A framework for analyzing CLO managers

01-06-2023

Denise Hesser

Sameer Riaz

Collateralized Loan Obligations (CLOs) are securitizations backed by diversified pools of broadly syndicated, institutional leveraged loans. Third party CLO managers construct, manage, and actively trade the underlying portfolio of leveraged loans. Today, more than 120 managers are active in the US CLO market, with over 10 new managers entering the market since the beginning of 2021. Moreover, the CLO market has seen tremendous growth over the past decade, with the asset class now topping $1 trillion outstanding globally. This highlights how the asset class has attracted both issuer and investor interest, as well as why analyzing CLO manager style and performance is imperative to investing in the CLO market.

In the current macroeconomic context of high interest rates and a slowing economy, CLO investors are contending with increasing loan downgrades and defaults along with often contentious loan restructurings. Since CLOs are now the largest holders of institutional loans in the US, analyzing the varying styles of CLO managers is an integral part of understanding trends in both the loan and CLO market. In this note, we introduce our framework for analyzing and differentiating managers. This is just one tool we use in our holistic fundamental research process.

Our manager selection framework uses two-prongs – quantitative and qualitative. We use five categories of objective, quantitative attributes to calculate an overall score for each manager that we use to rank the universe of managers. We then overlay a qualitative score—which is based on an analysis of the manager’s institutional structure, portfolio management and research resources, and secondary liquidity—to capture additional important, but more subjective, characteristics.

Quantitative rankings

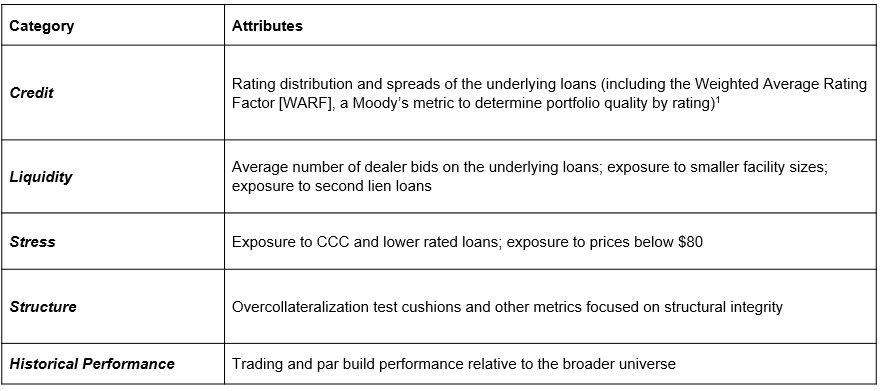

Below are the five categories that inform the quantitative score. Since portfolios and structures change from month-to-month (creating volatility around rankings) we focus on quartile rankings which tend to be more consistent over time.

For each attribute, we score the manager versus the universe average. We then weight each attribute-level score to create category scores. The overall quantitative score is the average of these category scores. It is important to note that relying on an average attribute per manager may mask variability across vintages for larger managers.

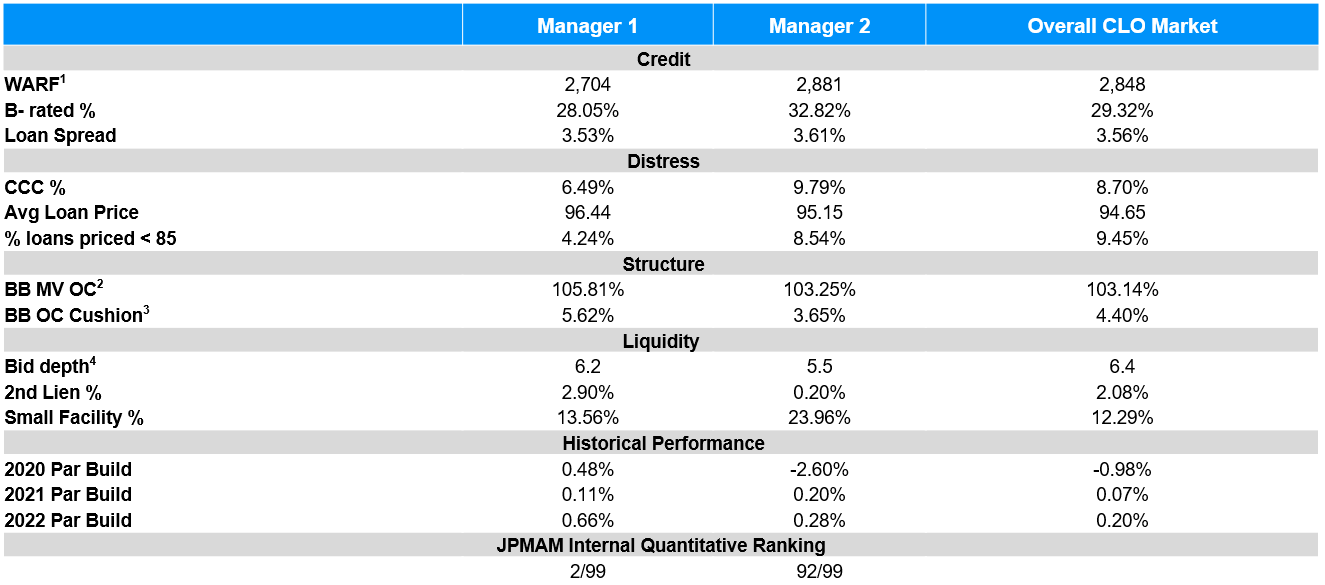

As a concrete example, below are some selected metrics of two managers. Manager 1 ranks highly in our quantitative rankings across several different categories, while Manager 2 ranks lower. The broader universe is also highlighted for comparative purposes.

Source: Bank of America, Deutsche Bank, JPMAM Securitized Research (as of March 2023)

Qualitative rankings

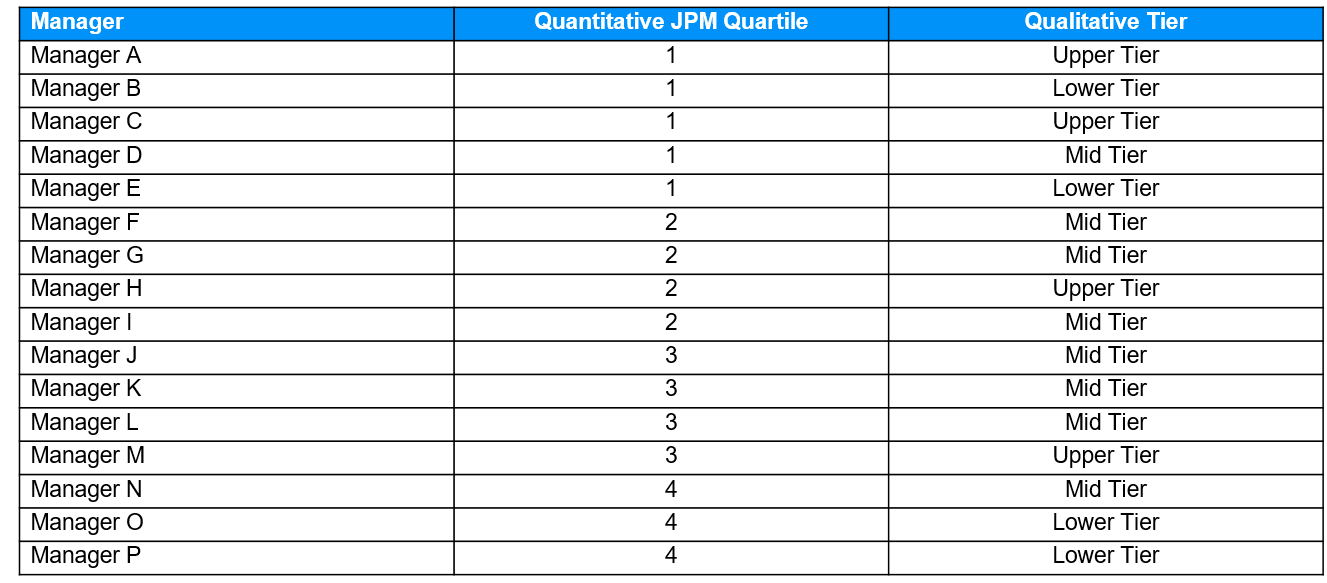

The second prong of our framework overlays a qualitative assessment of the manager. We assign each manager to one of three tiers. Some of the qualitative factors we consider include the manager’s institutional structure, the team’s expertise in managing loan portfolios, and the perceived liquidity in the CLO shelf.

The quantitative rankings and qualitative assessments do not always align. A newer manager may have a strong structure with high-quality portfolios, but poor secondary liquidity, skewing them to “lower-tier”. Conversely, a larger manager with varying vintages may rank on the lower end quantitatively, but enjoy strong sponsorship of their shelf, skewing them to “mid-tier” or “upper-tier”. By incorporating a qualitative factor, we can identify relative value opportunities, such as avoiding managers with potentially stressed portfolio “tails” or finding an undervalued manager with a profile similar to more established, well-known managers.

We highlight both our quantitative and qualitative rankings for a sub-set of managers below.

Source: JPMAM Securitized Research (as of March 2023)

Conclusion

Our approach to CLO manager diligence relies both on quantitative data as well as an ongoing, qualitative assessment of the manager. By marrying the two approaches, we can differentiate manager styles in a more granular manner, allowing us to proactively identify under-performing manager styles and realize relative value opportunities. In the current rapidly changing environment, our deep diligence process helps us efficiently screen attractive CLO investment opportunities from managers that align with our up-in-quality bias.

1 Weighted Average Rating Factor (WARF): metric used by rating agencies to represent the credit quality of a portfolio. A lower WARF indicates a higher rated portfolio

2 Market Value Overcollateralization (MVOC): Marked to market value of the loan portfolio relative to CLO debt outstanding

3 OC Cushions: Par cushion available before deal triggers are breached

4 Bid Depth: Average number of daily bids in the secondary market for portfolio loans

09nc233005173643