The United States of COVID

2020-05-28

Mark Willauer

Over the past 3 months, COVID-19 has taken the world by storm. Over 5.5 million people have been infected (including yours truly) and the disease has accounted for over 347 thousand deaths. It has rocked not only our social lives but every aspect of our daily lives. Now that we have finally “flattened the curve” and are in the beginning stages of the reopening process, I wanted to take a moment to better understand how fast or slow the US economy will be able to rebound. In this blog we will focus on the recovery of the systemically important States (largest as a % of US GDP) and the potential impact politics might play in the recovery of the US and Global economy.

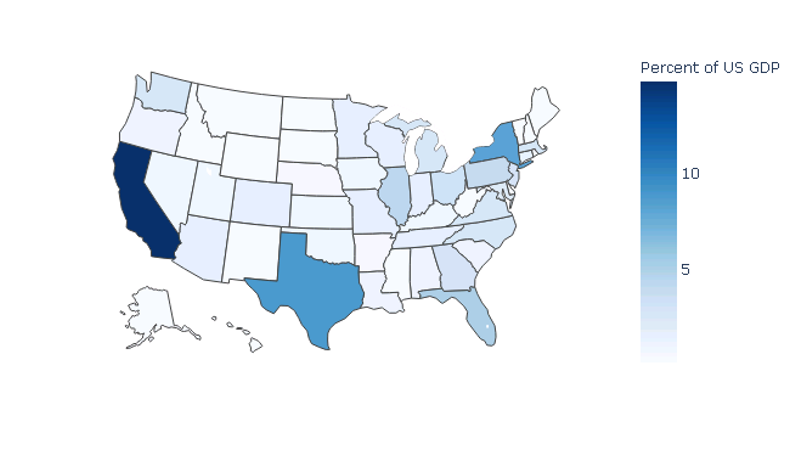

Aristotle famously coined the phrase, “the whole is greater than the sum of its parts.” While I don’t disagree that synergies are extremely important, we need to spend time analyzing the parts when assessing the speed in which the US economy can bounce back. California (a strong Democratic state) for example has a GDP (Gross Domestic Product) of $3.1 Trillion which accounts for 14.8% of the United States’ total GDP. To put this into perspective California has the 5th largest GDP in the WORLD (accounting for 3.5% of Global GDP) lagging only China ($15.3 TN), Japan ($5.4 TN), Germany ($4.0 TN) and India ($3.2 TN). On the other hand, Wyoming (a strong Republican state) is the second smallest State with a GDP of $39.6 Billion and accounts for only 0.2% of US’s total GDP (equivalent of Bahrain and Tunisia on the global scale). While the health and safety of the people in both states are equally important – their impact to both US and Global growth are drastically different.

State-Level Contribution to GDP

Source: GDP by State (Bloomberg) as of 12-31-19

Largest States: The largest 10 states (by % of US GDP) make up 57.3% of US GDP and 13.4% of Global GDP (Figure 1). Using Gallup’s Political Party identification by State, 6 of the States are Democratic and 4 are considered “Competitive” (also known as Swing States) (including Texas). This list includes 4 of the hardest hit states – New York (#1), New Jersey (#2), Illinois (#7) and Pennsylvania (#11) and in aggregate account for 19.3% of US GDP.

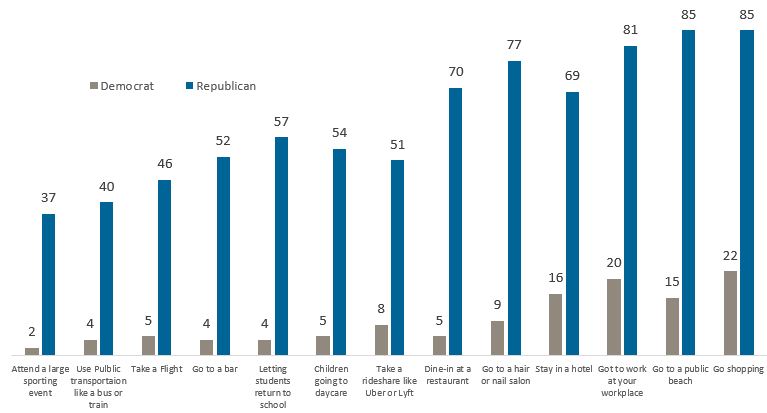

Figure 1:

Source: Party Identification by State (Gallup) as of 2-22-19 / GDP by State (Bloomberg) as of 12-31-19 / COVID Cases and Trends (NY Times) as of 5-26-20

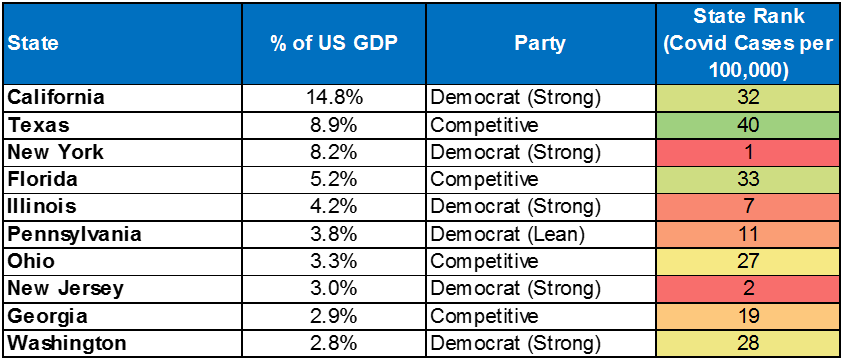

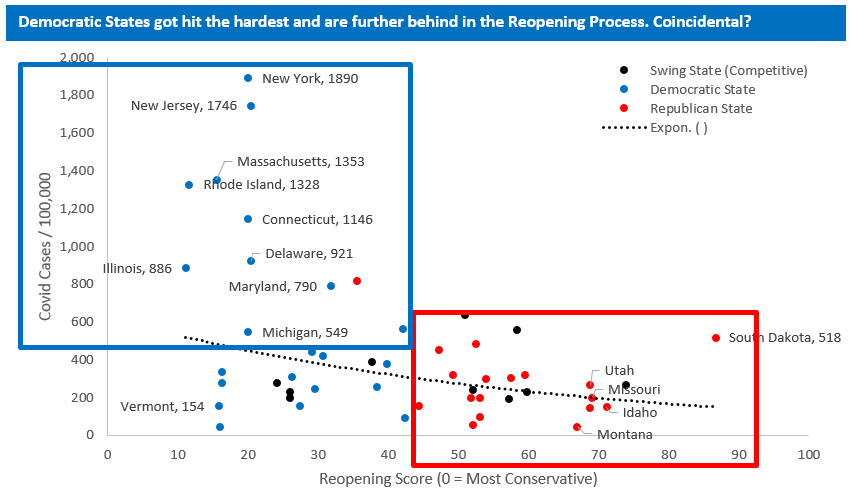

Do Politics Matter? On average, Democratic States (average ranking of 19/50) were hit harder by COVID than Republican States (average ranking of 31/50) but this isn’t due to political alliances but instead a number of other factors including population density (Figure 2).

Figure 2:

Source: Party Identification by State (Gallup) as of 2-22-19 / COVID Cases (NY Times) as of 5-26-20 / Population Density (Wikipedia) using 2013 Census Data.

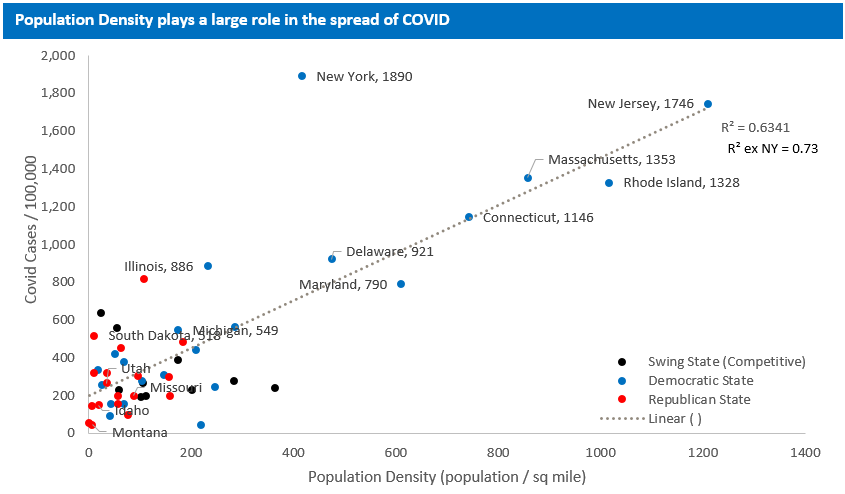

Democrat’s perception of COVID has been drastically impacted by firsthand experience and you can see this in the results of a CNBC/Change Research poll (Figure 3) conducted in battleground states in the first week of May which showed, among other things, that 85% of Republicans consider going shopping to be “safe” versus only 22% of Democrats.

Figure 3:

Source: States of Play in Battleground States as of 5-3-20 (CNBC / Change Research)

The results of this survey are also partly driven by a lack of trust in our Republican President. A recent CNN poll showed that 88% of Democrats disapproved of the job Trump has done as President (vs. 7% of Republicans) and 90% disapproved of the job he’s done handling COVID (vs. 11% of Republicans).

While the COVID outbreak in Democratic States wasn’t impacted by political alliances – these alliances will impact the reopening process on 3 fronts: speed, magnitude and enforcement. As of Wednesday May 20th all 50 States partially reopened however at different paces. WalletHub (working with a team of Ph.D. economists and health specialists) recently created a proprietary scoring system to differentiate the reopening process for all 50 States. Figure 4 highlights not only how Democratic States have been hit harder by COVID but they are also further behind in the reopening process. In short, Democratic states are implementing a more conservative reopening process than their Republican counterparts. All 22 Democratic States have a ‘reopening score’ below 50 (vs. 4/18 Republican States) and 12 of those 22 experienced a below-average case count (average of 451 cases per 100,000 people). Vermont is a great example of a State that wasn’t hit hard (9th lowest case count) but has the 3rd most conservative “reopening score.”

Figure 4:

Source: Party Identification by State (Gallup) as of 2-22-19 / COVID Cases (NY Times) as of 5-26-20 /Reopening Score (WalletHub) as of 5-18-20

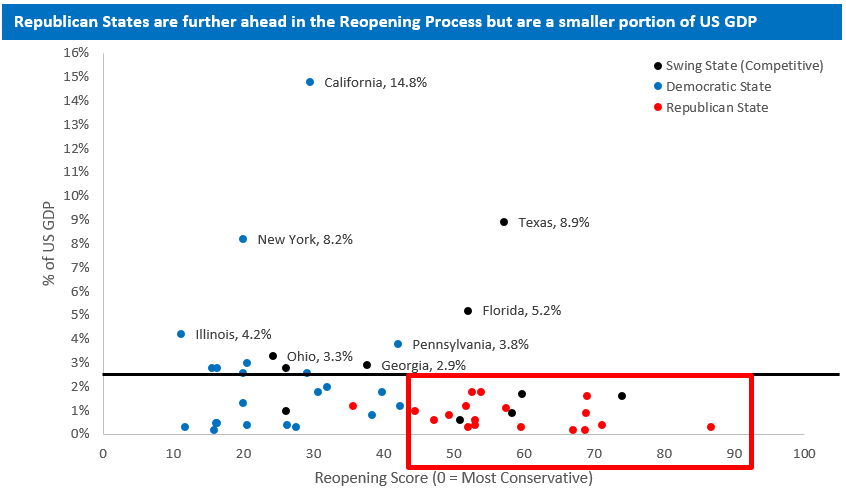

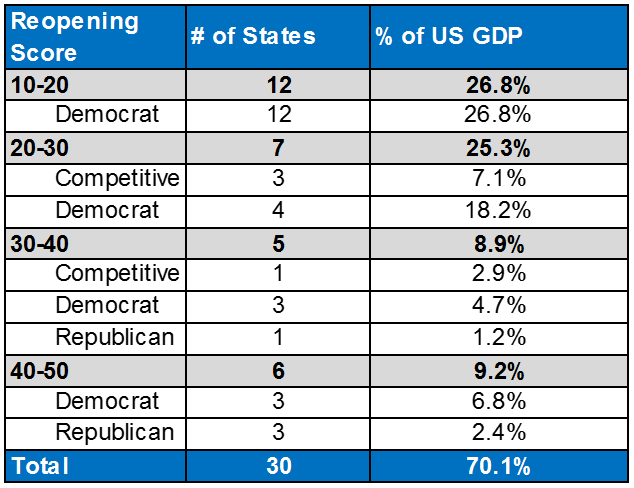

17 of those 22 Democratic States have a ‘reopening score’ below 30 and account for 45% of US GDP (Figure 6). Understanding how the speed, magnitude and enforcement in these States evolves over the next couple of months is going drastically impact how fast the US economy is able to rebound.

Figure 5:

Source: Party Identification by State (Gallup) as of 2-22-19 / COVID Cases (NY Times) as of 5-26-20

Figure 6:

Source: Reopening Score (WalletHub) as of 5-18-20 / GDP by State (Bloomberg) as of 12-31-19

In an effort to better answer this question, we look at two of the largest States (both of which happen to be Democratic) and combined account for 23% of US GDP.

New York: New York State has a GDP of $1.7 Trillion which makes it the 3rd largest State and 10th largest economy in the world (accounting for 1.9% of Global GDP). New York State was the hardest hit State and for that reason has taken an extra cautious approach to reopening and enforcement.

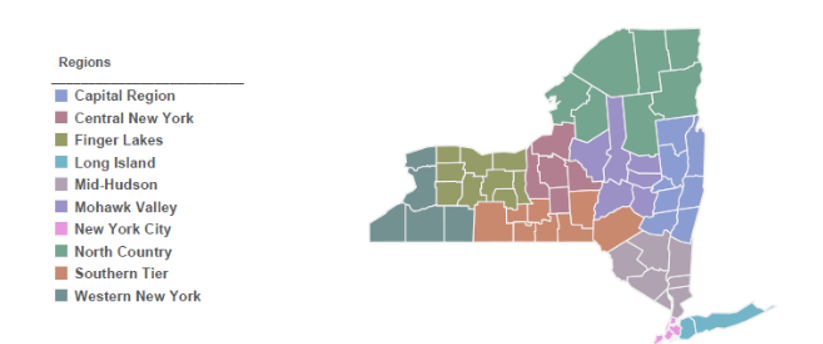

Reopening: In early May Governor Cuomo laid the framework to slowly reopen the State by introducing a seven step program (based off of public health metrics) that each region needed to pass in order to reopen. The first regions opened on May 15th, and within a week seven of the State’s ten regions entered Phase 1. Yet these regions comprise a mere 21% of the State's GDP. And while two large economic regions, Mid-Hudson and Long Island, have entered Phase 1 earlier this week, their progress will be tied to that of New York City, which accounts for 59% of the State’s GDP and won't reopen before mid-June.

Source: Region by Region Status (NY State) as of 5-25-20

But reopening in New York State does not imply “business as usual.” In early May, NY State introduced a 4 Phase program which is notably more conservative than Red States such as Georgia where hair salons, restaurants, gyms and bowling alleys reopened in late April. For comparison, hair salons in NY State fall under Phase 2 and restaurants fall under Phase 3. Regions cannot move to the “next” Phase until at least two weeks have passed without the region falling out of compliance with the seven metrics.

Source: NY Forward Reopening Guide (Link) as of May 2020

Enforcement: Since NY State has only been partially reopened for two weeks it is difficult to fully assess how strict rules will be enforced but on numerous occasions Governor Cuomo has stressed a zero tolerance policy. For example NY beaches reopened last weekend with strict rules (ex. Max 50% capacity) and Cuomo stressed that he would close the beaches immediately if the rules were not enforced. It is the author’s belief that New York State will maintain their overly cautious approach and will strictly enforce the COVID reopening guidelines across industry and activity. This is something that the markets will closely watch over the upcoming weeks and months as it will have a large impact on the US economy.

California: Although California (largest economy in the US accounting for 14.8% of US GDP) wasn’t hit as hard as other parts of the country (32nd hardest hit State), it was the first State to issue a ‘stay at home’ order and has since taken a conservative approach (18th most conservative) to both reopening and enforcement

Reopening: Unlike other parts of the State, Los Angeles was hit particularly hard by COVID. The city and its surrounding counties (account for 43% of California GDP) have seen over 2,400 deaths which ranks higher than 42 States. For that reason Los Angeles has taken an overly conservative approach and at one point hinted that the city would extend their ‘stay at home’ order until the end of August. The city has since walked back that target and are now targeting July 4th at the earliest. Reopening Los Angeles and its surrounding counties will be critical to a rebound in the US economy as this region accounts for 6.9% of US GDP.

Over the past couple of months everyone from the Center for Disease Control and Prevention (CDC) to World Health Organization (WHO) have warned that the Northern Hemisphere is likely to see a second wave in fourth quarter. For that reason I believe both Red and Blue States will take a cautious approach to reopening and enforcement; however due to the reasons mentioned in this blog I believe that Democratic States will be slower to reopen (speed) and will take more conservative approach (magnitude) with stricter enforcement. This is especially relevant since these States account for over 56.5% of US GDP.

COVID-19 disclosure: The extent of COVID-19’s impact will depend on many factors, including the ultimate duration and scope of the public health emergency and the restrictive countermeasures being undertaken, as well as the effectiveness of other governmental, legislative and financial and monetary policy interventions designed to mitigate the pandemic and address its negative externalities, all of which are evolving rapidly and may have unpredictable results. Even if and as the spread of the COVID-19 virus itself is substantially contained, it will be difficult to assess what the longer-term impacts of an extended period of unprecedented economic dislocation and disruption will be on future macro- and micro-economic developments, the health of certain industries and businesses, and commercial and consumer behavior. The financial performance of the Fund’s investments will depend on future developments all of which are highly uncertain and cannot be predicted at this time and the effects of which may be more adverse to the aggregate investment performance and any projected future performance of the Fund and to certain or all of the individual investments described herein than currently anticipated.