Introduction to ETFs

What is an ETF?

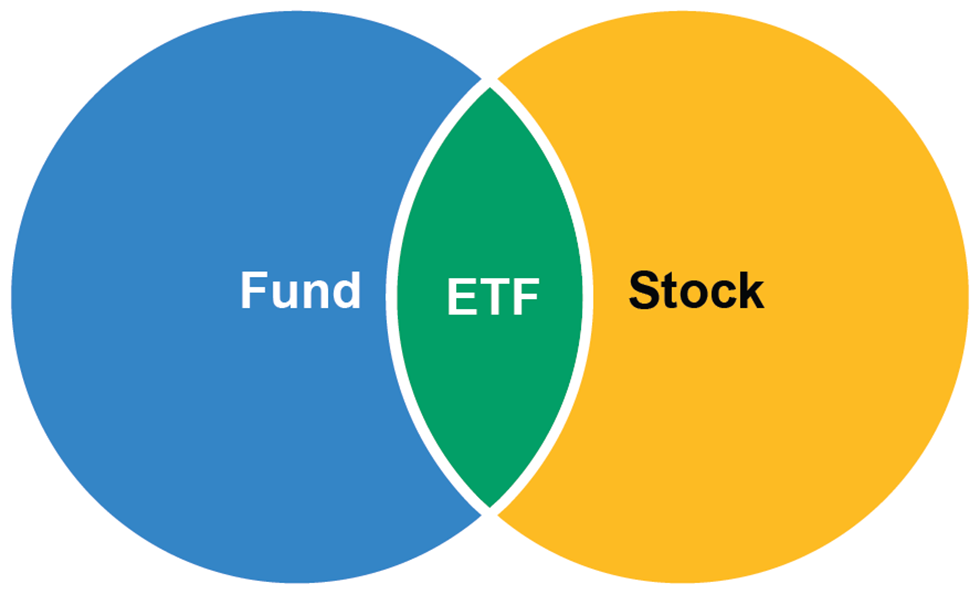

An Exchange-Traded Fund (ETF) is an investment wrapper which combines the benefits of a fund and a stock.

A fund offers:

- Diversified exposure

- Economies of scale

- Professional management

A stock offers:

- Liquidity

- Transparency

- Trading flexibility

How does an ETF work?

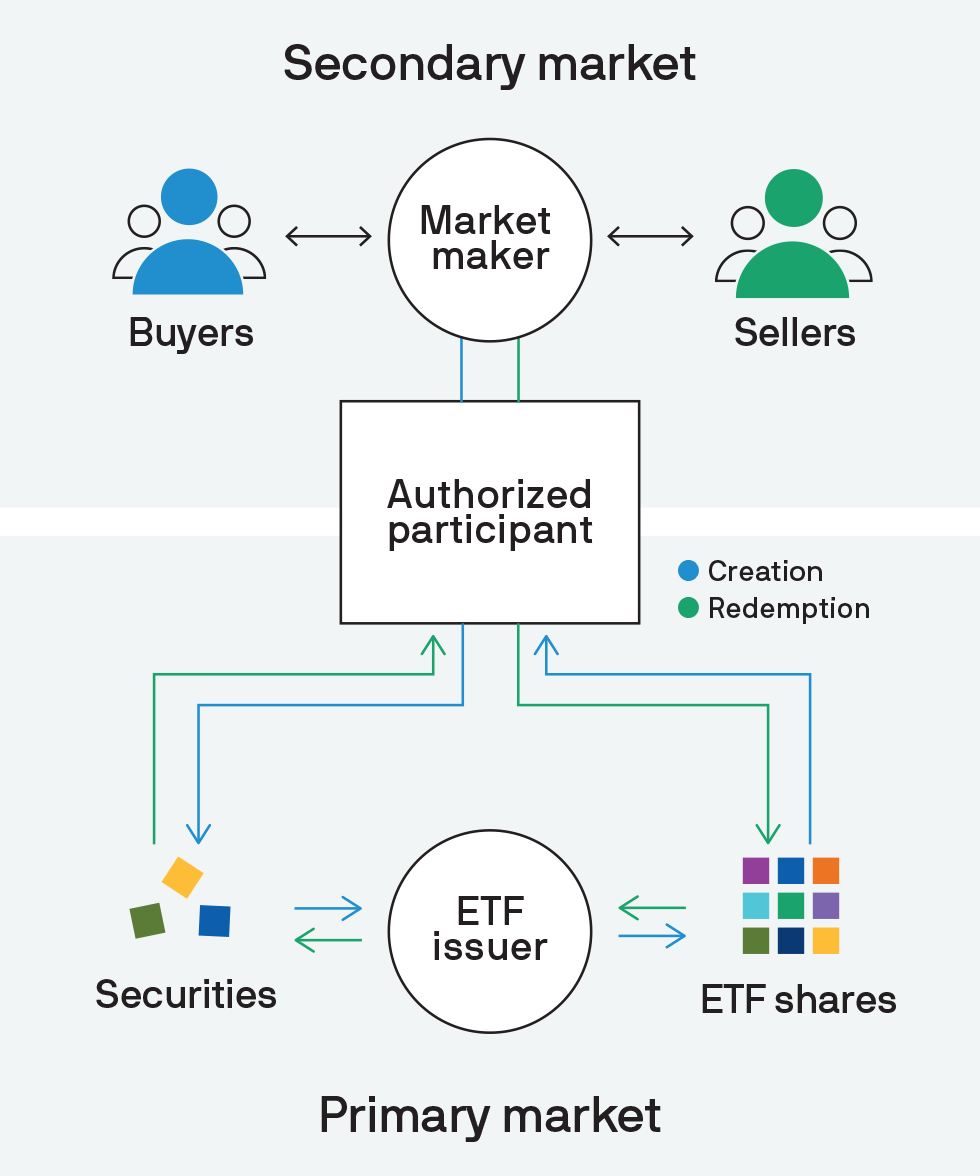

The structure of the ETF wrapper provides greater opportunity for improved economics.

- In-kind creations/redemptions, where securities are exchanged for ETF shares, contribute to the cost-effectiveness of ETFs

- Market-makers help mitigate outsized premiums/discounts of the ETF market-price to the ETF net asset value

Type of ETFs

How do ETFs trade:

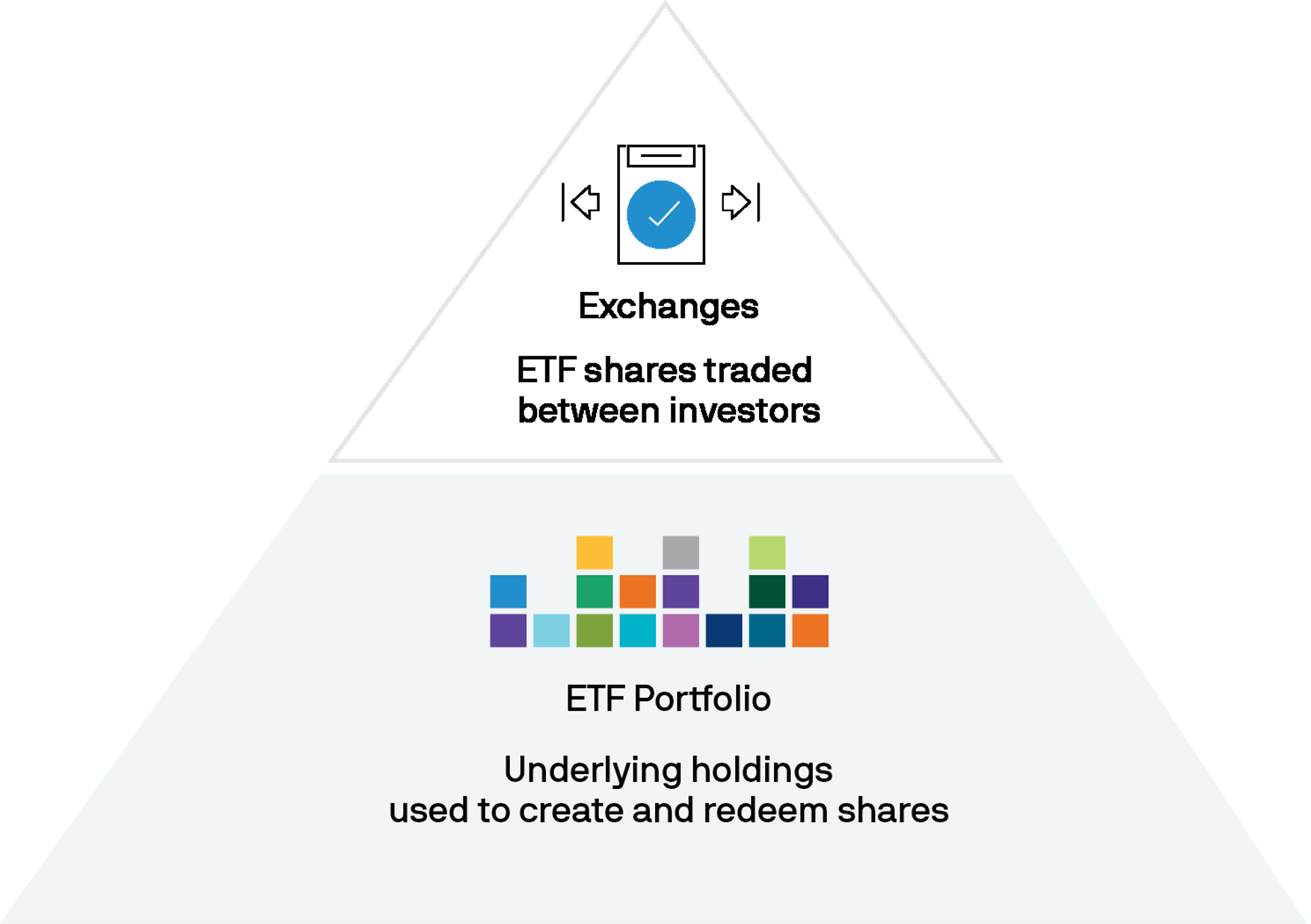

ETFs offer more liquidity than meets the eye.

What are active ETFs?

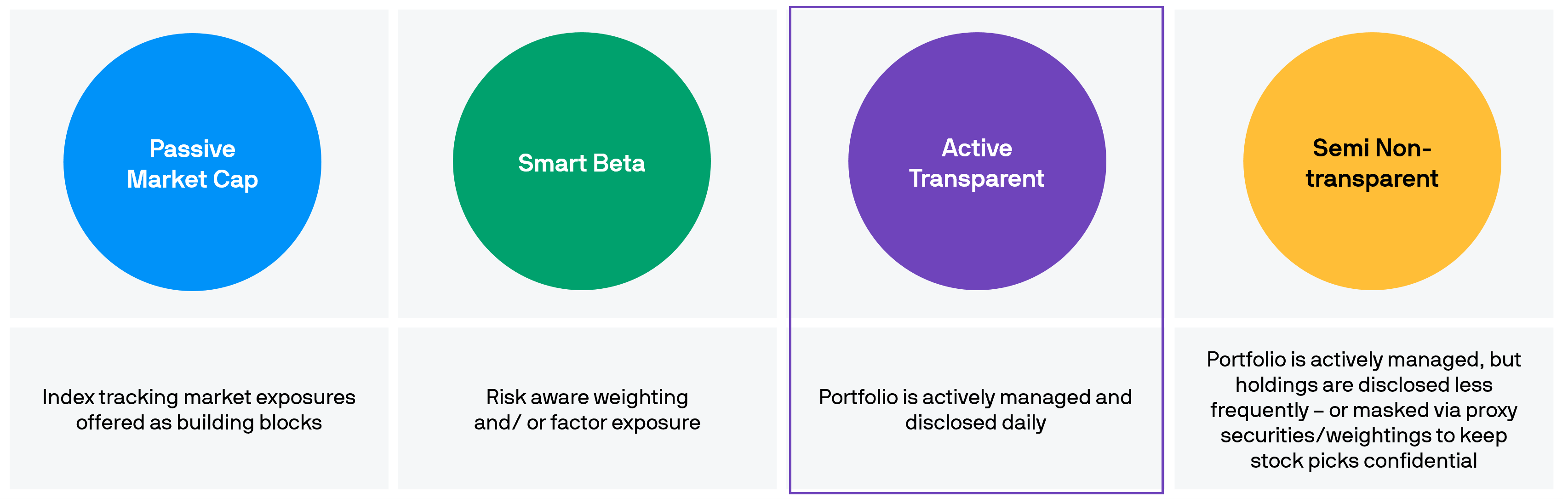

When looking at active ETFs, it is first important to note that terms such as “ETF”, “passive” and “index” are not synonymous. ETF simply means Exchange-Traded Fund, which means an ETF is traded at an exchange regardless of the investment strategy used.

A variety of “engines” or strategies can therefore be placed in the ETF structure to leverage its benefits.

“Active” refers to specific investment decisions, which are designed to achieve specific outcomes, such as outperforming an index (Alpha), generating income, or achieving control in terms of duration, yield or credit quality.

An active ETF provides access to these specific outcomes, all while maintaining the attributes of the ETF structure.

The ETF is just a wrapper and the content itself is independent of the vehicle

Active ETFs overview

Why invest in active ETFs?

Getting to know an active ETF

Getting started

A leader in ETF investing

At J.P. Morgan, we’re combining the built-in benefits of ETFs with our best-in-class research insights, portfolio expertise and trading capabilities.

1 J.P. Morgan Asset Management, as of March 31, 2024.