Transportation outlook: Navigating supply chain shifts

The transportation sector is being impacted by sanctions which are shifting and lengthening existing supply chains globally

12/01/2023

Anurag A. Agarwal

Geopolitical conflicts and tensions, shifting global supply chains and a continued need for investment supporting decarbonization efforts underpin our positive 12- to 18-month outlook for the transportation sector. The transportation asset class is expected to maintain its low correlation to equities and continue to deliver a diversified source of consistent income-oriented returns.

Given transportation’s resilient and stable returns during the past year of extremely volatile markets, we expect the asset class to continue providing investors with reliable returns and income through today’s volatility and a looming global economic slowdown. We attribute this resilience to the key function these assets play in driving the global economic engine through moving raw materials and finished goods to their next stage in the value chain.

As global supply chains shift due to sanctions and conflicts, key commodities must be sourced further away from their end markets, leading to forecasted strength in lease rates as tonne-miles increase, even in the face of a slower growth in global demand.

Transport is positioned for stable demand and renewed investment

Despite the headwinds from slowing global growth, we are constructive on global transport as a whole in the year ahead, with sanctions shifting and lengthening existing supply chains. Global order books remain low in certain sectors and with shipyards over capacity the supply of assets will be kept tight even in the face of slower global trade growth. Geopolitical conflicts and sanctions have led to markets looking further abroad to supply their demands for commodities, effectively tightening global transport supply, which has supported lease rates across the industry in the face of slower global growth. Global port constraints shouldn’t be a factor in the coming year, as the backlogs from the COVID-19 years have largely been alleviated. Uncertainty around future asset designs has kept a lid on the pace of new orders and kept supply tight.

Trends: Disrupted supply chains from geopolitical conflict; strong end-users, stable lease rates

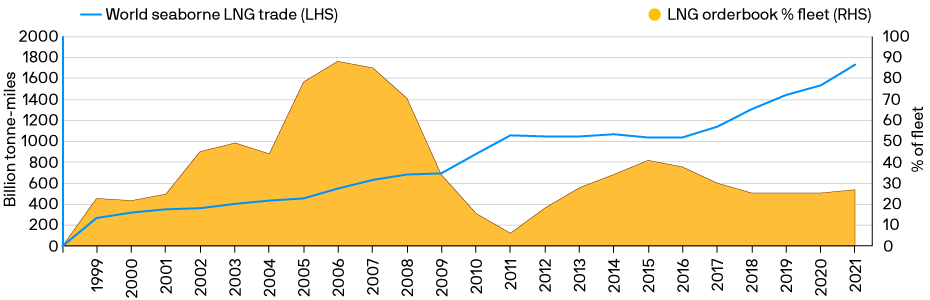

Energy Logistics: With the ongoing war between Ukraine and Russia and subsequent sanctions on Russia, natural gas supply from Russia to the European Union (EU) is expected to completely shift to new sources. This will create new demand for transport assets. As illustrated in the chart below, limited supply of liquefied natural gas (LNG) carriers, with limited shipyard capacity to build more, has led to record lease rates that are expected to continue beyond 2023. Continued investment in both floating storage regasification units (FSRUs) and other land-based, fixed regasification facilities are required in Europe to meet ongoing demand as a result of the monumental shift in energy supply chains.

Global LNG trade and orderbook

Source: Clarksons Research, J.P. Morgan Asset Management; as of 12/31/21.

Maritime: The maritime segment outlook remains stable and has normalized to historic averages after several years of supply chain pressures from the pandemic. We expect slow growth in the coming year but limited orderbooks contain the downside. Some sectors, such as the container sector, are expected to come under more pressure given the impact of slowing demand and lower consumer spending. Long duration leases with high credit quality counterparties should insulate against the downside pressures.

Aviation: We expect improvements in domestic passenger volumes to continue as global travel restrictions have largely fallen away post pandemic. The continued recovery in travel demand, a low supply of new aircraft and inflation kickers should positively impact lease rates for aircraft in 2023. Sovereign-backed carriers should remain attractive counterparties if governments, as they have historically demonstrated, prioritize airline service and continue to support their national carriers.

Land-based transport (auto and rail): The outlook for the rail freight market remains cautiously positive despite looming recession fears. Railroads remain the most fuel-efficient method to transport cargo over land, an attractive alternative for shippers in a higher fuel cost environment.

A strong focus on ESG and de-carbonization

An intense focus to reduce the transportation sector’s impact on global emissions is the goal of end users, regulatory bodies, customers and investors – and is shaping technology development, end user demand and financing. Innovative new fuels – ranging from methanol and other biomass sources to hydrogen and ammonia – are being researched as low carbon emitting energy sources but require further investment and research and development (R&D) to become globally viable. With these new fuels come increased investment requirements to modify existing assets, design and construct next-generation assets and build the associated global infrastructure to support these new fueling methods.

Attaining financing is increasingly linked to environmental performance, as ESG standards rise among traditional bank lenders and others. Market participants with ample access to capital will be better positioned to make the necessary investments in green technology solutions and meet end-user demand for environmentally friendly assets.

Opportunities: Leveraging scale, decarbonization and next-generation investments

Against a weaker global economic macro backdrop, we expect consistent returns through several preferred strategies:

- A diversified portfolio: A diversified approach to core-plus transportation investing allows for shifting to the subsectors with the best relative value. When the pandemic hit, for example, the aviation sector was significantly impacted, and capital deployment was redirected to the maritime sector, where industry fundamentals remained strong.

- Energy transition: With the disruption of gas supply from Russia to the EU, we continue to favor investments in assets that directly support the energy transition. These include next-generation LNG carriers, offshore wind farm maintenance and installation vessels and charging infrastructure for electric vehicles (EVs). The supply chain disruption in natural gas markets is expected to continue through 2023 and beyond with traditional gas pipelines to the EU being supplemented or replaced by a floating pipeline of LNG carriers from North America and the Middle East, which creates further supply tightness and continued profitability for asset owners.

- Partnering with leading operators: Partnering enables the asset owner (investor) and operator to develop solutions that reduce the carbon footprint along the operator’s supply chain. In anticipation of changes coming to global industry standards across the maritime and land transport sectors, such partnerships enable technology transfer and capital risk sharing.

Going forward, potential risks include the headwinds associated with global demand and looming global recession, as the duration and severity of any economic contraction can add risk to future lease rates. Other risks include the threat of technological obsolescence for older assets, uncertainty of clean fuel options and supply and distribution of these fuels over the long term.

09gz221412161224