Listen to On the Minds of Investors

Investors looking to the equity market for income should concentrate on sectors and industries that have healthy balance sheets and minimal direct exposure to the COVID-induced downturn, says Lebovit

In the aftermath of the global financial crisis (GFC), investors have embraced equity markets as a source of income. With the COVID-induced lockdown pushing policy rates back to the zero-bound and government bond yields near all-time lows, this trend has since gained additional momentum.

At the end of the day, what we are dealing with is a cash flow problem – businesses have no revenue, and consumers have no income. With revenues drying up, an increasing number of investors have become concerned with the ability of companies to continue paying their dividend. Furthermore, the policy response has created an added layer of uncertainty, as companies who receive government support are forbidden from paying dividends for the duration of the loan.

But what has happened to dividends during past economic downturns? Using data from Robert Shiller, we are able to track S&P 500 dividend growth since 1946. While the growth rate itself ebbs and flows, there have been seven distinct instances when S&P 500 dividends per share declined on a year-over-year basis. All but one occurred during or immediately after an economic recession, but the magnitude of these declines has increased over time.

Taking a deeper dive into these two recent periods of dividend stress can help us set expectations for the months ahead. During the GFC, dividends were for the most part cut across the board at the sector level, with only the technology, energy and telecommunications sectors seeing dividend growth remain in positive territory. During the Tech Bubble, on the other hand, the impact on dividends was far more nuanced – while most sectors saw a slight contraction in dividends during the ensuing recession, the majority of the decline in dividends was driven by the consumer sectors, telecommunications, utilities and energy. Given that the current downturn will see those industries and sectors most impacted by social distancing hit hardest, it seems reasonable to expect things to look more like they did during the Tech Bubble, rather than the GFC.

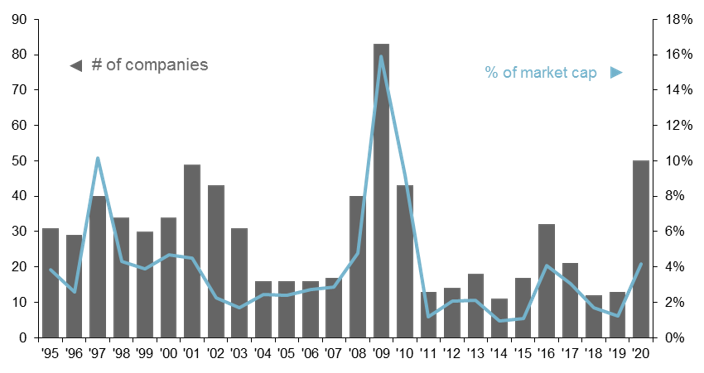

So what sectors are at the greatest risk of seeing dividends cut? The top three contributors to S&P 500 dividends are technology, financials and health care, and although it is not our base case, only the financial sector seems to be at risk of seeing material cuts. On the other hand, the majority of the dividend cuts thus far have been concentrated in the consumer discretionary, industrial and energy sectors. Furthermore, those industries most exposed to social distancing (excluding REITs) only account for 6.4% of S&P 500 market capitalization, and although we have seen 50 companies cut their dividends so far this year, these names only account for 4.2% of total S&P 500 market cap. In a worst case scenario where all of these companies cut their dividends to zero, aggregate S&P 500 dividends per share would fall to just below their 2019 level.

A prolonged downturn would obviously call the ability of S&P 500 companies, more broadly, to continue paying their dividends into question, but that is an issue for another day. In the interim, investors who are looking to the equity market for income should concentrate on those sectors and industries that have healthy balance sheets and minimal direct exposure to the COVID-induced downturn.

S&P 500 dividend cuts: Lots of companies, not a lot of market cap

# of companies and share of S&P 500 market capitalization cutting dividends

Source: Bloomberg, FactSet, Standard & Poor's, J.P. Morgan Asset Management. 2020 numbers are YTD through 5/12/2020.

0903c02a828c8c4d