Slide Image

Secondary market

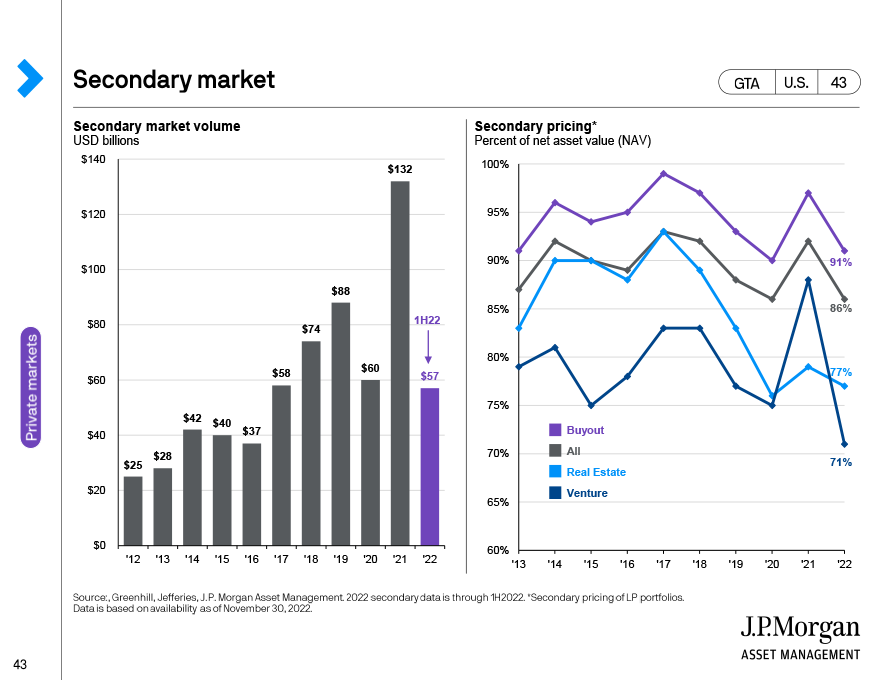

This slide looks at secondary market transactions. Secondary market transaction is when one private equity manager may sell a target to another private equity manager to raise liquidity, exit a position, modify exposures, or lock in gains. Although secondary market volume fell sharply during the pandemic, they recovered significantly in 2021 and have stayed strong in 2022, as weaker public markets have pushed investors to selling in the secondary market.

On the right-hand side, we show secondary market pricing, which is measured as a % of net asset value. Pricing shot up in 2021 but have since come down as market stress has led to write-downs and increased risk.