In brief

- At its first policy meeting of 2026, the RBA ended its rate pause and raised the cash rate by 25bps to 3.85%, due to persistent and broad-based inflation pressures.

- Stronger-than-expected private demand and a tight labour market triggered the hawkish pivot, signalling mounting capacity constraints.

- The RBA reiterated its data-dependent stance and indicated that further tightening was possible if inflation remains above target.

- Renewed rate hikes are positive for cash investors, presenting higher yields and a steeper yield curve, with ongoing uncertainty reinforcing the importance for diversification.

RBA Hikes Rates as Inflation Proves Persistent

At its first meeting of 2026, the Reserve Bank of Australia (RBA) ended its policy pause, hiking the cash rate target by 25bps to 3.85%. This move marks the bank’s first rate hike just six months after it finished its shallow rate-cutting cycle in August 2025. The widely expected decision highlights the RBA’s growing unease about persistent inflation pressures. There is also concern that capacity constraints in the economy could keep price growth “above its 2-3% target range for some time”.

The accompanying statement bluntly confirmed that inflation had “picked up materially in the second half of 2025”. The RBA attributes this mainly to stronger-than-expected momentum in private demand, both household spending and business investment. Financial conditions had eased through 2025, and credit remained readily available. With that, the central bank also highlighted it is “uncertain that interest rate remain restrictive”. The decision to hike was unanimous. This restores credibility and reflects a shift toward a more hawkish stance in the face of mounting evidence that the economy is running hotter than anticipated.

In the subsequent press conference, RBA Governor Bullock struck a hawkish tone, confirming the bank was “uncomfortable with the current inflation level”. She stated the hike was triggered by fears that they “cannot allow inflation to get away from us again”.

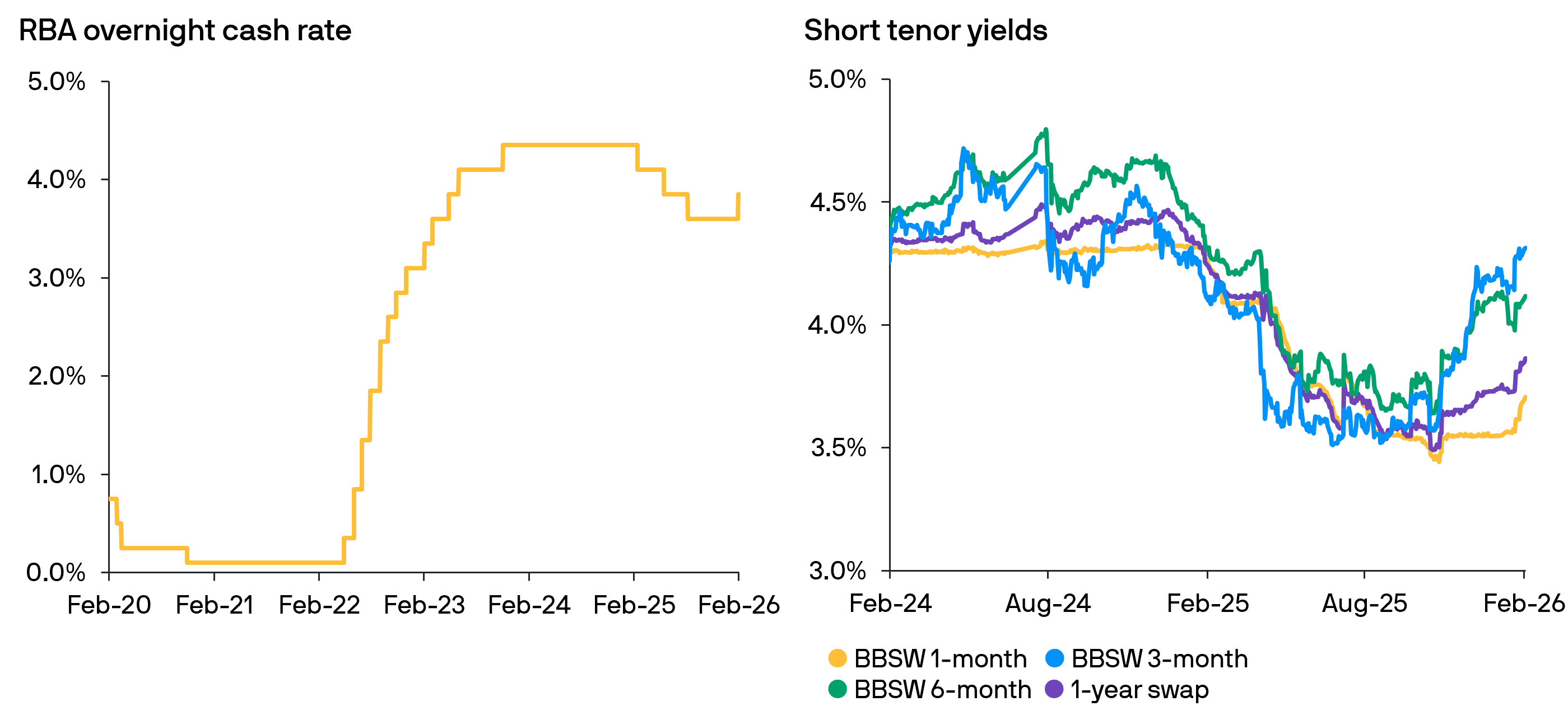

Fig 1: The RBA hiked rates for the first time since 2023; BBSW yields have climbed sharply recently in anticipation of rate hikes.

Source: RBA, Bloomberg and J.P. Morgan Asset Management; data as at 3rd February 2026.

Growth Momentum Surprises and Inflation Risks Tilted to the Upside

The RBA’s latest move marks a clear shift in policy thinking. By mid-2025, the Board adopted a cautiously optimistic outlook. Activity was recovering, private demand was improving, and the labour market was easing slightly. However, as the year went on, data revealed a more persistent inflation problem. By December, the RBA was already expressing discomfort with underlying prices and noted “signs of a more broadly based pick-up.”

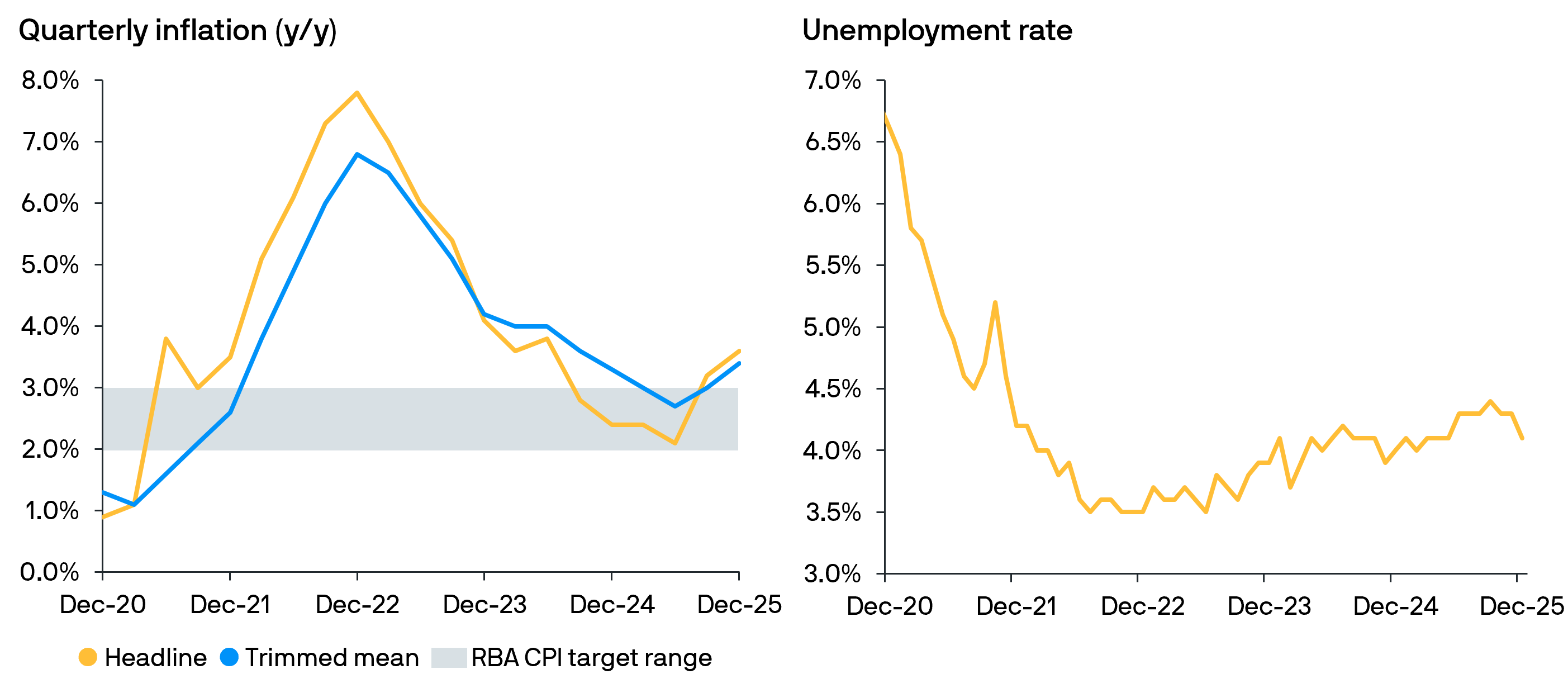

The February decision confirms these concerns have intensified, with the central bank acknowledging that “inflationary pressures picked up materially in the second half”. Private demand has strengthened “substantially more than expected,” with both consumption and investment driving growth. The housing market remains hot, and credit conditions are supportive. Labour market conditions are still “a little tight,” with unemployment lower than expected and wage growth strong. With inflation risks tilted to the upside, the RBA was forced to act, citing concerns that “inflation is likely to remain above target for some time.”

Fig 2: Headline and core inflation remain above the RBA target range; low unemployment hints at capacity constraints.

Source: Bloomberg and J.P. Morgan Asset Management; data as at 3rd February 2026.

RBA Setting a New Course

With this rate hike, the RBA signals a new phase in its policy cycle, shifting from a “wait and see” approach to a more proactive stance to contain inflation. The Board restated it remains data-dependent, considering the evolving outlook for inflation, growth, and the labour market. However, its hawkish tone confirms the risk now is that inflation expectations remain elevated, necessitating additional policy action. Conversely, if price pressures ease and growth slows, this hike could be a one-off risk management move. This would help curb inflation and allow a return to a more neutral stance.

For AUD cash investors, the RBA’s hike—making it the first major central bank to tighten—is welcome news. Overnight deposit rates will rise, and the yield curve has steepened in anticipation of further moves. However, given ongoing uncertainty, we continue to stress the importance of caution. Diversification across maturities and instruments remains key to achieve optimal risk-adjusted returns.