The 2021 budget proposal’s impact on PBGC premiums

Potential implications for pension plans

2020-02-17

Michael Buchenholz

On February 10th, the White House’s office of management and budget released President Trump’s proposed budget for the 2021 fiscal year: “A budget for America’s future.” The President’s budget proposal includes some potential changes to the single- employer pension benefit guaranty corporation (PBGC) program

Proposed changes to the PBGC program |

How would this impact pension plans? |

Freezing the inflation indexation of premium rates for the next 3 years. This change is in recognition of the improved financial health of the singleemployer program |

All else equal, reduce premium costs on average by ~11% over the next 3 years |

Increasing the variable rate per-participant cap ($561/participant in 2020) to $900/participant. This cap has allowed the most severely underfunded plans to limit their PBGC premiums and, perhaps, not pay their “fair share” of insurance costs |

Increase premiums by almost 30% in aggregate, the cost disproportionately borne by the worst funded plans (almost 70% of the Top 100 plans would see no change in premiums). This would in turn cause underfunded plans to:

|

Why does it matter?

If enacted, the proposed changes would increase PBGC premium costs overall while shifting more of the burden to the most poorly funded plans. The vast majority of plans will receive moderate relief from the curtailment of expected rate increases over the next 3 years. We estimate that all else equal, costs were expected to rise around 10% due to these scheduled inflation-indexed increases. These plan sponsors don’t have any immediate actionable takeaways, but the increase of the variable rate cap to $900/ participant removes a bit of the cost safety-net in the case of a large funded status drawdown. Costs could potentially skyrocket if plans find themselves underfunded so this should increase the incentive to de-risk for well-funded plans.

The variable rate cap increase will disproportionately shift premium costs towards the most poorly funded plans. We estimate the about 20% of the top 100 plans would see a cost increase of 10bps or more (as a % of assets) while more than 5% would see a cost increase of 30bps or more. These plans sponsors can mitigate costs in two ways:

- Accelerate plan funding to reduce unfunded benefits and bring down the variable rate premium. The cap increase should enhance the attractiveness of this option relative to other uses of corporate cash. Borrow-to-fund strategies may also look more attractive.

- Low-balance participant risk transfers via lump sum windows and annuity buyouts can help bring down variable rate costs for these plans. Given the increased cap rate, the participant balance threshold for this premium optimization exercise should be much higher. So even plans that have engaged in these transactions may find that they can target a higher balance subset of the population and engage in risk transfer with a positive NPV.

A closer look: Detailed charts and analysis

EXHIBIT 1 below outlines actual premium rates through 2020 and projected premium rates through 2023 under the existing inflation indexing regime:

EXHIBIT 1: HISTORICAL & PROJECTED PBGC PREMIUM RATES

| Plan Year | Flat Rate Premium Per Participant (FRP) | Variable Rate Premium (VRP) | |

| Per $1,000 of Unfunded Vested Benefits (UVB) | Per Participant Cap | ||

| 1974 | $1 | n/a | n/a |

| … | … | … | … |

| 2012 | $35 | $9 | n/a |

| 2013 | $42 | $9 | n/a |

| 2014 | $49 | $14 | $412 |

| 2015 | $57 | $24 | $418 |

| 2016 | $64 | $30 | $500 |

| 2017 | $69 | $34 | $517 |

| 2018 | $74 | $38 | $523 |

| 2019 | $80 | $43 | $541 |

| 2020 | $83 | $45 | $561 |

| 2021* | $85 | $46 | $572 |

| 2022* | $87 | $47 | $583 |

| 2023* | $89 | $48 | $595 |

*Projected assuming 2% annual inflation.

Source: J.P. Morgan Asset Management, Company 10-K filings, PBGC Data. For illustrative purposes only. PBGC = Pension Benefit Guaranty Corporation Please note that certain information shown is based on assumptions, therefore, exclusive reliance on these assumptions is incomplete and not advised. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecasts, projections and other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Given the scheduled increases outlined above we would expect about an 11% increase in PBGC premiums, assuming no change in funded status. This increased cost would be eliminated by part 1 of the proposal and would benefit each and every plan sponsor.

Part 2 of the proposal significantly increases premium costs for severely underfunded plans while having little to no impact on the vast majority of plan sponsors. The exhibits below analyze the impact on the Top 100 pension plans:

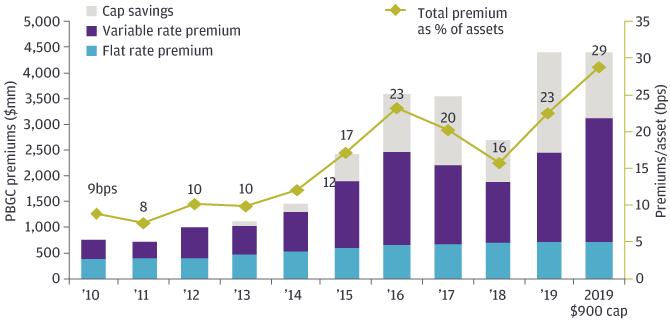

EXHIBIT 2 estimates the PBGC premiums for the Top 100 plans in both dollars and as a percentage of assets. The $900 variable rate cap, if applied to 2019, would increase costs by about $700mm or an additional 6bps of assets, all else equal.

EXHIBIT 2: TOP 100 PBGC PREMIUM COSTS

Source: J.P. Morgan Asset Management, Company 10-K filings, PBGC Data. For illustrative purposes only.

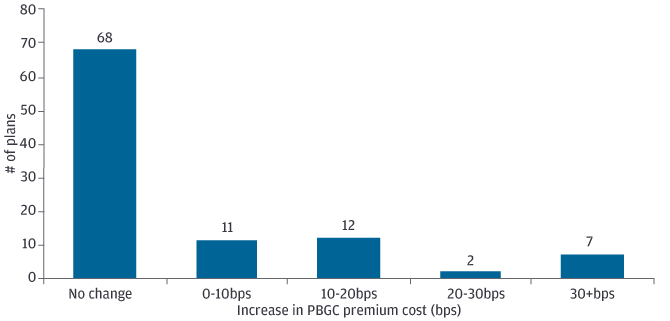

EXHIBIT 3: INCREASE IN PBGC PREMIUM COST

Source: J.P. Morgan Asset Management, Company 10-K filings, PBGC Data. For illustrative purposes only.

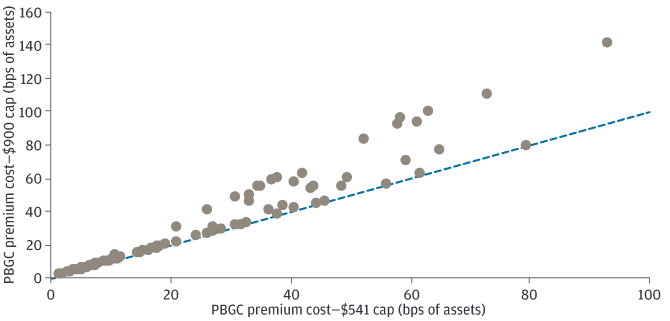

EXHIBIT 3 shows that for about 70% of the Top 100 plans there would be no change in costs. However, 20% of plan sponsors would experience a cost increase of 10bps or more. EXHIBIT 4 shows the before and after costs in bps for each individual Top 100 plan sponsor.

EXHIBIT 4: PREMIUM COSTS BEFORE & AFTER CAP CHANGE

Source: J.P. Morgan Asset Management, Company 10-K filings, PBGC Data. For illustrative purposes only.

0903c02a824a60d8