Insights on Artificial Intelligence

Artificial intelligence has moved from clever chatbots to an economic force reshaping industries, markets and global competition. This hub explores the AI story in depth, from the infrastructure supercycle to the winners and risks across the value chain.

-

The AI ecosystem

-

AI bull vs. bear debate

-

The AI capex boom

-

State of business adoption

-

Productivity potential

-

Private market landscape

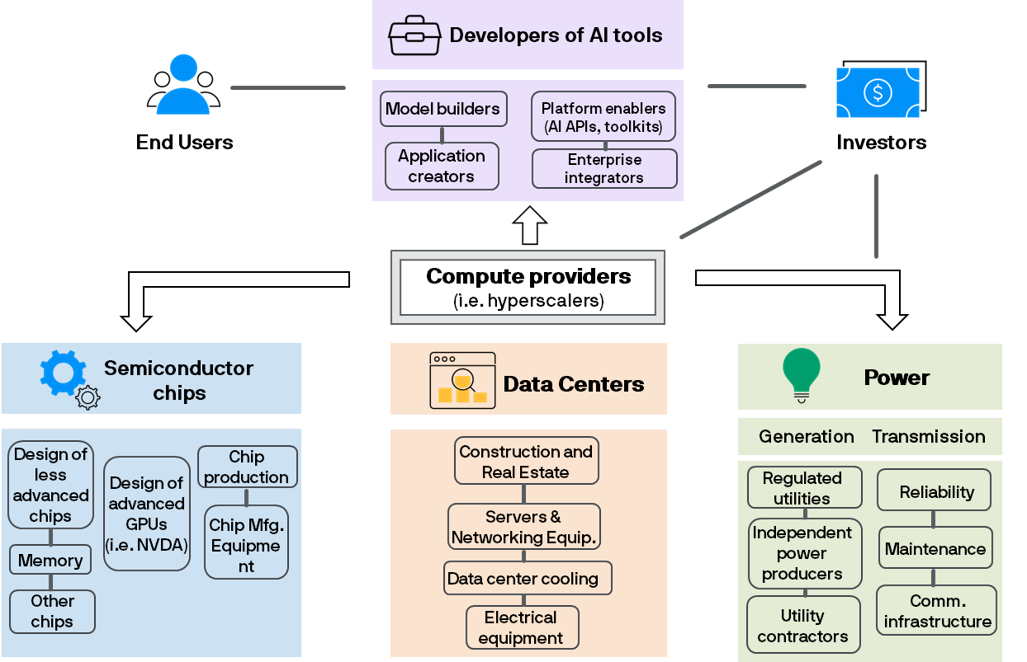

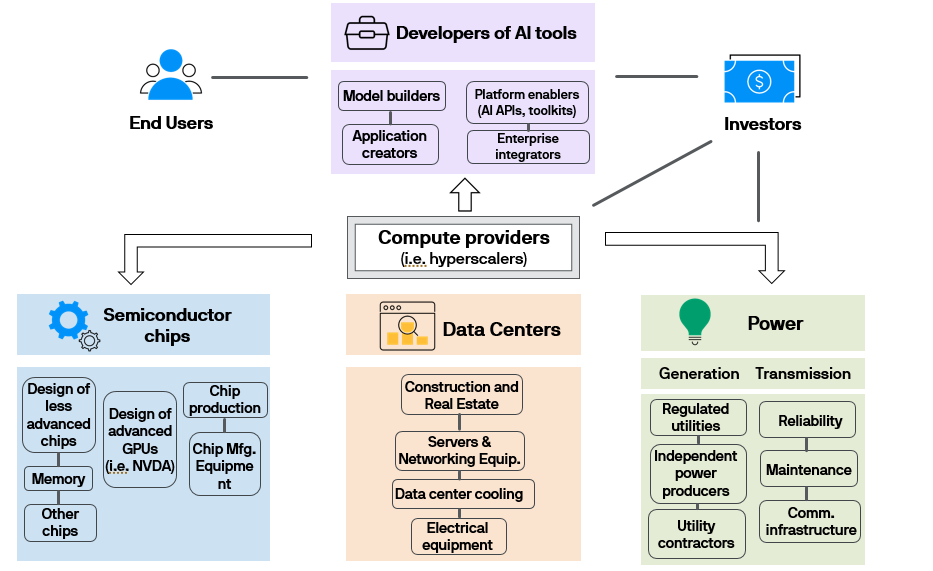

The AI ecosystem

To have any conversation about the AI investment boom, we must first get a grip on the increasingly sprawling AI ecosystem.

The hardware manufacturers sit at the bottom of the tech stack. This group includes companies like Nvidia (who design highly sophisticated chips), TSMC (who manufacture chips for Nvidia among others) and ASML (who create the incredibly precise tools that are used in chip manufacturing). While Nvidia has long been the market leader for the most sophisticated chips that are integral to AI, other chip producers like AMD and Broadcom are increasingly emerging as competitors. Data centers and power are other key components of AI infrastructure, involving companies that specialize in construction, data center cooling, electrical equipment, power generation and more.

Next come the “hyperscalers”. This group includes industry titans such as Alphabet, Amazon’s AWS business, Meta, Microsoft’s Azure and Oracle1. These companies build and operate data centers that are the backbone to artificial intelligence and cloud computing more broadly. With an estimated half of AI-related capex typically being spent on chips, the hyperscalers are critical customers for the hardware manufacturers and are increasingly fueling an acceleration in power generation and transmission.

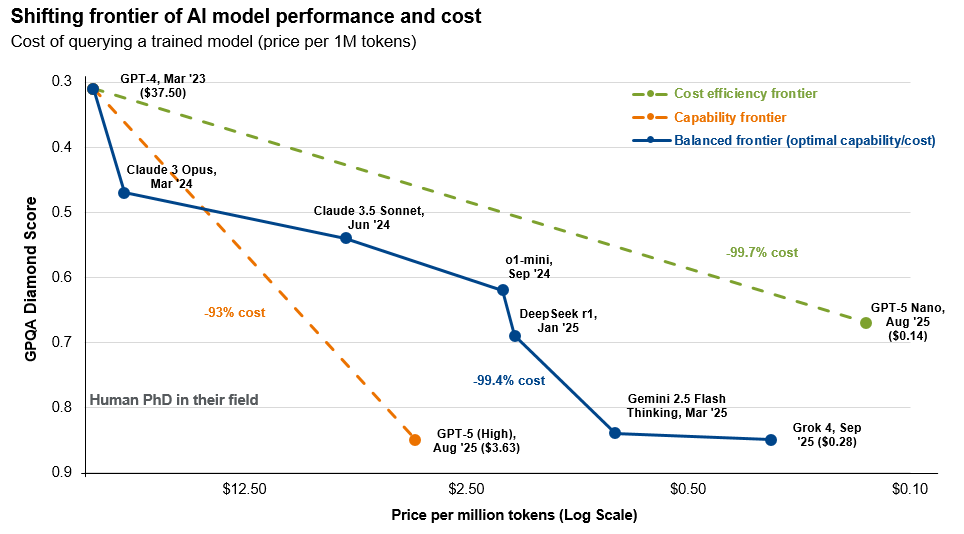

We’ll call our third group the AI architects. These companies develop large language models (LLMs) and other AI applications that can be used for everything from video creation, to chatbots, to complex medical research. OpenAI’s ChatGPT is the most popularized LLM to date, but there are many other examples, such as Anthropic’s Claude, xAI’s Grok as well as Mistral’s various models. Given the huge computing power (or “compute”) requirements to both train and deploy these AI models, the AI architects are essential customers for the infrastructure provided by the hyperscalers.

If the three groups above are critical to the supply of AI infrastructure, who generates the demand? It is far harder to apply a blanket definition to this group. Users range from individuals (say, using ChatGPT on a mobile device), to enterprises (say, a call center that deploys AI chatbots) and to companies for whom AI is at the heart of the services that they offer, such as a software company that sells AI-driven tools to other enterprises.

In a well-functioning, mature ecosystem, the money spent by the end users needs to be sufficient to generate profits right across the value chain. Take the example of a weekly supermarket shop. The money you spend at check-out should be enough for the supermarket, the real estate operator, the electricity provider, the food manufacturers and the farmers all to take their cut.

In today’s AI ecosystem, the demand from end users, at both an individual and enterprise level, is not yet sufficient for all the other players to turn a profit. For the past few years, the hyperscalers have been largely footing the bill, using revenues from other parts of their businesses to fund the build out of AI capacity, which in turn has created profits for the hardware players. AI monetization has started to build, with growth in paid LLM users, enterprise adoption of AI applications and growth in cloud services demand broadly. Whether end-demand can accelerate fast enough to generate a reasonable return on investment across the value chain is ultimately the million/billion/trillion-dollar question.

The AI ecosystem

1 While the link to data centers often receives most emphasis, the picture is muddied by the fact that these companies are also featured in many other parts of the ecosystem. Take Microsoft as an example: Azure is Microsoft’s cloud computing platform, Microsoft 365 Copilot is an AI-driven “productivity assistant” and the company has also invested in OpenAI since 2019.

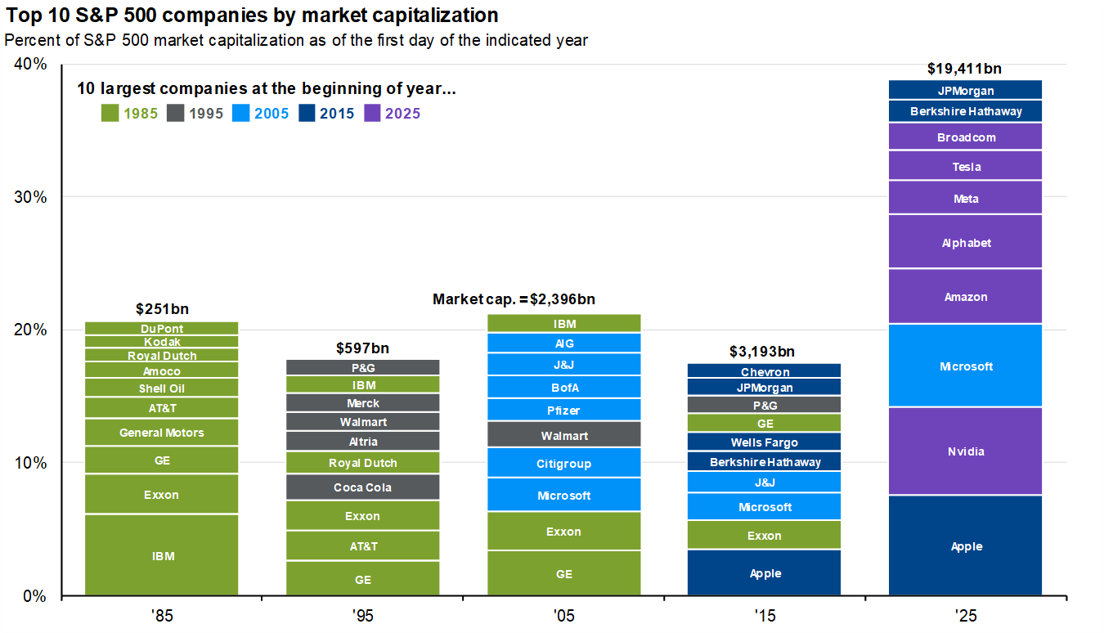

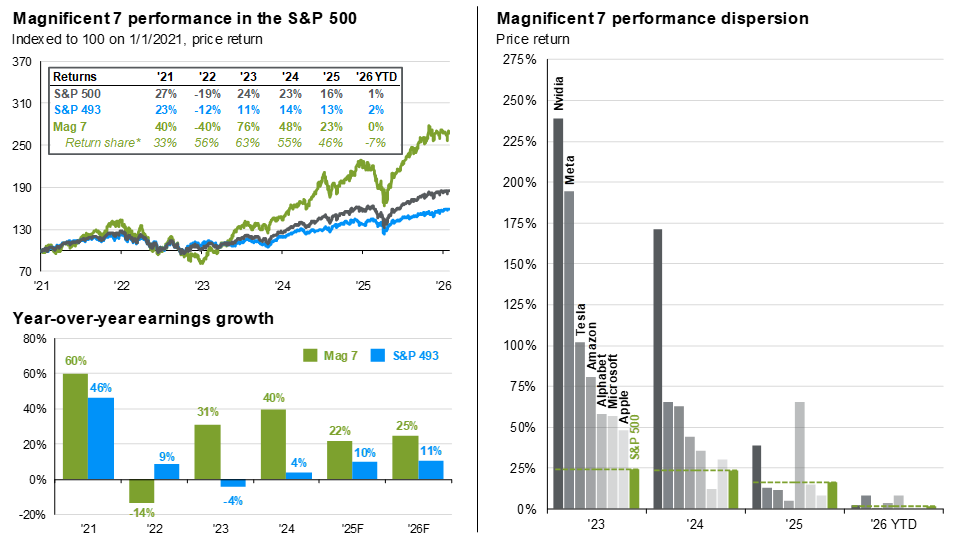

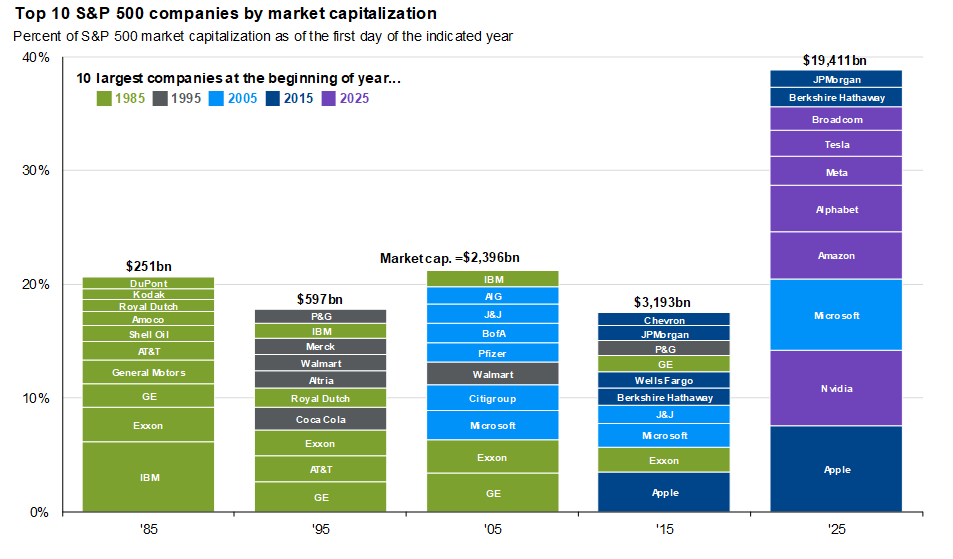

AI bull vs. bear debate

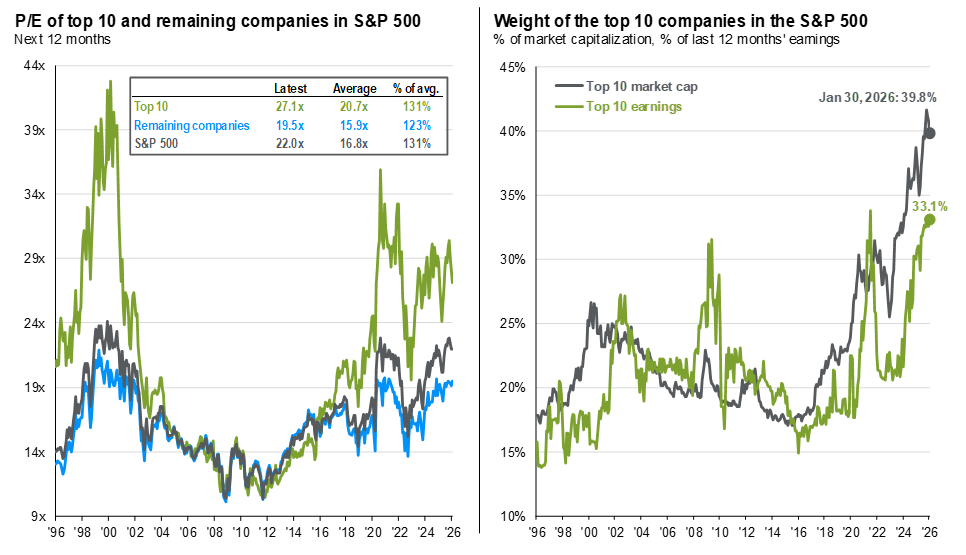

Since the launch of ChatGPT in late 2022, companies tied to the AI ecosystem have accounted for roughly 75% of S&P 500 total returns, 80% of earnings growth and 90% of capital spending growth1. The scale of that contribution is significant, and its composition has been evolving. After powering markets through 2023 and 2024, the Magnificent Seven are no longer the primary market leaders. In 2025, their performance has leveled off and dispersed—only 4 of the 7 are outperforming the S&P 500 year-to-date at the end of October. But AI-linked stocks have remained in the limelight, with AI companies ex. Mag-7 up 30% year-to-date, outperforming the Mag 7,2 as the AI trade broadens to power, semiconductor and software names.

Yet investors are growing jittery as markets have become increasingly dependent on the AI race, fueling an active debate over whether elevated valuations reflect a major productivity revolution, or an AI bubble. Circularity in AI spending has also led to comparisons to the problematic vendor-financing structures of the late 1990s telecom buildout.

As the AI story unfolds, let’s consider the bull vs. bear debate on AI:

Bear case: Timing and concentration risk. Critics highlight legitimate concerns:

- Physical and technological depreciation assumptions have inherent uncertainty. If further AI advancements render current chips obsolete quicker than expected (such as in 2-3 years vs. 5-7 years currently expected), the replacement burden would challenge economics across the AI ecosystem.

- Business adoption hurdles and uncertain pricing power, coupled with rising energy and infrastructure costs, may pressure margins or monetization goals.

- Regulatory and geopolitical risks are significant, with potential for chip export controls or limited access to critical rare earths could challenge the AI buildout.

- Elevated valuations mean that any revenue slowdown, margin pressure or AI monetization disappointments could trigger a re-rating.

- High portfolio concentration implies that even modest disappointments could lead to outsized volatility.

Bull case: Unprecedented fundamentals. Unlike the dot-com era, today’s AI leaders are generating substantial cash flows while reinvesting in the next platform shift. Key strengths include:

- Significant growth in capex has been anchored in an explosion in the demand for compute.

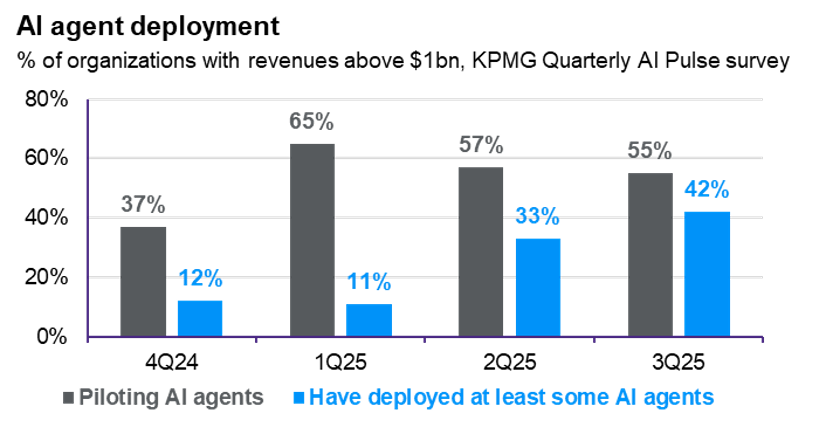

- AI use cases are growing and inspiring greater corporate spend. In KPMG’s AI Pulse Survey, the average anticipated investment in GenAI has grown to $130M, up 14% from Q1, and 42% of firms have deployed at least some AI agents.

- Strong competitive positioning with significant barriers to entry. Given the high costs of cloud infrastructure, a select few names could be positioned to be the all-important tollkeepers of AI as adoption ramps.

- Macroeconomic resilience, with investors valuing the durability and growth potential of AI amid macro and policy uncertainties. The largely self-funded nature of the AI buildout also limits the vulnerability of AI spend to credit conditions.

Both perspectives offer credible arguments. AI appears genuinely transformative, driven by companies with robust balance sheets and proven execution capabilities. However, valuations reflect high expectations in a market with elevated concentration risk and persistent uncertainties.

The challenge for investors? Participation and balance. Not every “AI company” will achieve enduring value, and disruption amongst the big names should be anticipated. But we do think this is an environment where active management can add value. Active managers can look beyond narratives to assess which firms are actually monetizing AI and building durable moats, while helping mitigate the risk of hype and euphoria by leaning out of names that have been overextended and adjusting positions as regulation, trade policy and technological adoption shifts. This flexibility is especially valuable when sentiment around AI alternates between euphoria and skepticism.

Market leadership has evolved significantly over time

Source: Bloomberg, Standard & Poor’s, J.P. Morgan Asset Management. Companies are organized from highest weight at the bottom to lowest weight at the top. Past performance is no guarantee of future results. Guide to the Markets – U.S. Data are as of October 31, 2025.

1 Michael Cembalest, Eye on the Market “The Blob: Capital, China, Chips, Chicago and Chiliwack”, September 24, 2025.

2 Coatue custom analysis, “Public Markets Update”, October 16, 2025.

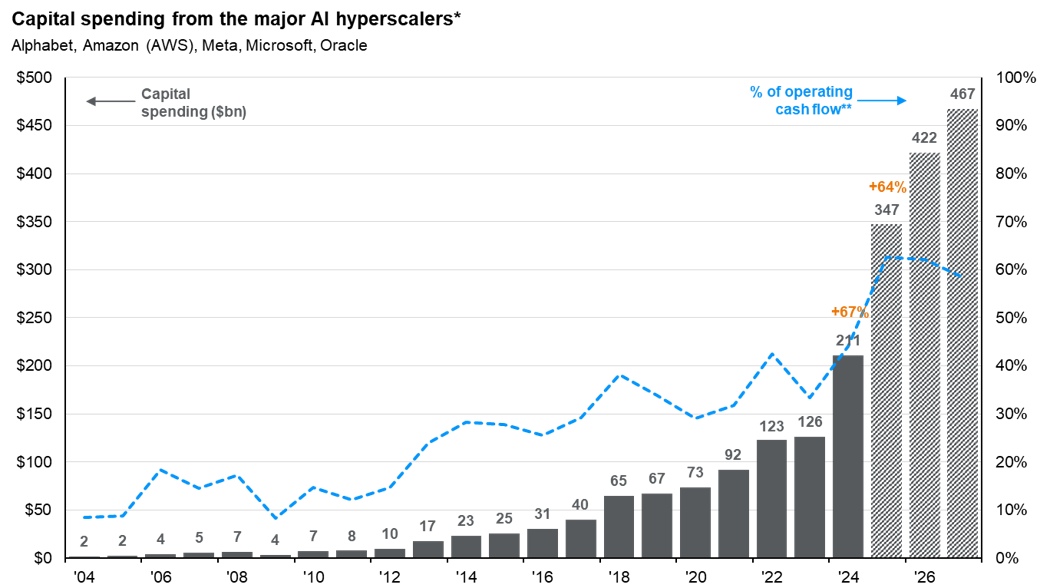

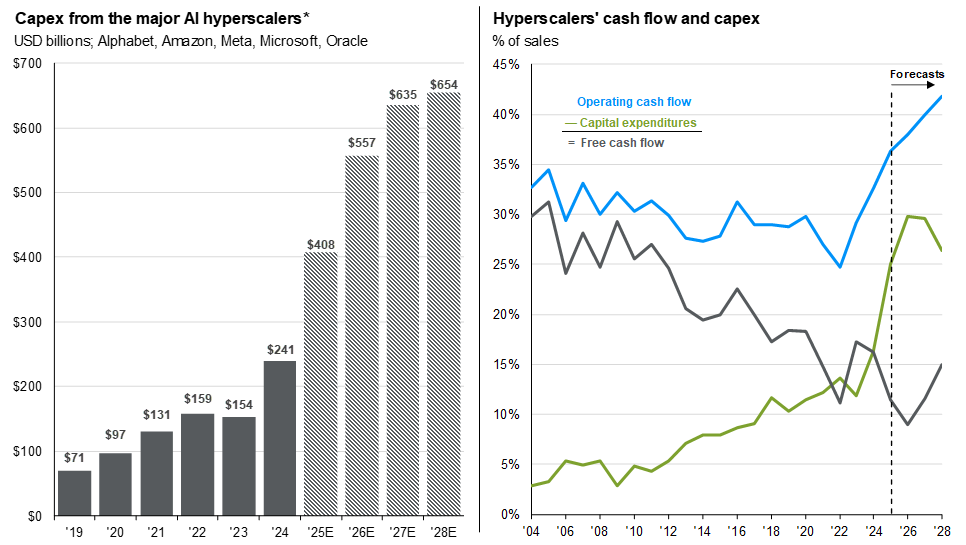

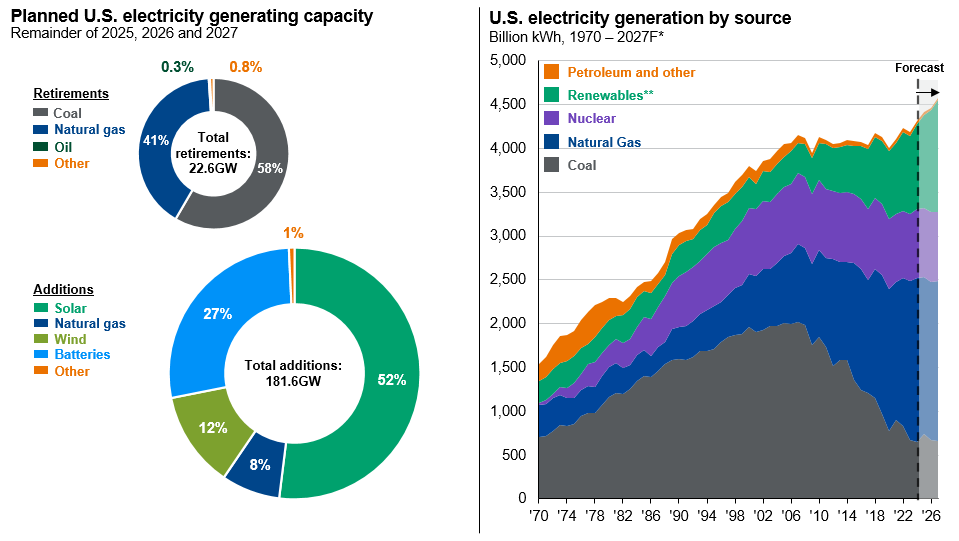

The AI Capex Boom

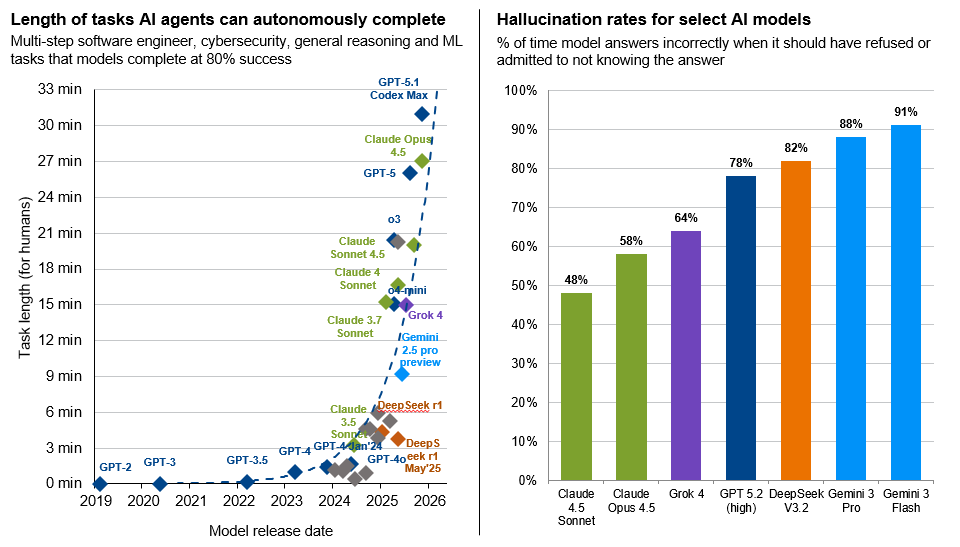

In 2025, headlines about AI infrastructure spending have started to feel almost hyperbolic. The major hyperscalers are on track to spend roughly $350 billion on AI infrastructure—a 60+% increase over last year, which itself saw over 60% growth. And AI leaders expect further acceleration. Nvidia has suggested the potential for $3-4 trillion in annual AI spending by the end of the decade. AI spending is already significant today in historical terms, representing the most capital-intensive transitions since the telecom boom.

Against this backdrop, investors are asking, how much compute do we really need and is this boom sustainable?

The rapid clip of AI infrastructure has been grounded in an exploding need for compute. As AI usage grows, and users task AI with more challenging tasks, the demand for AI inference is exploding. Google recently reported that the company was processing 1.3 quadrillion tokens per month. With adoption expected to grow and deepen, AI leaders are racing to secure compute capacity for the coming years.

And unlike the buildout of the internet infrastructure, the spending is happening at a time where the technology is supply-constrained, not demand-constrained. In 2002, near the peak of the dot-com bubble, only 7% of the fiber optic network was being used and it took many years for that excess capacity to be absorbed. Today, data center utilization is at its operational peaks and vacancy rates are at record lows.

History still warns us of the pitfalls of rapid capex booms—overbuilding or misallocating. But with rising demand, strong incentives and ample funding, this spending looks unlikely to slow down anytime soon.

Consider the existential challenges:

- Companies with search monopolies fear users migrating to chatbots instead of search browsers.

- Smartphone makers question the relevance of their devices in an AI-first world.

- Cloud leaders must expand infrastructure to keep up with demand or risk losing market share.

These firms are reinvesting profits from dominant legacy businesses in hopes of securing future leadership, yet returns are still uncertain. Business models tied to AI infrastructure are still evolving, as is pricing power for AI services. Predicting the future is always challenging, especially with AI. But as long as supply constraints persist across the data center ecosystem, the hurdle for continued AI investment doesn’t seem restrictive.

An AI-driven capex boom is underway

Source: Bloomberg, J.P. Morgan Asset Management.

Data for 2025, 2026 and 2027 reflect consensus estimates. Capex shown is company total, except for Amazon, which reflects an estimate for AWS spend (2004 to 2012 are J.P. Morgan Asset Management estimates and 2012 to current are Bloomberg consensus estimates). *Hyperscalers are the large cloud computing companies that own and operate data centers with horizontally linked servers that, along with cooling and data storage capabilities, enable them to house and operate AI workloads. **Reflects cash flow before capital expenditures in contrast to free cash flow, which subtracts out capital expenditures.

Guide to the Markets - U.S. Data are as of October 31, 2025.

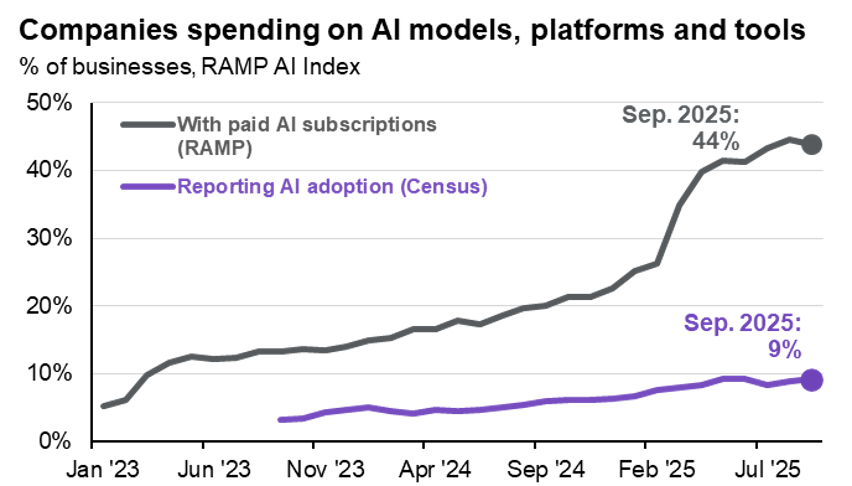

State of business adoption

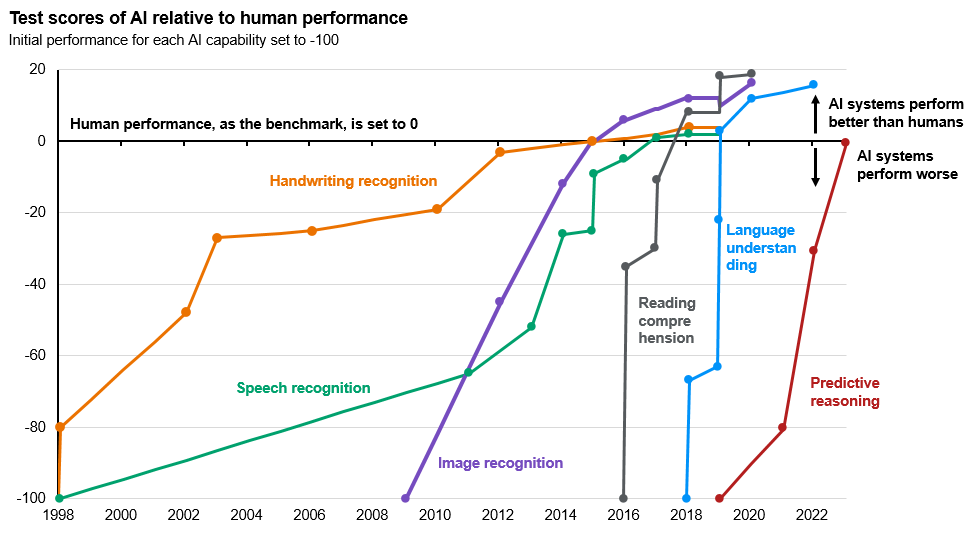

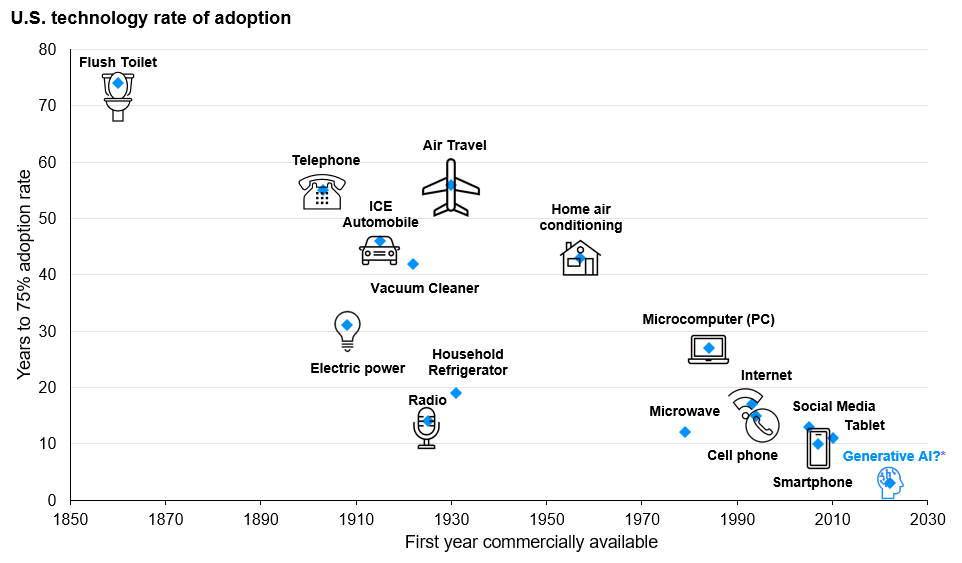

As AI continues to reshape the digital landscape, consumer adoption has been remarkable. However, for markets, the critical question is business adoption. While tools like ChatGPT have over 800 million weekly active users, and broad AI adoption is doubling the pace of the internet, the investment implications largely depend on whether businesses can transition from experimentation to generating measurable returns from AI.

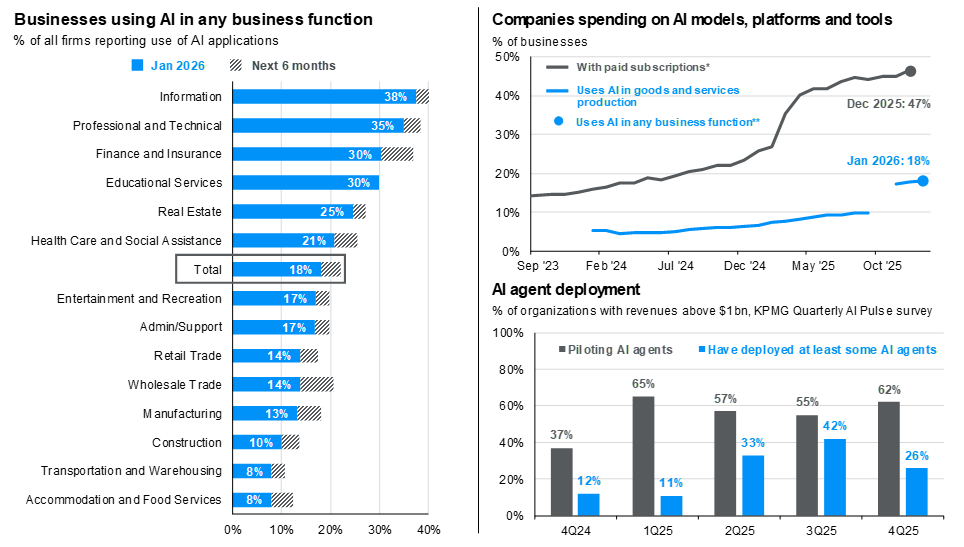

Momentum is building across multiple metrics. While the Census Bureau’s survey shows just ~10% of U.S. firms have formally adopted AI, the RAMP AI Index show that 44% of firms are already paying for AI tools or models, indicating a much broader pace of informal use or piloting of AI. In KPMG’s Quarterly AI pulse survey, 42% of large U.S. firms have now deployed at least some AI agents, as more businesses move past the “pilot” phase of AI. Overall, while business adoption is still in its early stages, we’re seeing a clear shift from curiosity to development, and eventually deployment.

Adoption data reflect several trends:

- Digital-native sectors are leading the charge: Tech, finance and professional services lead in formal adoption, leveraging existing digital infrastructure.

- Large companies are changing faster than smaller ones: According to a recent McKinsey survey1, large organizations are taking significant steps to restructure business functions to maximize AI deployment.

- A focus on operational efficiency: In Q1 earnings calls, nearly 70% of the S&P 500 companies that mentioned AI specifically cited automation, optimization or efficiency use cases.

- Doing more with less: Beyond operational efficiency, companies are using AI as a competitive lever to do more with less amid policy uncertainty and cost pressures.

Still, significant hurdles to broad adoption remain. Concerns about security, regulatory compliance, costs and integration with legacy systems create substantial barriers, particularly in manufacturing, healthcare and government. While AI costs have declined, they remain significant for smaller firms lacking the deep pockets of tech giants. Many businesses also require customized solutions, and the development and deployment of AI agents will take time and investment.

Once properly scaled, several industries appear well positioned for transformation:

- Healthcare: Diagnostic assistance and administrative automation

- Manufacturing: Predictive maintenance and quality control optimization

- Financial services: Risk assessment and personalized customer experiences

- Education: Customized learning and administrative efficiency

For investors, as adoption spreads across sectors, AI is becoming less of a standalone theme and more of a performance lever. In a landscape shaped by heightened policy uncertainty and moderating economic growth, how companies use that lever may ultimately define who leads and who lags.

While formal business adoption is still nascent, investment and development efforts are underway

Source: Census Business Trends and Outlook Survey, RAMP AI Index, KPMG Quarterly AI Pulse Survey, J.P. Morgan Asset Management. Ramp uses contract and transaction data from corporate spend with AI companies to produce a more timely and accurate measurement of AI adoption by U.S. businesses. Data are as of October 31, 2025.

1 Source: “The state of AI: How organizations are rewiring to capture value”, McKinsey, March 12, 2025.

Productivity potential

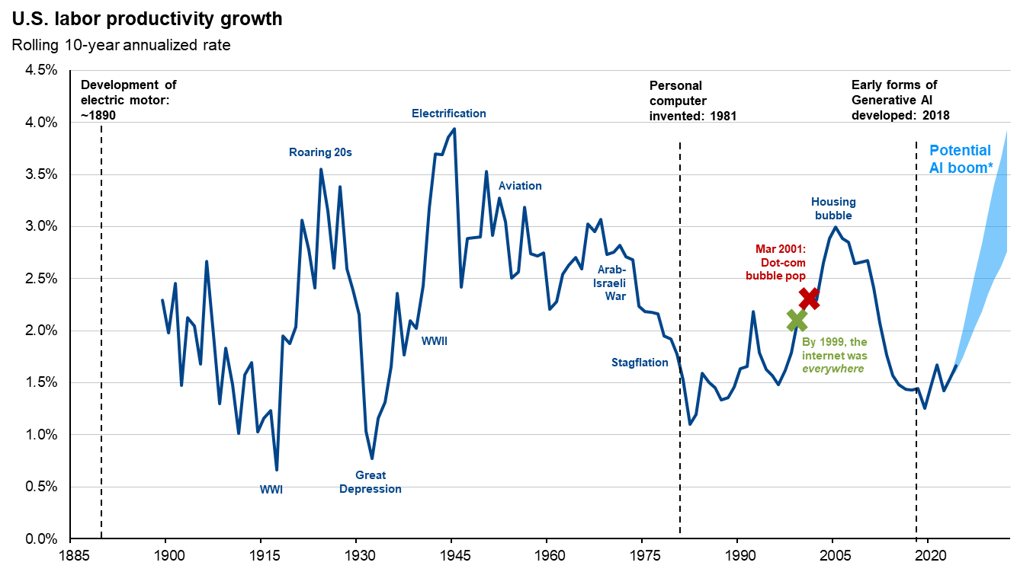

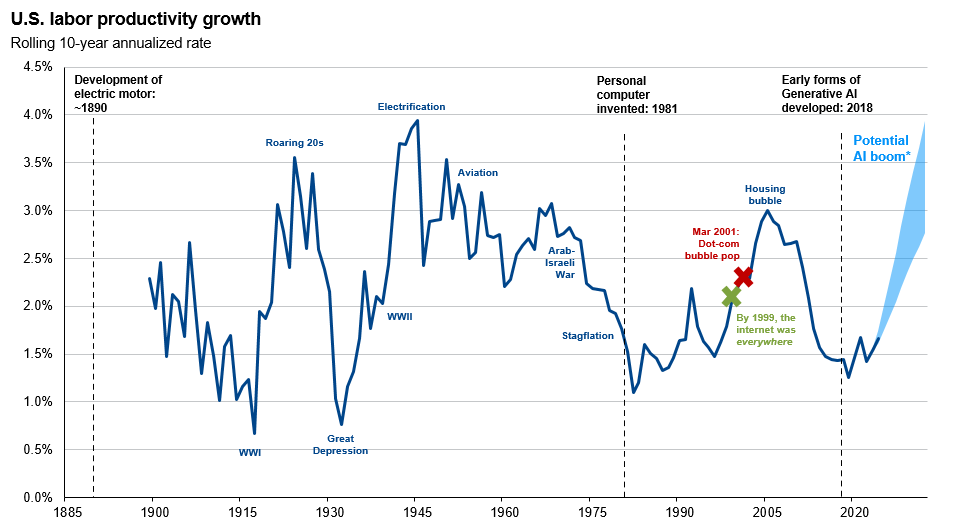

Paul Krugman once noted, "Productivity isn’t everything, but in the long run it is almost everything." By increasing productivity, the U.S. can improve its standard of living, reduce debt, create jobs in new industries and lower costs. With AI poised to become the next “general purpose technology”, are we on the cusp of a new productivity boom?

In our 2023 whitepaper “The transformative power of generative AI”, we explored scenarios of AI adoption that could accelerate productivity growth to between 1.0 and 4.0% annually over the next decade. Such a boost would be significant, though not without precedent.

Signs of an upswing may already be emerging. Despite past technological advancements failing to sustain productivity growth—averaging just 1.4% over the last decade—productivity has been on the rise since late 2022. Research concludes that it is likely too early to attribute this to AI1, but the timing coincides with increased capital expenditures and AI adoption, suggesting potential for future growth. As a global tech leader, the U.S. is investing heavily in AI, and a modernized capital stock can lead to substantial efficiency and quality improvements over time.

This has important implications for investor return assumptions as well. In our 2026 Long-term Capital Market Assumptions, we've incorporated a small positive increment to total factor productivity growth over the 10-to-15 year horizon. This boost, combined with stronger capital investment, helps offset valuation pressures on long-term equity returns. While it may underestimate AI’s full economic impact, which we plan to reassess as evidence emerges, it is already enhancing our expectations for economic growth and corporate earnings potential in the coming years.

Long term, AI presents meaningful productivity upside

Source: BLS, NBER, J.P. Morgan Asset Management. Data from 1888 to 1957 reflect productivity data for the total private economy from John Kendrick, “Productivity Trends in the United States,” NBER. Data from 1958 to 2023 reflect non-farm productivity data from the BLS. Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecasts, projections or other forward-looking statements, actual events, results or performance may differ materially from those reflected or contemplated. Data are as of October 31, 2025.

1 See for instance, “AI and recent productivity growth” by Michael Feroli and Abiel Reinhart (May 14, 2025).

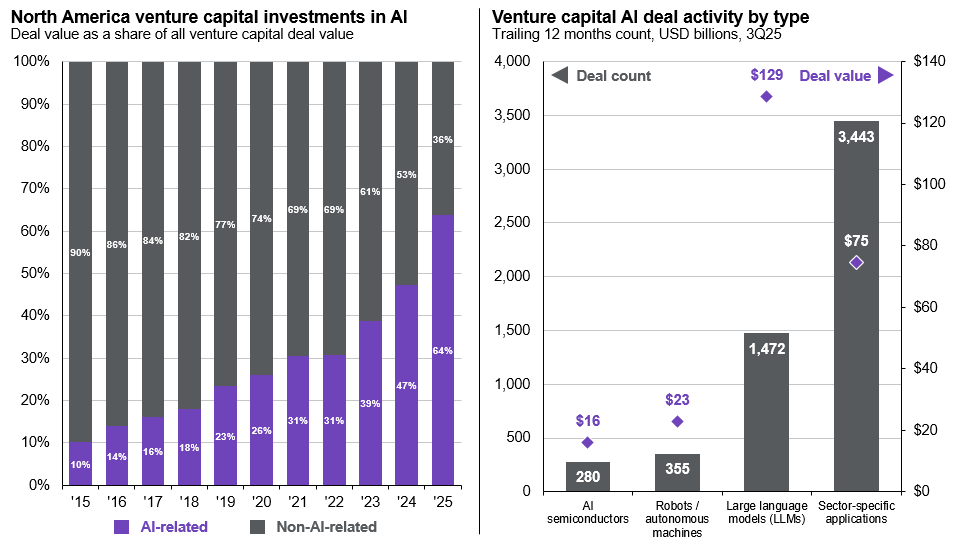

Private market landscape

Unlike the Dot-Com era, which saw an explosion of young companies going public "pre-revenue," today's AI race is characterized by disruptive firms achieving public company scale and substantial valuation premiums while remaining private.

In 2025, AI has accounted for one in five startups and captured nearly one of every two dollars, raising exit hurdles and concentrating returns1. Individual funding rounds have reached historic proportions. For instance, OpenAI’s $40 billion recent raise set a record as the largest private technology funding round, and after a secondary share sale this summer the company’s valuation has reached $500 billion. This trend has been driven by abundant private capital availability, strategic investor partnerships and founders’ desire to maintain control while building transformative businesses.

AI momentum has sparked a rebound in VC activity post-2021 peak, but capital concentration has intensified. The top 10 fundraising rounds in private markets now account for over 50% of total funding2—mirroring the concentration issue in public markets. This has created a new class of mega private companies, with the combined market cap of $1.4 trillion for those valued at $50 billion or more.

Funding patterns reveal some important dynamics:

- Foundational model companies capture the largest funding rounds, accounting for nearly 40% of all VC deal activity this year3.

- Increasing concentration in VC activity: a third of all venture investment in Q3 went to just 18 companies that raised funding rounds of $500 million or more each.

- Sector-specific application4 startups, catering to large enterprises with specific AI solutions, are gaining momentum, developed at a fraction of the cost of horizontal development, and account for roughly 60% of all deal volume in 1H25.

- Premium valuations across AI categories far exceed traditional benchmarks, with some companies trading at 20-40x revenue multiples.

The application boom has broadened the range of AI beneficiaries and warrants watching.

- Healthcare AI stands out, with solutions like AI-powered clinical documentation and safety-focused healthcare LLMs indicating transformative potential for the sector.

- Legal AI startups have been in-demand, targeting the sector’s language-heavy, repetitive tasks ripe for automation.

- Autonomous systems across manufacturing, logistics and transportation are gaining traction.

Investment implications require careful consideration. Private AI companies command elevated valuations, reflecting both genuine technological breakthroughs and significant market enthusiasm. For investors with access, these companies offer exposure to potentially transformative applications before reaching public markets. However, capital concentration and winner-takes-most dynamics suggest that careful selection is crucial as the private AI ecosystem matures.

Private markets have been home to many of the emerging players in LLMs and application development

Source: Crunchbase, EY, Pitchbook, J.P. Morgan Asset Management. (Left) 1H25 estimated with Pitchbook and Crunchbase data. (Right) Sector-specific applications are built on top of AI models and enable domain-specific performance and integration.

Guide to Alternatives. Data are based on availability as of October 31, 2025.

1 Source: Pitchbook, as of August 31, 2025.

2 Source: Coatue’s 2025 State of the Union, Pitchbook.

3 Source: Pitchbook, as of August 31, 2025.

4 Vertical applications are tailored to specific sectors and built on top of horizontal platforms, enabling domain-specific performance and integration.

AI Presentation

Latest Insights

206c164a-6480-11ee-8fe5-9dc5c8727cb0