goals. A lot of Chinese stocks have been clobbered after new rules on everything from e-commerce, tutoring, data sharing, crypto, online finance, labor practices, antitrust, drug prices, food disclosures, and then of course these corrosive Western practices such as celebrity-watching, social media, and gaming.

For investors that have patience, there are some attractive opportunities here. They're not massive across all sectors, even with the large selloff in Chinese equities, and some of the categories are down 35% or so. The valuation gap versus the U.S. isn't that big because China started out trading at much higher multiples before this whole crackdown began. But there does seem to be some interesting opportunities here for very long-term investors, given the growth dynamics that are in China.

Another course you'll be taking is on progressivism in film. We're going to be looking at progressive scenes in film history and then pivoting to the Biden administration's progressive plans to raise corporate taxes to pay for infrastructure and other initiatives. Democrats haven't reconciled yet competing visions. Mansion and cinema have taken well-established positions of what they can and can't support or will and won't support. The most likely scenario to us is an infrastructure bill of about a trillion dollars in new spending and a reconciliation bill for all the other stuff, with around 2 trillion in new spending. And that's as high as I think they'll be able to go.

The base case scenario for corporate taxes to me doesn't look nearly as bad as it could have been. But to tax policy experts, they're disappointed because part of what the Trump tax bill accomplished was to level the playing field with other countries for U.S. multinationals. And we've got some charts in here showing how what's likely to come out of this will push the U.S. to the back of the line again in terms international tax competitiveness. It looks like a 25% corporate rate up from 21, an increase in the effective tax rate applied to low-tax jurisdictions, currently around 13, that would go up to 18 or 19, a minimum book tax of 15% on large companies, although that's not going to have much of an impact, given since most of them pay more than that anyway.

The bottom line is around a 5% hit to next year's earnings per share, with slightly higher tax rates for the tech, healthcare, and communications services sectors. To me, this appears modest. And again, when you compare it to the overall Biden agenda, this could have been much worse when you look at what the original plans were again. But that said, this is a large bill from an international perspective. And also, once you throw in all the individual tax rates, this is, it looks like one of the largest tax increases in the post-war era, not anywhere near what took place in 1951 or 1968, but bigger as a share of GDP than almost all of the other bills that have taken place over the last few decades. Anyway, we'll take a look at the data here. You can take a look.

And then the last three courses are all COVID-related. One of them is on a fear of flying, where we take a look at consumer reactions to the Delta variant. So far, airline spending is where we're really seeing the brunt of it. We're seeing much smaller reductions in social distancing spending related to bars, restaurants, lodging, parks, theaters, et cetera. So the sharp decline in some of these COVID recovery baskets of stocks could be an interesting opportunity. But again, most of what we're seeing here is airline-related.

And the other problem, the other thing with the airline spending is hard to disentangle, it's not just the Delta variant, but companies now have electronic means through Zoom and other methods to avoid this kind of spending. Almost 5% of companies in one of these Conference Board surveys said they expect to spend less on aviation, with budget declines of 20 to 40%, which is a pretty big hit. And corporate customers only represent around 12% of all the seats, but they can represent as much as three-quarters of airline profits. This is going to have knock-on effects for hotels as virtual meetings replace corporate travel, mostly the internal non-client stuff. So this looks like the most pronounced long-term impact of the pandemic.

Just a couple more COVID-related courses. One of my favorites is on a biology course on natural selection and its rare deviations. You'll be reviewing examples of actual natural selection, peppered moths, rat snakes, warrior ants, things like that. And then examples of reverse natural selection in which species adapt behaviors that are contrary to their own survival, and the best example of that are vaccine-resistant communities in the U.S. where hospitalizations are rising very sharply for unvaccinated people and also for their younger unvaccinated people as well. The U.S. hotspots in the Southeast, the mortality rates, forget about discrepancies over how you measure an infection and what are people in the hospital for, mortality rates are now the highest in the world alongside Malaysia and Iran, and are ten times higher than the mortality rates in the rest of the developed world.

So there is that, and then we have a final course that looks at some of the vaccine efficacy statistics. You have to be very careful. I wrote about this in the last Eye on the Market. You have to be very careful when you're looking at this data. There's a very strange mathematical paradox that can happen when you're showing the overall efficacy result on a large population that is skewed by age. And so the studies that divide the efficacy numbers by age group are much more reliable. And this is kind of amazing. In one of the studies that came out on Pfizer, the overall efficacy number for the entire population was described as being 68%, whereas for the under-50 group it was 92, and for the over-50 group it was 85. So in other words, the headline number being reported in the press was grossly misleading because of this weird mathematical paradox. You can read more about it in the last Eye on the Market. But this time we have a table showing what the age-bucketed results are.

The bottom line is there does seem to be fading efficacy versus infection after a few months. But even so, efficacy against mortality, severe infection, ICU, and hospitalization still appears to be somewhere in the neighborhood of 90 to 92% across different studies and for all of the mRNA vaccines. The numbers are markedly lower for the AstraZeneca and the J&J vaccines by about 10 or 15%, depending on the study that you're looking at. So welcome back to school, and we will talk to you again next time, bye.

FEMALE VOICE: Michael Cembalest's Eye on the Market offers a unique perspective on the economy, current events, markets, and investment portfolios, and is a production of J.P. Morgan Asset and Wealth Management. Michael Cembalest is the Chairman of Market and Investment Strategy for J.P. Morgan Asset Management and is one of our most renowned and provocative speakers. For more information, please subscribe to the Eye on the Market by contacting your J.P. Morgan representative. If you'd like to hear more, please explore episodes on iTunes or on our website.

This podcast is intended for informational purposes only and is a communication on behalf of J.P. Morgan Institutional Investments Incorporated. Views may not be suitable for all investors and are not intended as personal investment advice or a solicitation or recommendation. Outlooks and past performance or never guarantees of future results. This is not investment research. Please read other important information which can be found at www.JPMorgan.com/disclaimer-EOTM.

[END RECORDING]