Alternative asset assumptions

09-11-2020

Anthony Werley

Pulkit Sharma

Nicolas Aguirre

Shay Chen

A welcome source of alpha, income and diversification

IN BRIEF

Relative to 2020 estimates, return assumptions for financial strategies are down, driven by expected declines in underlying public markets, but with an improving alpha outlook. Assumptions for real assets (ex-commodities) are flat to up, reflecting the stable income component of core assets and an expected widening of value-added spreads. Our return assumptions are for the median manager; due diligence is key to successful investment.

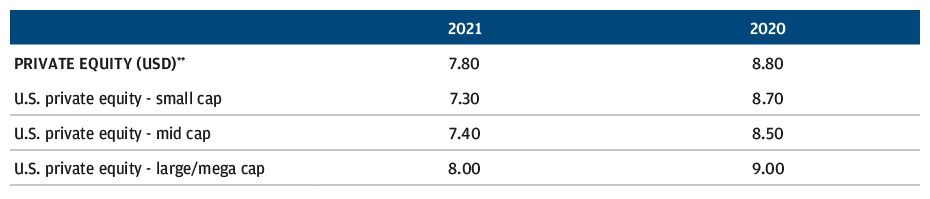

PE return assumptions are lowered, reflecting declining public equity market return expectations. Alpha projections are stable to slightly higher. The disruption and digitalization of the economy along with changing consumer preferences should create significant opportunities to put dry powder to productive use.

SELECTED ALTERNATIVE STRATEGIES RETURN ASSUMPTIONS (LEVERED,* NET OF FEES, %)

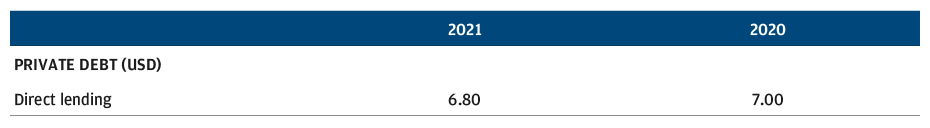

Direct lending return estimates are trimmed slightly, given expected credit loss increases and challenges from lower cash rates.

SELECTED ALTERNATIVE STRATEGIES RETURN ASSUMPTIONS (LEVERED,* NET OF FEES, %)

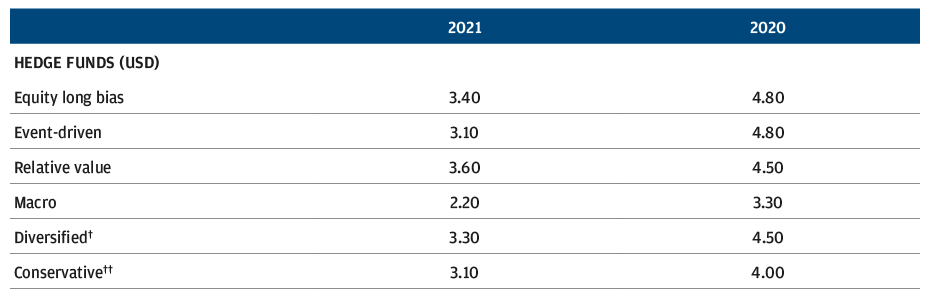

Hedge fund return projections decrease, given a declining public market outlook. Alpha generation should gradually improve as volatility and the dispersion of returns increase while fundamentals gain importance vs. macro factors.

SELECTED ALTERNATIVE STRATEGIES RETURN ASSUMPTIONS (LEVERED,* NET OF FEES, %)

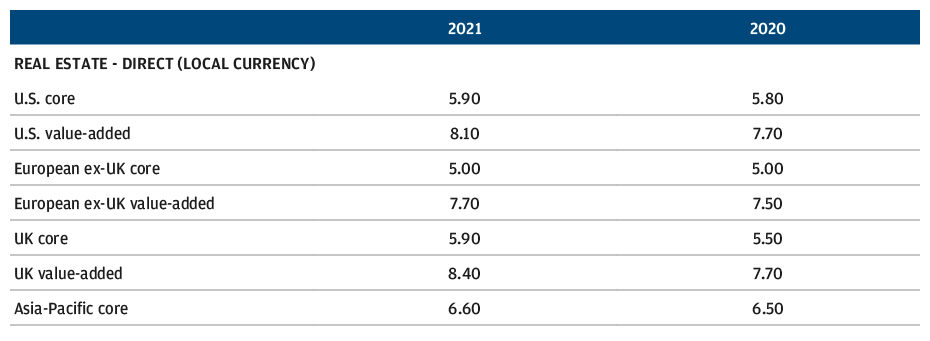

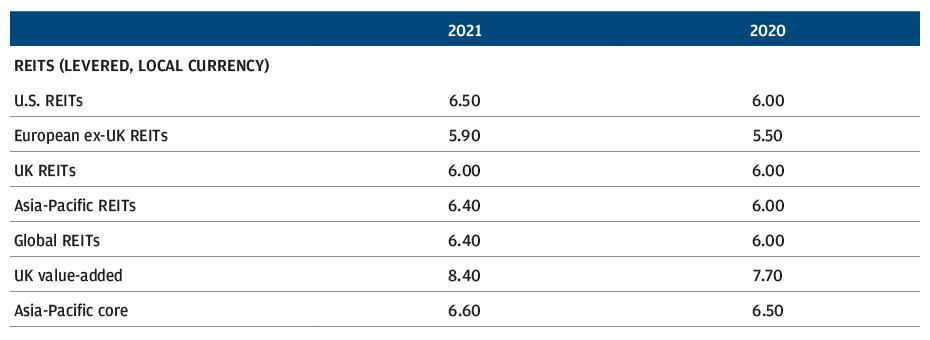

Core real estate assumptions rise for the UK, are close to flat for the U.S. and APAC, and are unchanged for Europe ex-UK. Value-added risk premia vs. core increase moving into the new cycle. REITs return projections improve for most regions.

SELECTED ALTERNATIVE STRATEGIES RETURN ASSUMPTIONS (LEVERED,* NET OF FEES, %)

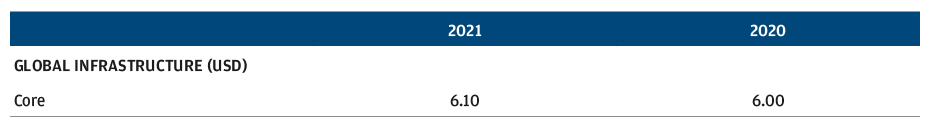

Core infrastructure estimates are essentially flat. We expect stable returns, with a high proportion of those returns coming from operating assets with long-dated contractual cash flows.

SELECTED ALTERNATIVE STRATEGIES RETURN ASSUMPTIONS (LEVERED,* NET OF FEES, %)

We see attractive returns for core transport, underpinned, as for other core real assets, by long-term contractual cash flows backed by strong counterparties.

SELECTED ALTERNATIVE STRATEGIES RETURN ASSUMPTIONS (LEVERED,* NET OF FEES, %)

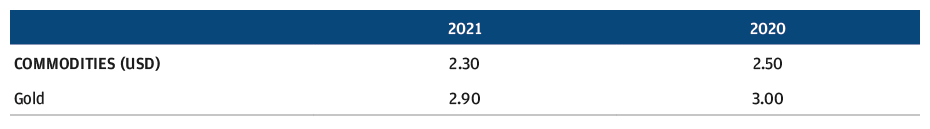

Commodity returns are reduced marginally, given lower collateral return expectations and less support from a falling U.S. dollar. Gold is expected to maintain its premium vs. overall commodity returns, given anticipated demand from central banks, investors and emerging markets consumers.

SELECTED ALTERNATIVE STRATEGIES RETURN ASSUMPTIONS (LEVERED,* NET OF FEES, %)

Source: J.P. Morgan Asset Management; estimates as of September 30, 2019, and September 30, 2020.

* All return assumptions incorporate leverage, except for Commodities, where it does not apply.

** The private equity composite is AUM-weighted: 65% large cap and mega cap, 25% mid cap and 10% small cap. Capitalization size categories refer to the size of the asset pool, which has a direct correlation to the size of companies acquired, except in the case of mega cap.

† The diversified assumption represents the projected return for multi-strategy hedge funds.

†† The conservative assumption represents the projected return for multi-strategy hedge funds that seek to achieve consistent returns and low overall portfolio volatility by primarily investing in lower volatility strategies such as equity market neutral and fixed income arbitrage.