Slide Image

Private equity valuations

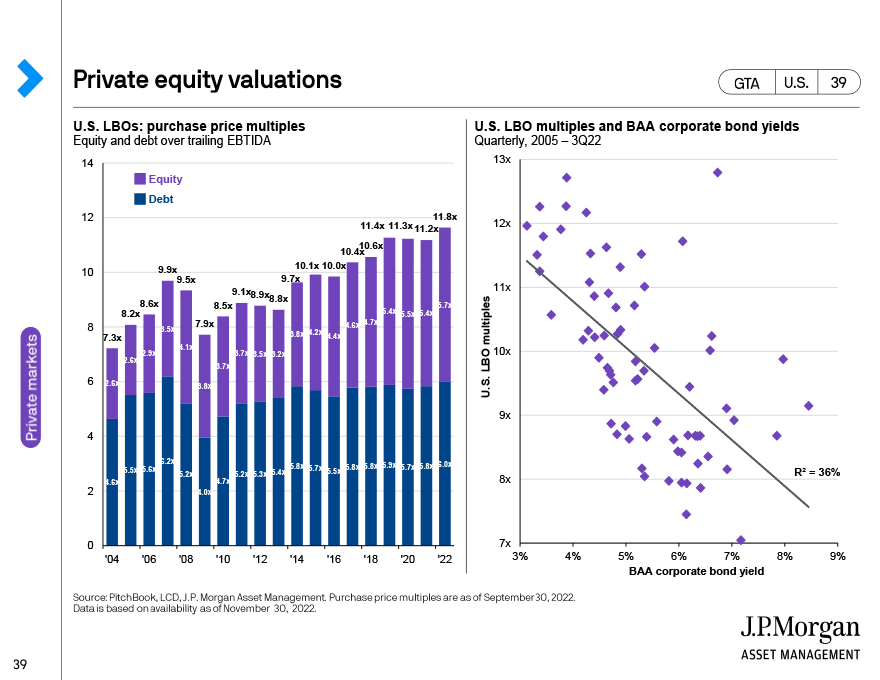

As of 1Q212 purchase price multiples have continued to rise, while B2B and Technology have made up the brunt of deals. Additionally, rising debt multiples suggest sponsors are now willing to take on more leverage, a reversal of what we saw in 2020. However, this will likely slow as interest rates continue to move higher and compress valuations.

We show this dynamic on the right-hand side chart, which shows the relationship between LBO multiples and BAA corporate bond yields. As you can see, higher rates, tend to correspond to lower valuations.