20-April-2022

Monetary Authority of Singapore – affirming its inflation fighting credentials

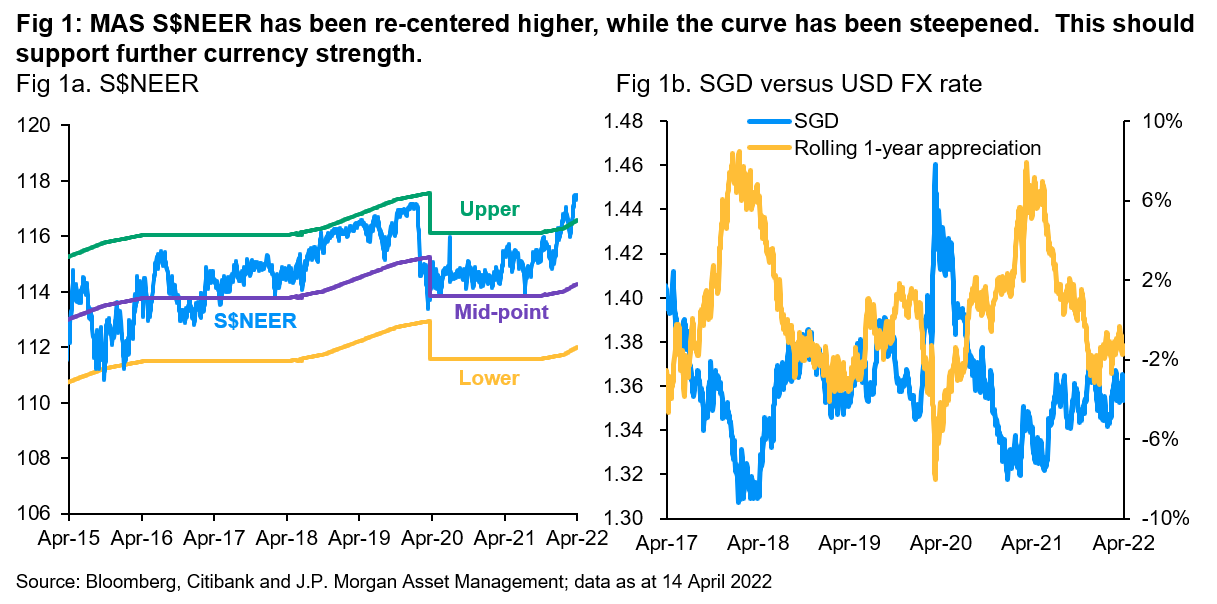

At its semi-annual monetary policy meeting on 14 April, the Monetary Authority of Singapore (MAS) acknowledged that “consumer price inflation in Singapore will increase by more than previously anticipated” and announced a more aggressive than anticipated decision to “further tighten monetary policy, in two ways”. Firstly, it will “re-center the mid-point of the exchange rate policy band at the prevailing level of the S$NEER1” and secondly, it will “increase slightly the rate of appreciation of the policy band” (Fig 1a).

This is the third hawkish adjustment by the MAS, which uses exchange rates as its main policy tool, following previous slope increases in October 2021 and January 2022. It is also the first time they have re-centered and steepened the band since April 2010, highlighting their concerns about surging pricing pressures. The announcement and accompanying upward revisions to the MAS’s growth and inflation outlook are expected to have important implications for Singapore interest rates and cash investment opportunities.

Challenging growth, elevated inflation:

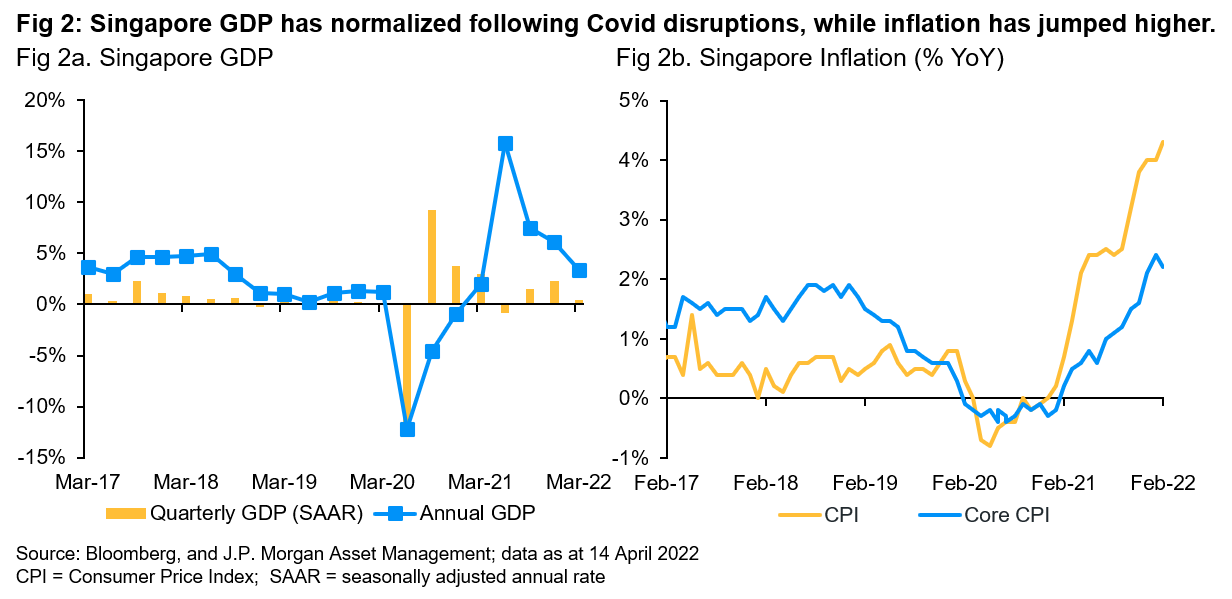

The advanced first quarter GDP reading (Fig 2a), also released on the day of the monetary policy meeting, printed at 0.4%q/q. This is the slowest print in three quarters as services and manufacturing moderated from previously elevated levels, offsetting improvements in domestic demand as Covid restrictions were relaxed. Nevertheless, the annual pace printed at a robust 3.4%y/y and the MAS forecasts full year growth of between 3-5% in 2022, as they believe solid global demand is unlikely to be derailed by the recent geopolitical crises while local demand should recover as border restrictions ease

In contrast, the MAS noted that “higher global oil and food prices” had pushed core inflation to decade high of 2.3% in the first two months of 2022 (Fig 2b). The central bank confirmed that “inflation is forecast to pick up sharply in the coming months” as higher commodity prices, supply chain disruptions and pent up demand will “exacerbate pre-existing inflationary pressures”. MAS revised the mid-point of its 2022 core inflation forecast upwards by 50bps to 3%, while the mid-point of its headline inflation forecast has been revised sharply higher by 200bps to 5%.

A hawkish escalation:

Although the MAS’s original hawkish pivot in October 2021 was significantly earlier than many central bank peers, its latest policy announcement was more aggressive than previous adjustments, underscoring the challenges global central banks face to restrain soaring inflation. While not officially announced, we believe the re-centering should lift the S$NEER by approximately 2%, while the annual pace of S$NEER appreciation will likely increase by approximately 0.5% to 1.5%.

Following the MAS’s policy announcement, the SGD appreciated sharply (Fig 1b) and the S$NEER moved towards the top of its new trading range, while local interest rates declined slightly.

Outlook and implications:

The MAS’s policy announcement reaffirmed its inflation fighting credentials and desire to “slow the inflation momentum and help ensure medium-term price stability”. However, with the unemployment rate declining and the output gap estimated to have closed already, inflation pressures will likely further broaden into labor costs. This in turns creates additional challenges for the MAS, forcing a pivot from supporting growth to dampening inflation. In our opinion, the upward revisions to inflation already suggest further tightening of monetary policy at the MAS’s next monetary policy meeting in October is likely.

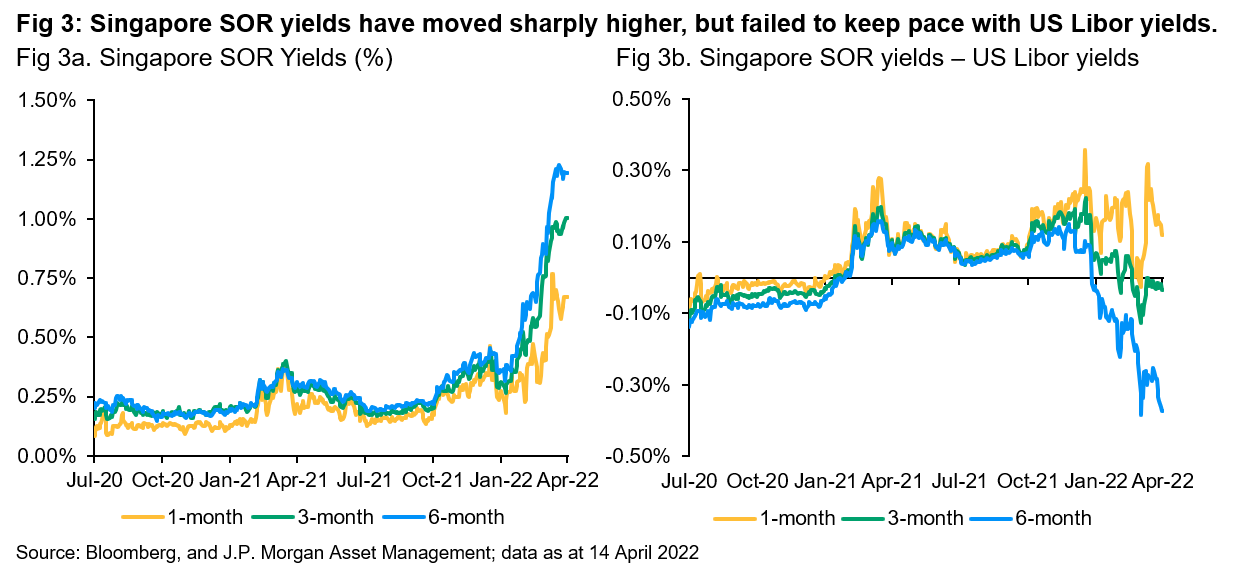

Since the start of the year, Singapore interest rates have moved sharply higher (Fig 3a) and the curve has steepened in anticipation of rising inflation and increasingly hawkish central bank actions. With the US Federal Reserve expected to start aggressively hiking interest rates in the coming months, the MAS’s policy decision will likely dampen the upward trajectory of Singapore bond yields, pushing the Singapore-US gap negative (Fig 3b). Nevertheless, for SGD cash investors, we believe the higher local yields are already providing welcome respite from an extended period of low yields – a trend that is likely to continue for the foreseeable future.

1 Singapore Dollar Nominal Effective Exchange Rate