Climate change remains a dominant theme in sustainable investing, as investors look to take account of climate risk in portfolios and contribute to a more sustainable future. There are three key climate change investment risks that investors can focus on now if they want to support long-term climate change solutions.

1. Long-term energy transition risks

The recent rebound in traditional energy stocks, boosted by soaring commodity prices, and the simultaneous underperformance of renewables, has left some investors asking whether the level of transition risk (and opportunity) often associated with these energy stocks is, in fact, overblown.

The answer, in our opinion, is no. Volatility is to be expected on the road to net zero emissions, and it is crucial that climate investors stay focused. Recent performance drivers behind the energy stock rebound already look to be reversing, as high fossil fuel costs boost the competitiveness of renewable energy providers and attract new investment to the sector. And in the longer term, solving the challenges presented by the transition to a low carbon economy will likely require further leaps forward in renewable energy and carbon capture technology, providing potentially compelling future opportunities for climate investors.

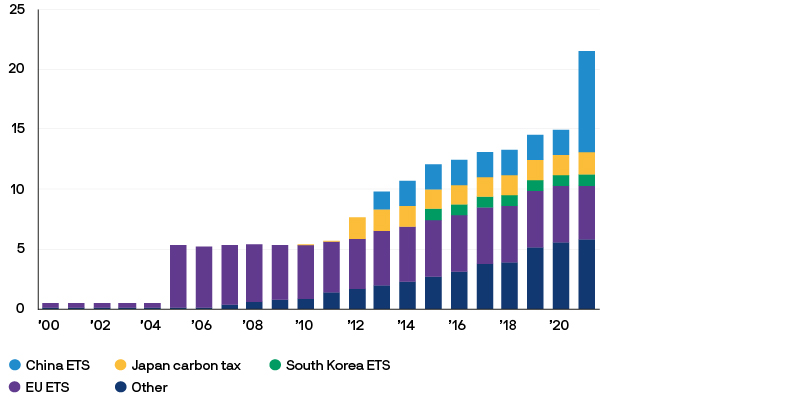

For anyone still sceptical about long-term transition risks, the recent increase in carbon prices should be a wake-up call. Carbon prices are rising towards the $75 per ton level that the International Monetary Fund says is needed to keep the global temperature rise below 2 degrees Celsius by 2050, while the proportion of emissions covered by carbon trading schemes is also increasing. As carbon prices rise, traditional energy production based on fossil fuels will become more expensive, supporting the economic argument for a transition to zero-emission energy sources.

Global emissions covered by carbon pricing

Source: World Bank, J.P. Morgan Asset Management.

Moreover, the risks that geopolitical instability pose to domestic energy security in countries that are reliant on fossil fuel imports have been made very clear by the war in Ukraine. As such, the crisis has the potential to be a catalyzing force for accelerating the transition to renewable energy. Renewable energy can no longer be seen as an isolated response to environmental concerns. Rather, it may come to be viewed as a solution that can help countries achieve strategic energy autonomy and ensure the safety and wellbeing of national populations.

2. Physical climate change risk

Another important area of climate risk that investors need to bake into asset allocation decisions is physical risk, including the threat to asset prices posed by climate-related natural disasters, such as flooding, or hurricanes.

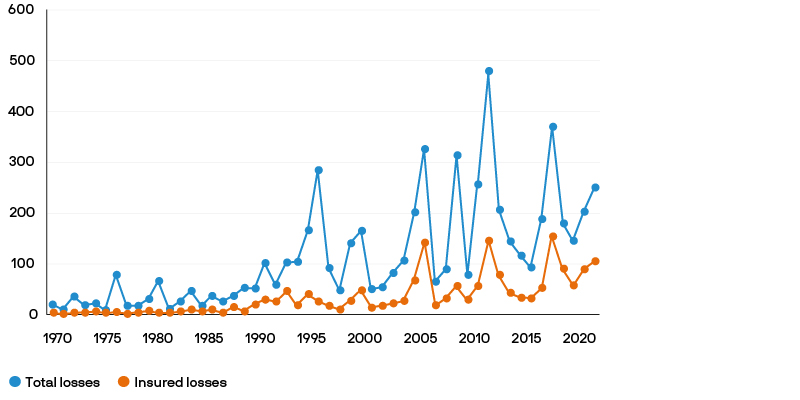

The impact of climate change on economies and businesses tends to be underpriced by markets, despite the fact that there has been a notable rise in both insured and uninsured losses from natural disasters over recent decades. Insurance against severe climate-related events remains lowest in emerging markets, where many countries are particularly vulnerable to natural disasters but lack the resources to plan for them, or to handle the economic consequences, such as post-disaster relief efforts and rebuilding costs.

Physical climate risk often is not priced in

Source: Munich Re, 2022.

To prepare portfolios for the impact of climate change, investors will need to give more consideration to the sectors, countries and regions with the resilience, forward planning and flexibility to not only survive, but thrive, as global temperatures rise. It’s also important to factor physical climate risk into bottom-up company-level analysis, looking at global supply chains and other business vulnerabilities to disruptive events and disasters linked to global warming.

3. Climate change and biodiversity

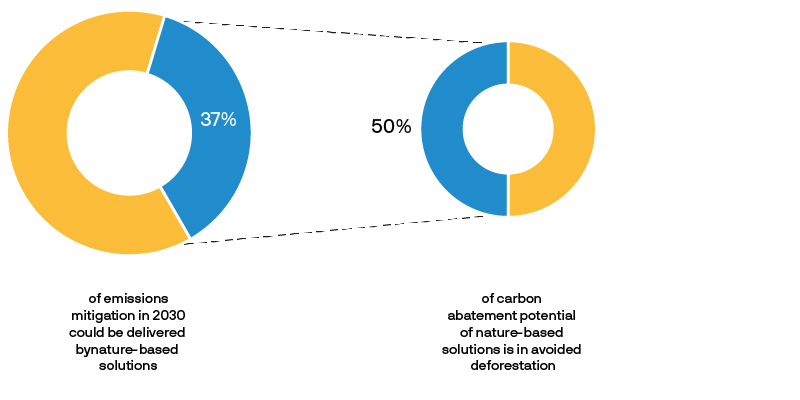

Preserving biodiversity is emerging as one of the most effective ways to address long-term climate-related challenges – as well as being an important sustainability issue in its own right. Climate risk is inextricably linked to biodiversity, with around 20% of global greenhouse gas emissions attributed to deforestation. At the same time, it’s estimated that over a third of the reduction in emissions required to reach 2030 climate targets could be met with nature-based solutions, such as avoided deforestation. Preserving biodiversity is a win-win for the climate.

Biodiversity loss is a genuine source of financial risk for investors, although the economic impact of the destruction of species and ecosystems will hit harder in some regions, and have a bigger impact in some industries, than in others. Three sectors that account for some 15% of global GDP – construction & infrastructure, agriculture & commodities, and food & beverages – are expected to be among the most affected by action to prevent biodiversity loss. The capacity of these sectors to generate value for investors will suffer if the biodiversity they rely on is degraded.

But preserving biodiversity shouldn’t mean avoiding these sectors. Instead, construction, agriculture and food companies provide tremendous potential for investors to support sustainable innovation, such as the move to green buildings, reforestation and raw materials certification.

The link between climate change and biodiversity is clear

Source: WEF, Nature and Net Zero, 2021.

Investors are also being supported by a number of important steps that are now being taken at the global level to help boost biodiversity, in terms of policy, disclosures and investor action. For example, the United Nations recently held part two of its COP15 Biodiversity Conference – the nature-focused equivalent to COP26. And in 2022, we expect to see the release of the Task Force on Nature-Related Financial Disclosures draft framework, and a proposal from the World Bank for a Nature Action 100+ as a vehicle for collaborative engagement.

Don’t lose focus on long-term climate change investment solutions

While further periods of volatility around the energy transition are to be expected, the trend towards a more sustainable future is here to stay. For investors looking to mitigate climate risk, and support climate solutions, it’s important not to get distracted by the short-term noise. Instead, as financial markets and the global economy move into an era of climate policy implementation, retaining a solutions-oriented mindset with a focus on long-term climate objectives is key.

Stay informed with all the latest climate investing opportunities and developments >

09ch220403121659