Currency exchange rate assumptions

09/11/2020

Thushka Maharaj

Michael Feser

U.S. dollar downtrend may be finally underway

IN BRIEF

- Our long-held view that the U.S. dollar is on a secular downtrend now has a cyclical catalyst: the start of a new synchronized global business cycle. Our conviction in a USD downtrend is also driven by the dollar’s expensive starting valuation and relatively higher expected inflation in the U.S. than in the eurozone and Japan.

- Should the U.S. pursue stimulative fiscal policy, and monetary policy focused on stoking inflation expectations, those actions would powerfully support reflation and growth, and an erosion in the dollar’s real value.

- Developed market currencies’ bilateral relationships with the USD drive our views; above others, we expect the euro to serve as a more credible counterweight to the dollar and potentially to reassert its standing as an alternative reserve currency, boosted by the region’s pandemic recovery fund, which underscores the eurozone’s new economic solidarity.

- We expect a wide dispersion among emerging market currencies and continue to expect the Chinese yuan to appreciate, albeit to a somewhat lesser degree than implied by its fair value.

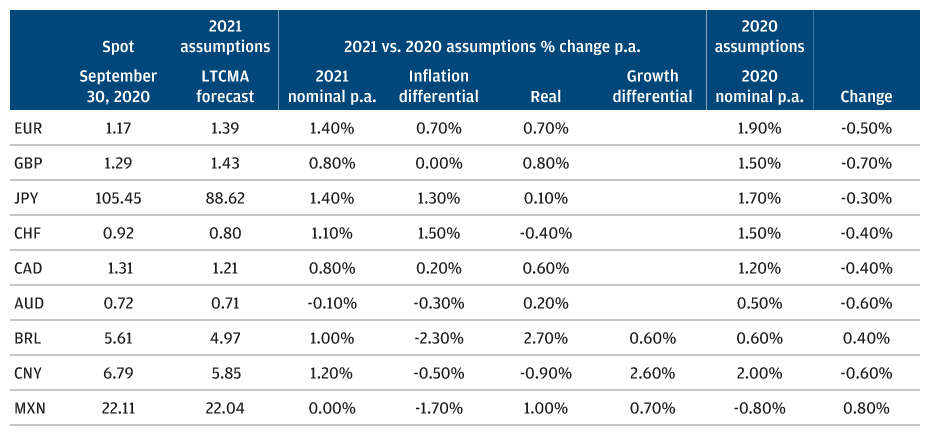

Assumptions for selected changes in currency exchange rates vs. USD, nominal and real

OUR LONG-HELD VIEW OF A SECULAR USD DOWNTREND HAS A CYCLICAL CATALYST IN THE NEW CYCLE

Source: Bloomberg spot FX, J.P. Morgan Asset Management; estimates as of September 30, 2020. P.A.: per annum.

Spot FX rates are quoted using market convention; % changes p.a. are quoted uniformly vs. USD such that a positive number reflects appreciation vs. USD, and vice versa.

View Other Assumptions

Examine our return projections by major asset class, their building blocks and the thinking behind the numbers.