Joe Biden’s target of zero carbon emissions will increase the challenges for US power companies, and their debt. However, it presents opportunities for European utilities.

Like a driver who realises he has been heading the wrong way down the highway (for four years), Joe Biden has manoeuvred an abrupt U-turn in the US government’s climate policy.

On his first day as president, Biden signed the US up to rejoining the international Paris Agreement to limit climate change. He also committed the country to net zero carbon emissions by 2050. President Biden has even said he would ideally like the US to get there by 2035, though we deem this unlikely.

The president’s environmental zeal does provide a tailwind for the decarbonisation of US utilities. However, although the US federal government has just performed a U-turn, many state governments and utility companies, never changing their course towards decarbonisation, have been performing their own policy reversals for many years. No fewer than 38 states have carbon reduction goals, which include increasing the share of renewables in electricity generation. This tendency shows up in the national figures. In 2010, 44% of US power came from coal; by 2020, this had slumped to 20%. The proportion that comes from renewables has doubled from 10% to 20%. We think it will reach close to 50% by 2040.

A challenge to bond investors

As investors, we welcome decarbonisation: global warming will hit the values of an extremely wide range of assets. However, the greening of US power does present a challenge for utilities. If a utility retires a power station early because it burns fossil fuels, that power station will be a “stranded asset” if it is retired before its value has been fully depreciated in the accounts. A stranded asset is an asset whose value must be written down prematurely, because of a change in public and regulatory priorities. In the case of bonds, mothballing assets leaves less cashflow to pay coupons and redemptions.

There are solutions to stranded asset risk. For example, some state regulators allow utilities to securitize undepreciated balances from power plants. Securitization refers to the issuance of off-balance sheet bonds backed by a specific revenue streams from customer bills that have been approved by regulators and/or state legislators. To understand potential problems and permitted solutions, we follow regulatory proceedings for 51 regulators – one for each state, plus the Federal Energy Regulatory Commission.

Exhibit 1: What repercussions does the global climate agenda have on how we assess fixed income sectors and in particular with a consideration of stranded assets?

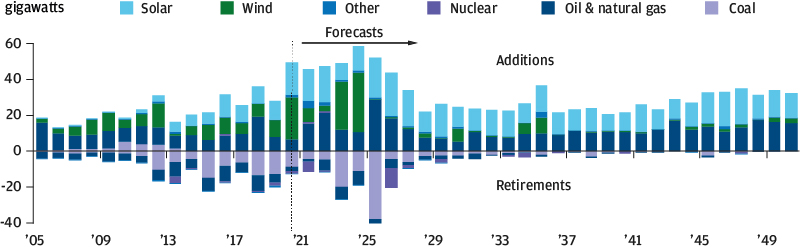

U.S. retiring and new generating capacity

Source: EIA, Lazard, Eurostat, METI, BP Statistical, J.P. Morgan Asset Management.

2020 generating capacity is a forecast based off July 2020 data. Data is based on availability as of May 31, 2021.

Greening US electricity also presents investment opportunities. Many European utilities already have particular expertise in green energy, because of an earlier focus on renewables from companies and national governments. Disciplined expansion into markets with supportive energy policies could make the debt of these companies correspondingly more attractive. Take Spain’s Iberdrola. It has sizeable assets in solar, wind and green hydrogen – and a large US presence.

Conclusion

US utilities have long since started down the green road. While President Biden’s mission to turn the US into a net zero country will accelerate this journey, the subsequent increased risk to the debt of US utilities can be managed. European utilities with the expertise needed to help the US reach its carbon reduction targets also look all the more attractive as issuers.

09dz212007091309