Listen to On the Minds of Investors

What are the risks and opportunities in high yield?

Global high yield markets have been rocked by recent volatility, with risk-off sentiment, in the face of the spread of COVID-19, compounded by a collapse in oil prices driving the asset class down -16% year-to-date. But these miserable returns should not come as too much of a surprise to investors, as the asset class can be quite capricious. During good times, the discussion tends to be centered on spreads and rating upgrades; during tough times, the conversation tone sours.

High yield spreads have now widened to roughly 1,000bps, the highest level since the Global Financial Crisis. As a result, the conversation has now shifted, with investors paying attention to three key variables:

- Downgrades: High yield managers will have to absorb “fallen angels” into their benchmarks. “Fallen angels” are downgraded issuances that were previously trading with an investment grade rating. Forecasts suggest as much as 500bn USD of issuance might be downgraded to junk by the end of 2020, a record high, if achieved.

- Defaults: As an economy enters recession, defaults often begin to rise. Unfortunately, the composition of the global high yield market makes it especially vulnerable to the current state of affairs. Consumer-cyclicals and energy, two sectors that have come under pressure in recent weeks, make up 15% and 6% of the market, respectively.

- Recovery rates: In the event of a default, not all of the principal debt is always lost and investors can sometimes recoup some losses. However, recovery rates have been trending lower in recent years. In 2019, U.S. recovery rates were at just 25%, versus a 25-year average of 45%. This is a record low level.

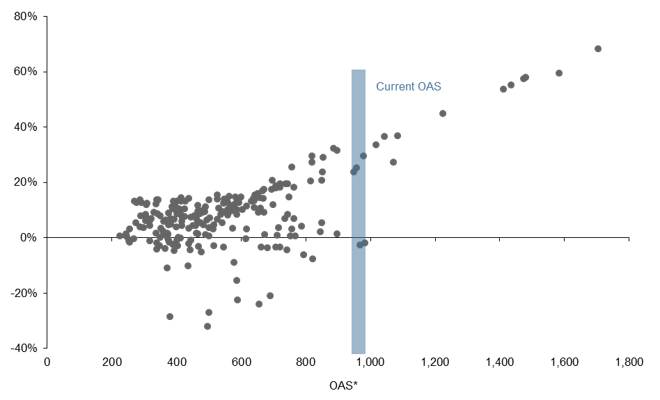

But despite all of these headwinds, there may still be some opportunity for patient, risk-tolerant and long-term investors. The chart below looks at starting spreads and subsequent 12-month returns over the last 30 years. While there are a few instances where spreads have continued to widen from current levels, the average return has been approximately 18% over the subsequent 12-months. As a result, for the right investor, today’s objectively complicated credit market may be an excellent source of future portfolio growth.

Global High Yield OAS versus subsequent 12-month return

Source: Bloomberg, Barclays, FactSet, J.P. Morgan Asset Management. Index is Bloomberg Barclays Global High Yield. *OAS is Option Adjusted Spread Data are as of April 7, 2020.

0903c02a82876029